Answered step by step

Verified Expert Solution

Question

1 Approved Answer

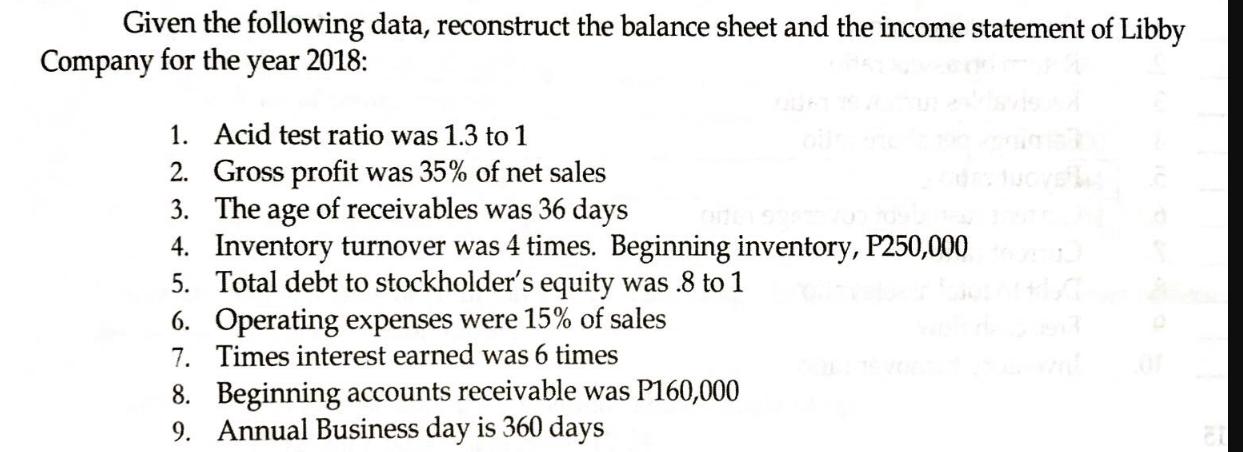

Given the following data, reconstruct the balance sheet and the income statement of Libby Company for the year 2018: 1. Acid test ratio was

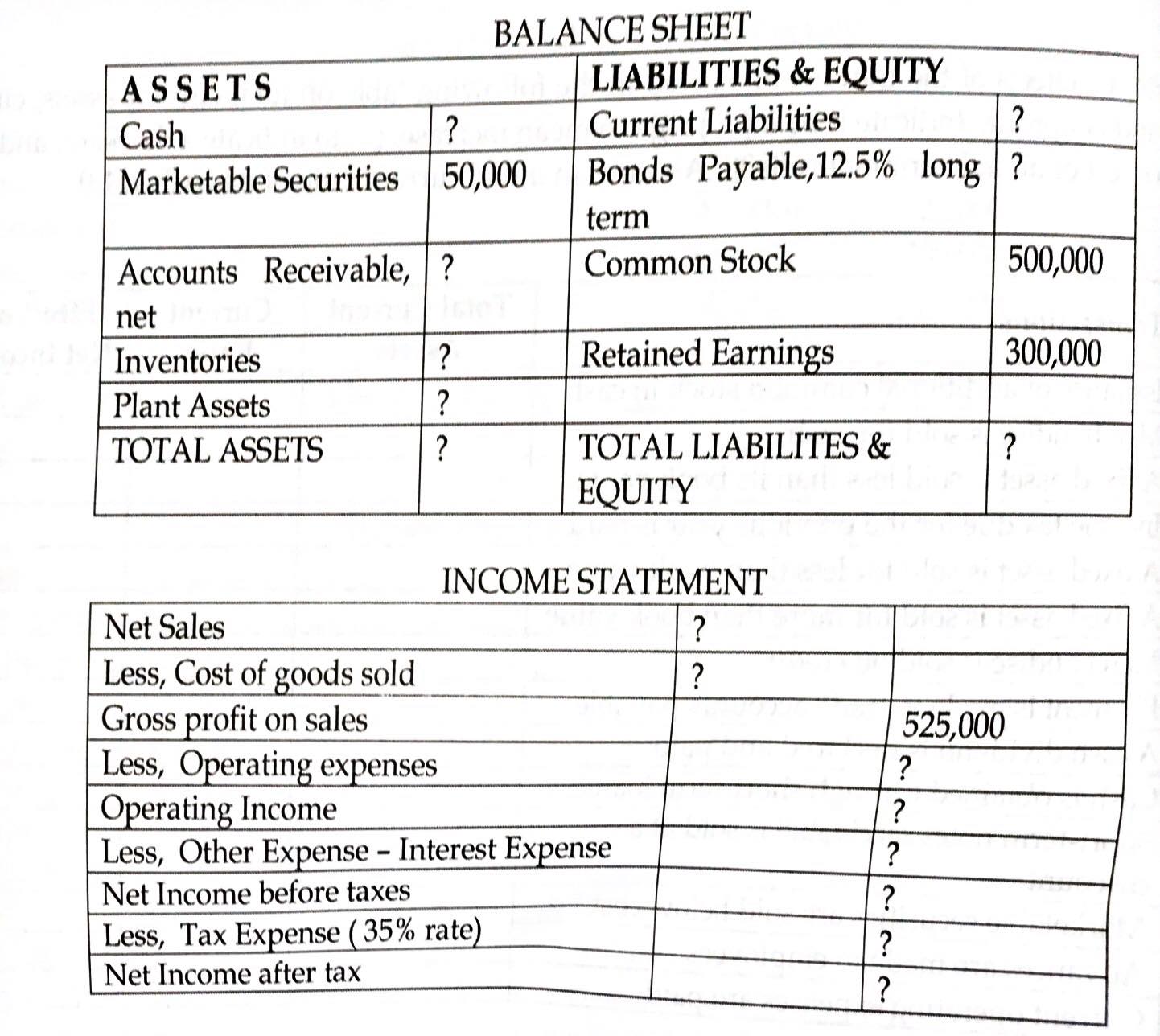

Given the following data, reconstruct the balance sheet and the income statement of Libby Company for the year 2018: 1. Acid test ratio was 1.3 to 1 2. Gross profit was 35% of net sales 3. The age of receivables was 36 days 4. Inventory turnover was 4 times. Beginning inventory, P250,000 5. Total debt to stockholder's equity was .8 to 1 6. Operating expenses were 15% of sales 7. Times interest earned was 6 times 8. Beginning accounts receivable was P160,000 9. Annual Business day is 360 days ASSETS Cash ? Marketable Securities 50,000 Accounts Receivable, ? net Inventories Plant Assets TOTAL ASSETS ? ? ? BALANCE SHEET LIABILITIES & EQUITY Less, Tax Expense (35% rate) Net Income after tax Current Liabilities ? Bonds Payable,12.5% long? term Common Stock Retained Earnings TOTAL LIABILITES & EQUITY INCOME STATEMENT ? ? Net Sales Less, Cost of goods sold. Gross profit on sales Less, Operating expenses Operating Income Less, Other Expense - Interest Expense Net Income before taxes ? ? ? ? ? 525,000 ? 500,000 300,000 ?

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Gross profit on sales is 35 Gross profit on sales is given as 525000 Net sales will be 525000 35 150...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started