Question

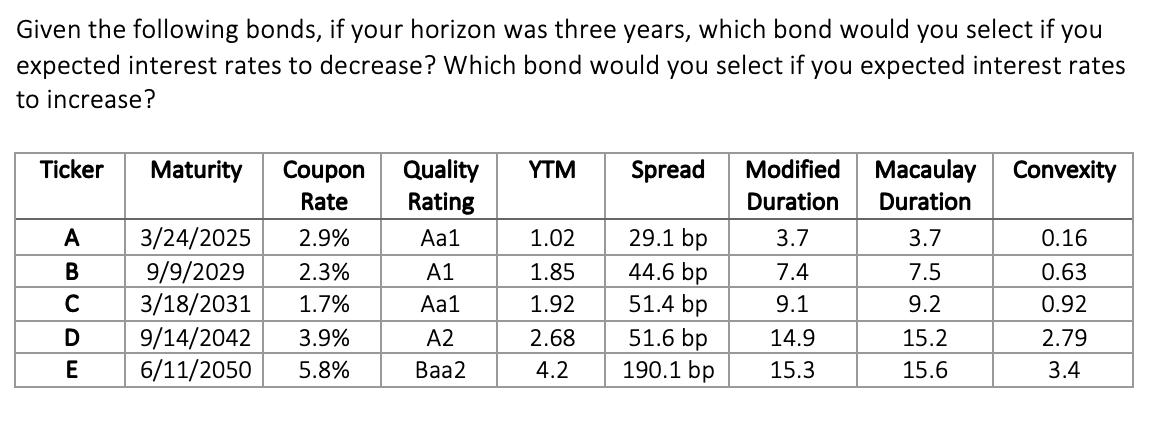

Given the following bonds, if your horizon was three years, which bond would you select if you expected interest rates to decrease? Which bond

Given the following bonds, if your horizon was three years, which bond would you select if you expected interest rates to decrease? Which bond would you select if you expected interest rates to increase? Ticker Maturity Coupon Quality YTM Spread Modified Macaulay Convexity Rate Rating Duration Duration ABCDF A 3/24/2025 2.9% Aa1 1.02 29.1 bp 3.7 3.7 0.16 9/9/2029 2.3% A1 1.85 44.6 bp 7.4 7.5 0.63 C 3/18/2031 1.7% Aa1 1.92 51.4 bp 9.1 9.2 0.92 D 9/14/2042 3.9% A2 2.68 51.6 bp 14.9 15.2 2.79 E 6/11/2050 5.8% Baa2 4.2 190.1 bp 15.3 15.6 3.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: LibbyShort

7th Edition

78111021, 978-0078111020

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App