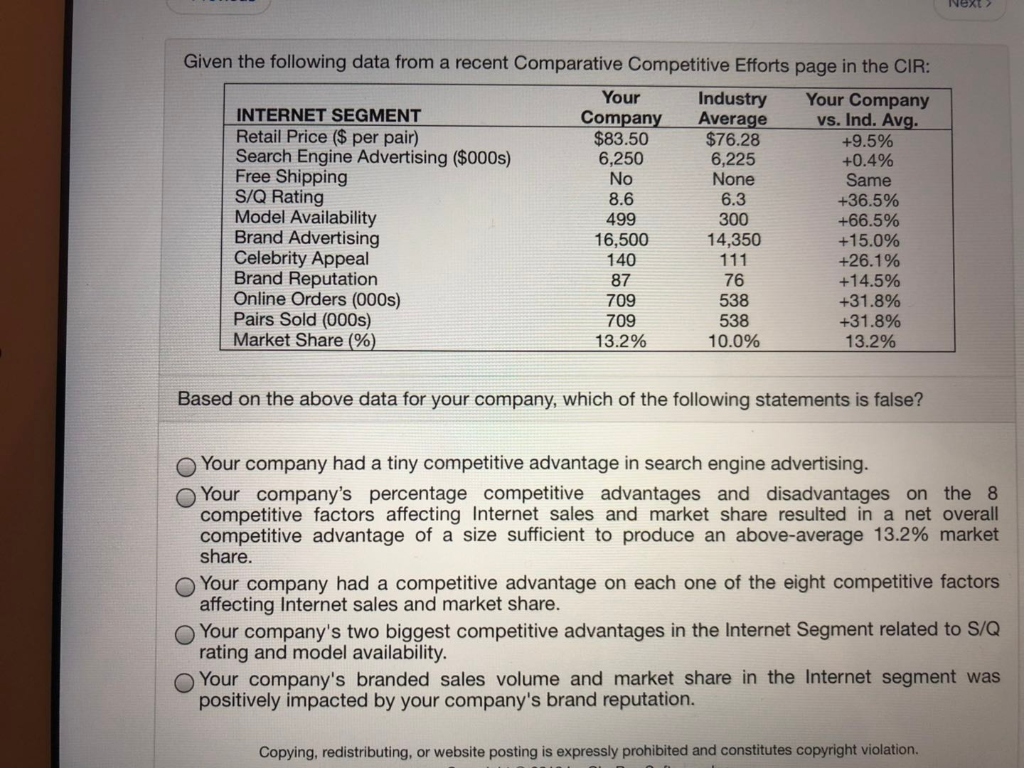

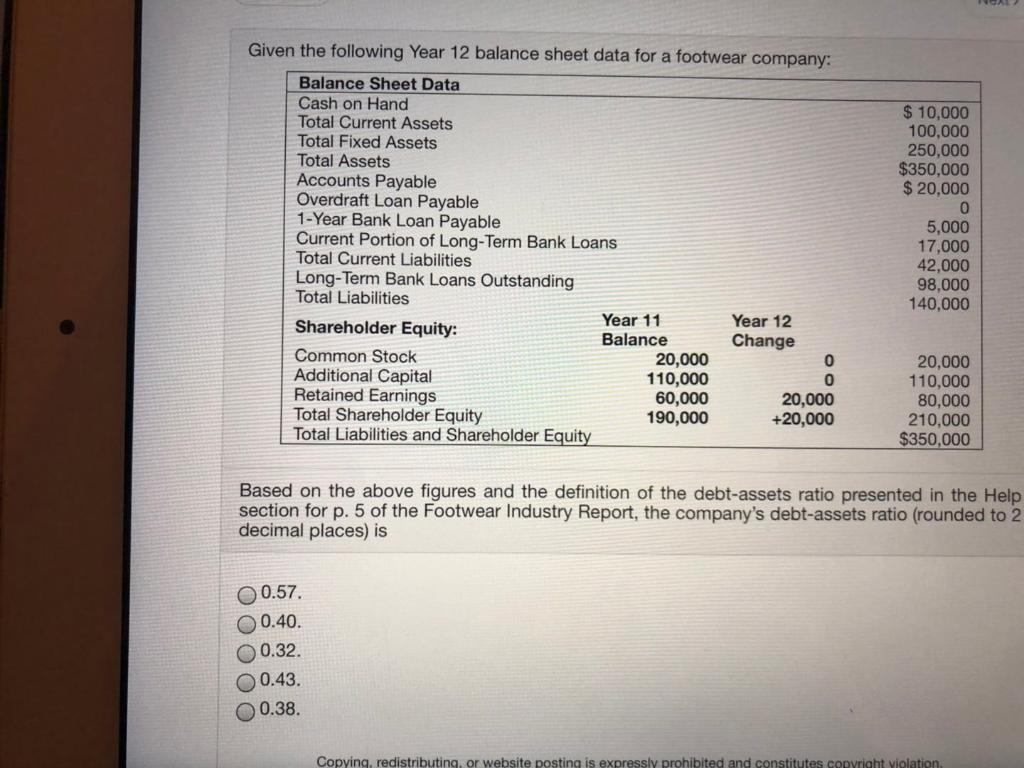

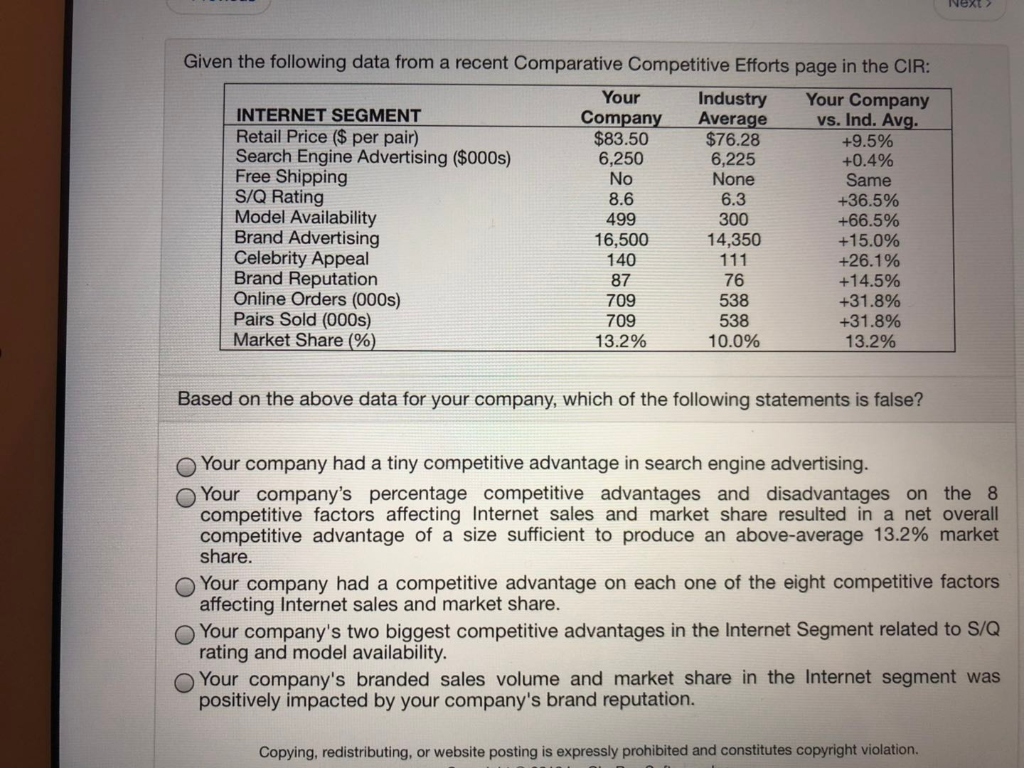

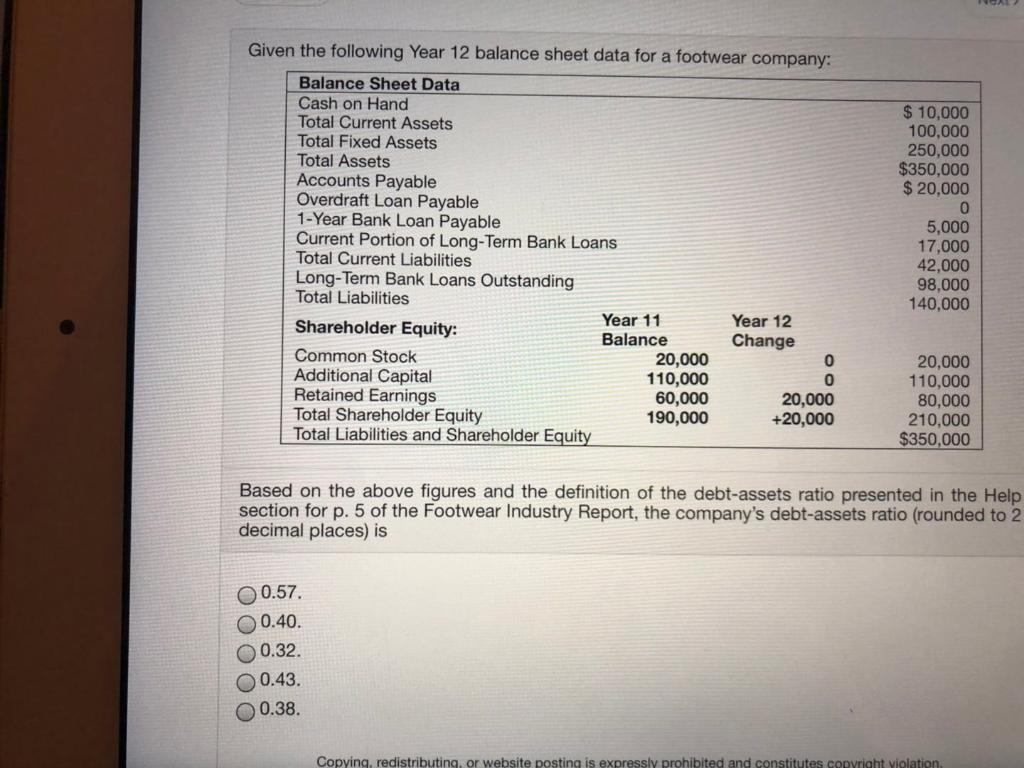

Given the following data from a recent Comparative Competitive Efforts page in the CIR: Your Industry Your Company Ind. Avg. INTERNET SEGMENT Retail Price ($ per pair) Search Engine Advertising ($000s) Free Shipping S/Q Rating Model Availability Brand Advertising Celebrity Appeal Brand Reputation Online Orders (000s) Pairs Sold (000s) Market Share (%) Company Average vs. $83.50 6,250 No 8.6 499 16,500 140 87 709 709 13.2% $76.28 6,225 None 6.3 300 14,350 +9.5% +0.4% Same +36.5% 66.5% +15.0% +26.1 % +14.5% +31.8% +31.8% 13.2% 76 538 538 10.0% Based on the above data for your company, which of the following statements is false? O Your company had a tiny competitive advantage in search engine advertising. OYour company's percentage competitive advantages and disadvantages on the 8 competitive factors affecting Internet sales and market share resulted in a net overall competitive advantage of a size sufficient to produce an above-average 13.2% market share O Your company had a competitive advantage on each one of the eight competitive factors O Your company's two biggest competitive advantages in the Internet Segment related to S/Q O Your company's branded sales volume and market share in the Internet segment was affecting Internet sales and market share. rating and model availability. positively impacted by your company's brand reputation. Copying, redistributing, or website posting is expressly prohibited and constitutes copyright violation Given the following Year 12 balance sheet data for a footwear company Balance Sheet Data Cash on Hand Total Current Assets Total Fixed Assets Total Assets Accounts Payable Overdraft Loan Payable 1-Year Bank Loan Payable Current Portion of Long-Term Bank Loans Total Current Liabilities Long-Term Bank Loans Outstanding Total Liabilities $10,000 100,000 250,000 $350,000 $ 20,000 0 5,000 17,000 42,000 98,000 140,000 Year 11 Balance Year 12 Change Shareholder Equity: Common Stock Additional Capital Retained Earnings Total Shareholder Equity Total Liabilities and Shareholder Equity 20,000 110,000 60,000 190,000 0 20,000 +20,000 20,000 110,000 80,000 210,000 $350,000 Based on the above figures and the definition of the debt-assets ratio presented in the Help section for p. 5 of the Footwear Industry Report, the company's debt-assets ratio (rounded to 2 decimal places) is 0.57. 0.40. O0.32 0.43 O 0.38. Copying, redistributing, or website posting is expressly prohibited and constitutes copvright violation