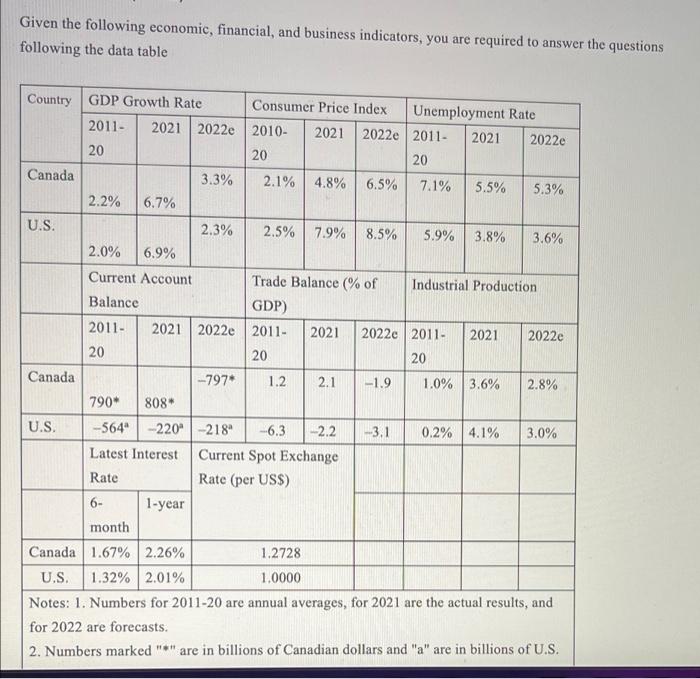

Given the following economic, financial, and business indicators, you are required to answer the questions following the data table Country GDP Growth Rate Consumer Price Index Unemployment Rate 2010- 2021 2022e 2011- 2021 2022e 2011- 20 20 20 Canada 2.1% 4.8% 6.5% 7.1% 5.5% 5.3% 2.2% 6.7% U.S. 2.5% 7.9% 8.5% 5.9% 3.8% 3.6% 2.0% 6.9% Current Account Trade Balance (% of Industrial Production Balance GDP) 2011- 2021 2022e 2011- 2021 2022e 2011- 2021 2022e 20 20 20 Canada -797* 1.2 2.1 -1.9 1.0% 3.6% 2.8% 790* 808* U.S. -564-220 -3.1 0.2% 4.1% 3.0% -218 -6.3 -2.2 Current Spot Exchange Latest Interest Rate Rate (per USS) 6- 1-year month Canada 1.67% 2.26% 1.2728 U.S. 1.32% 2.01% 1.0000 Notes: 1. Numbers for 2011-20 are annual averages, for 2021 are the actual results, and for 2022 are forecasts. 1111 2. Numbers marked are in billions of Canadian dollars and "a" are in billions of U.S. 2021 2022e 3.3% 2.3% Numbers marked "*" are in billions of Canadian dollars and "a" are in billions of U.S. llars. Interest rates are on government treasury bills and bonds. a. Taking an overall look of the data without doing any calculation, what is your directional view the values of Canadian dollar and U.S. dollar in one year's time (end of Year 2022)? Give at le: two arguments/reasons/pieces of information to support your view: both currencies will be appreciating/depreciating or which currency will be appreciating and which currency will be depreciating. b. Using the theory of purchasing power parity, forecast the spot exchange rates one year from now between U.S. dollar and Canadian dollar. c. Applying International Fisher theory, forecast the exchange rate one year from now between Canadian dollar and U.S. dollar. d. Using the spot rate and the appropriate interest rates, calculate the 180-day forward exchange rate between Canadian dollar and U.S. dollar. Given the following economic, financial, and business indicators, you are required to answer the questions following the data table Country GDP Growth Rate Consumer Price Index Unemployment Rate 2010- 2021 2022e 2011- 2021 2022e 2011- 20 20 20 Canada 2.1% 4.8% 6.5% 7.1% 5.5% 5.3% 2.2% 6.7% U.S. 2.5% 7.9% 8.5% 5.9% 3.8% 3.6% 2.0% 6.9% Current Account Trade Balance (% of Industrial Production Balance GDP) 2011- 2021 2022e 2011- 2021 2022e 2011- 2021 2022e 20 20 20 Canada -797* 1.2 2.1 -1.9 1.0% 3.6% 2.8% 790* 808* U.S. -564-220 -3.1 0.2% 4.1% 3.0% -218 -6.3 -2.2 Current Spot Exchange Latest Interest Rate Rate (per USS) 6- 1-year month Canada 1.67% 2.26% 1.2728 U.S. 1.32% 2.01% 1.0000 Notes: 1. Numbers for 2011-20 are annual averages, for 2021 are the actual results, and for 2022 are forecasts. 1111 2. Numbers marked are in billions of Canadian dollars and "a" are in billions of U.S. 2021 2022e 3.3% 2.3% Numbers marked "*" are in billions of Canadian dollars and "a" are in billions of U.S. llars. Interest rates are on government treasury bills and bonds. a. Taking an overall look of the data without doing any calculation, what is your directional view the values of Canadian dollar and U.S. dollar in one year's time (end of Year 2022)? Give at le: two arguments/reasons/pieces of information to support your view: both currencies will be appreciating/depreciating or which currency will be appreciating and which currency will be depreciating. b. Using the theory of purchasing power parity, forecast the spot exchange rates one year from now between U.S. dollar and Canadian dollar. c. Applying International Fisher theory, forecast the exchange rate one year from now between Canadian dollar and U.S. dollar. d. Using the spot rate and the appropriate interest rates, calculate the 180-day forward exchange rate between Canadian dollar and U.S. dollar