Question

Given the following binomial interest rate tree with equal probability of moving up and down for government bonds, and an OAS of 200 bps

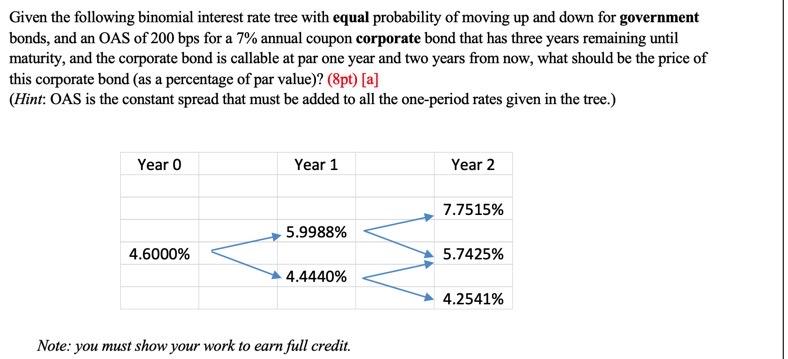

Given the following binomial interest rate tree with equal probability of moving up and down for government bonds, and an OAS of 200 bps for a 7% annual coupon corporate bond that has three years remaining until maturity, and the corporate bond is callable at par one year and two years from now, what should be the price of this corporate bond (as a percentage of par value)? (8pt) [a] (Hint: OAS is the constant spread that must be added to all the one-period rates given in the tree.) Year 0 4.6000% Year 1 5.9988% 4.4440% Note: you must show your work to earn full credit. Year 2 7.7515% 5.7425% 4.2541%

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Government bond tree rates are given as Year 0 57425 59988 Year 1 44440 46000 Year 2 42541 46000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Derivatives Markets

Authors: Robert McDonald

3rd Edition

978-9332536746, 9789332536746

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App