Question

Given the European call prices for the non-dividend-paying stocks of the companies, ABC and XYZ, shown in the table below, for which company is

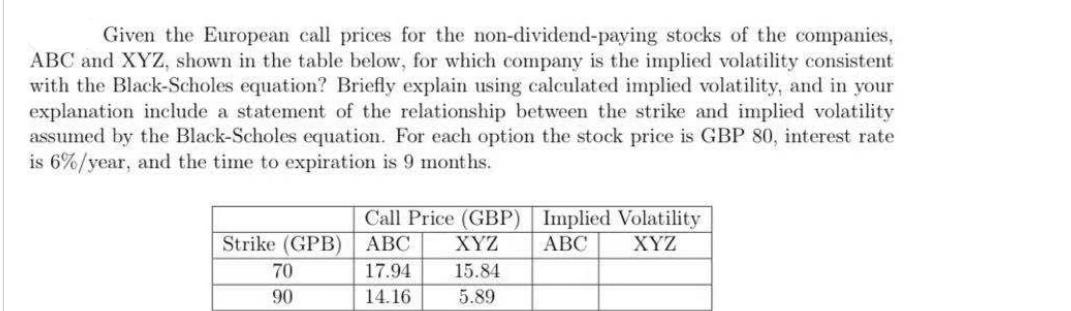

Given the European call prices for the non-dividend-paying stocks of the companies, ABC and XYZ, shown in the table below, for which company is the implied volatility consistent with the Black-Scholes equation? Briefly explain using calculated implied volatility, and in your explanation include a statement of the relationship between the strike and implied volatility assumed by the Black-Scholes equation. For each option the stock price is GBP 80, interest rate is 6%/year, and the time to expiration is 9 months. Implied Volatility XYZ Strike (GPB) ABC Call Price (GBP) XYZ ABC 70 17.94 15.84 90 14.16 5.89

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which companys implied volatility is consistent with the BlackScholes equation we need ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Futures and Options Markets

Authors: John C. Hull

8th edition

978-1292155036, 1292155035, 132993341, 978-0132993340

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App