given the financial statements for

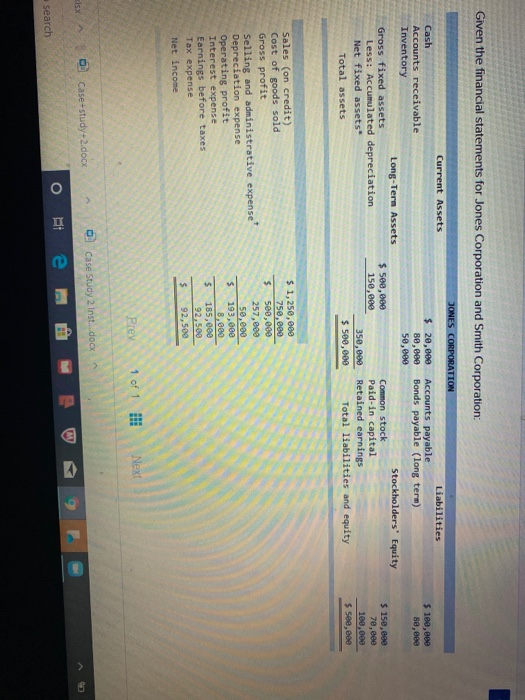

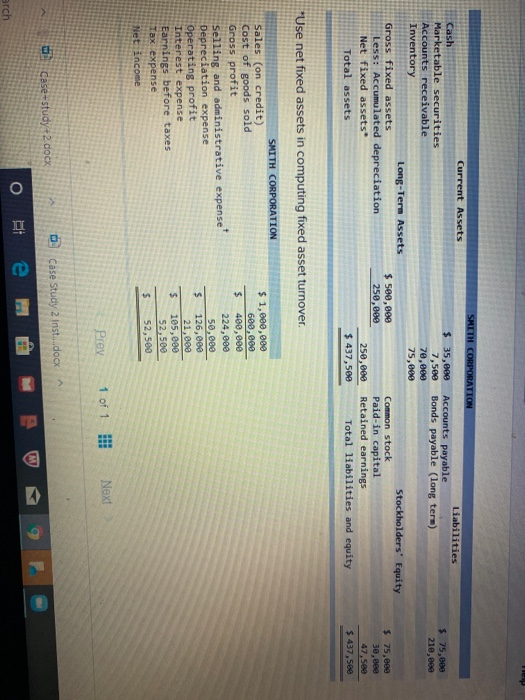

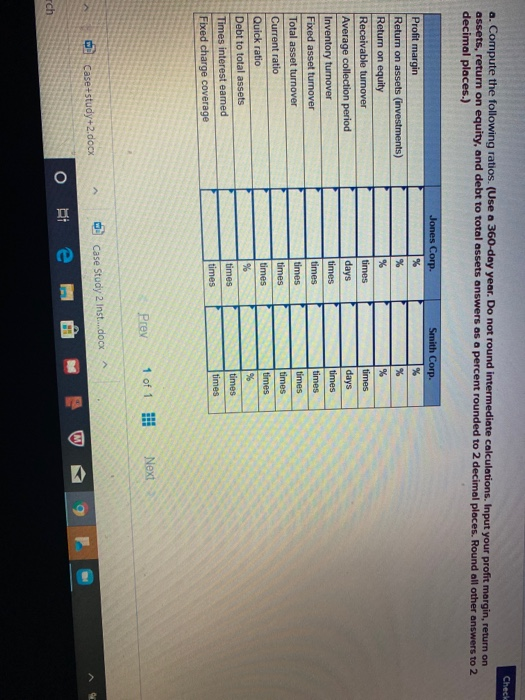

Given the financial statements for Jones Corporation and Smith Corporation: $ 180,888 se, eee Current Assets Cash Accounts receivable Inventory Long-Term Assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets JONES CORPORATION Liabilities $ 20,000 Accounts payable 80,000 Bonds payable (long term) 50,ese Stockholders' Equity $ 500,000 Common stock 150,000 Paid-in capital 350,890 Retained earnings $ 500,000 Total liabilities and equity $ 150,000 70, see 100.000 $ see, eee $1,250,000 _750,000 $ 500,000 257,000 50,000 Sales (on credit) Cost of goods sold Gross profit Selling and administrative expense Depreciation expense Operating profit Interest expense Earnings before taxes Tax expense Net income $ 185,000 92,500 193,000 8,000 92,see $ Prey Case Study 2 inst.docx alsx Case-study-2.docx Search $ 75,000 210,869 Current Assets Cash Marketable securities Accounts receivable Inventory Long-Term Assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets SHITII CORPORATION Liabilities $ 35,080 Accounts payable 7,500 Bonds payable (long ters) 70,000 75,000 Stockholders' Equity $ 500,000 Common stock 250,000 Paid-in capital 250,000 Retained earnings $ 437,589 Total liabilities and equity $ 75,888 30,eee 47,5ee $ 437,500 *Use net fixed assets in computing fixed asset turnover. SMITH CORPORATION Sales (on credit) Cost of goods sold Gross profit Selling and administrative expense Depreciation expense Operating profit Interest expense Earnings before taxes Tax expense Net income $ 1,000,000 600,000 400,000 224,000 50,000 126,000 21, e8e 105,000 52,500 52,500 Prev 1 of 1 Next Case-study+2.docx 0 Case Study 2 Inst....docx arch o te eW9P Check a. Compute the following ratios. (Use a 360-day year. Do not round intermediate calculations. Input your profit margin, return on assets, return on equity, and debt to total assets answers as a percent rounded to 2 decimal places. Round all other answers to 2 decimal places.) Jones Corp. Smith Corp. % % times days days times times Profit margin Return on assets investments) Return on equity Receivable turnover Average collection period Inventory turnover Fixed asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets Times interest eamed Fixed charge coverage over times times times times 1 times times Prev 1 of 1 !!! Next Case Study 2 Inst.docx C Case study+2.docx sch