Answered step by step

Verified Expert Solution

Question

1 Approved Answer

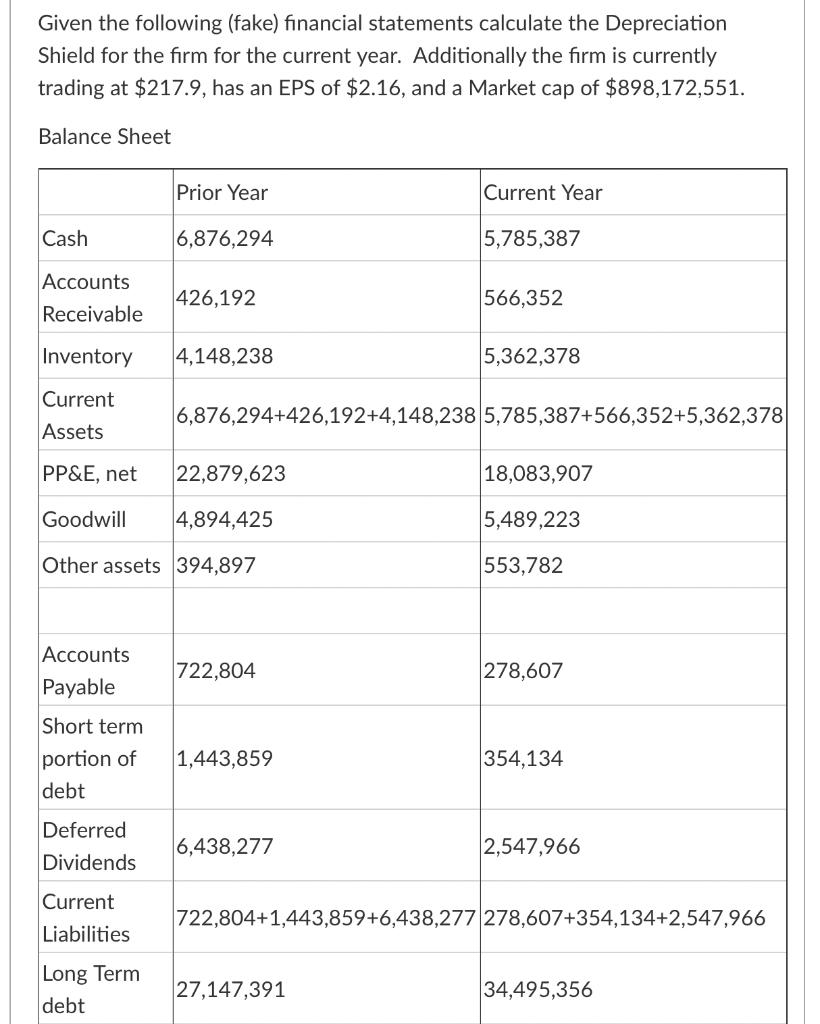

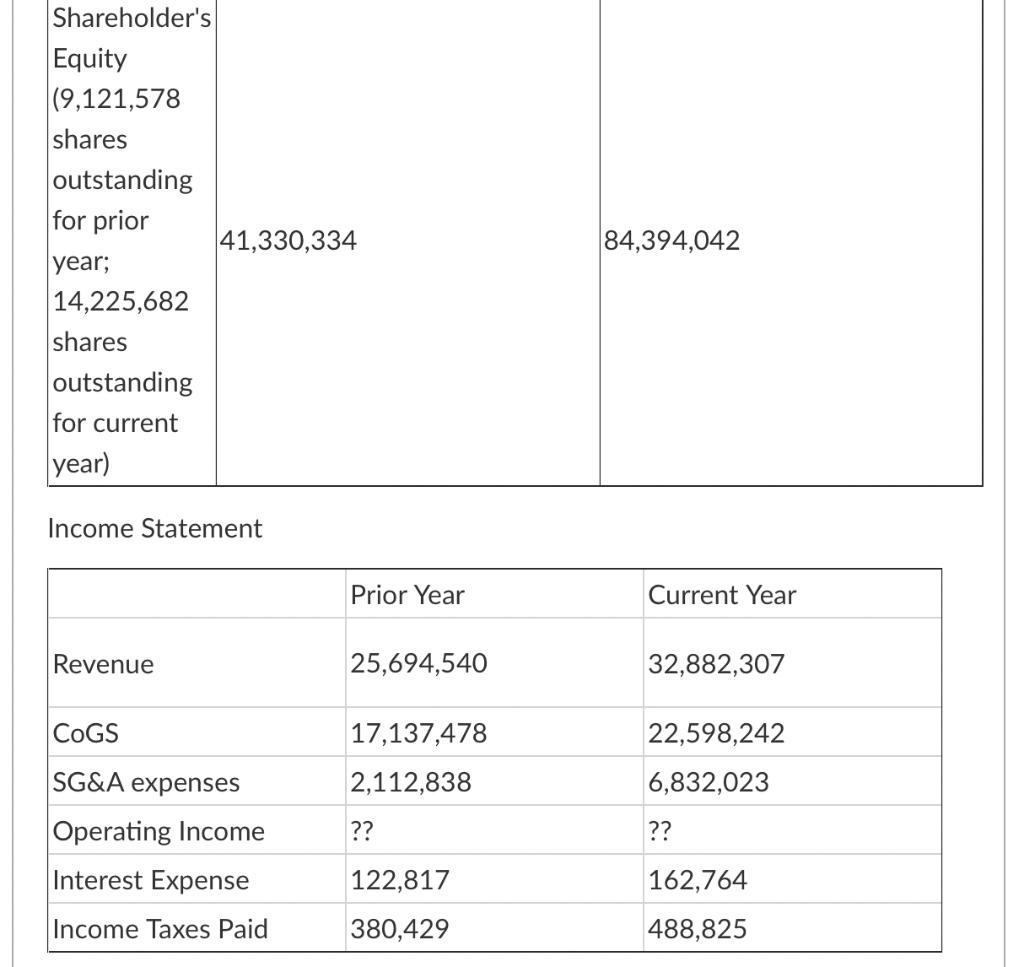

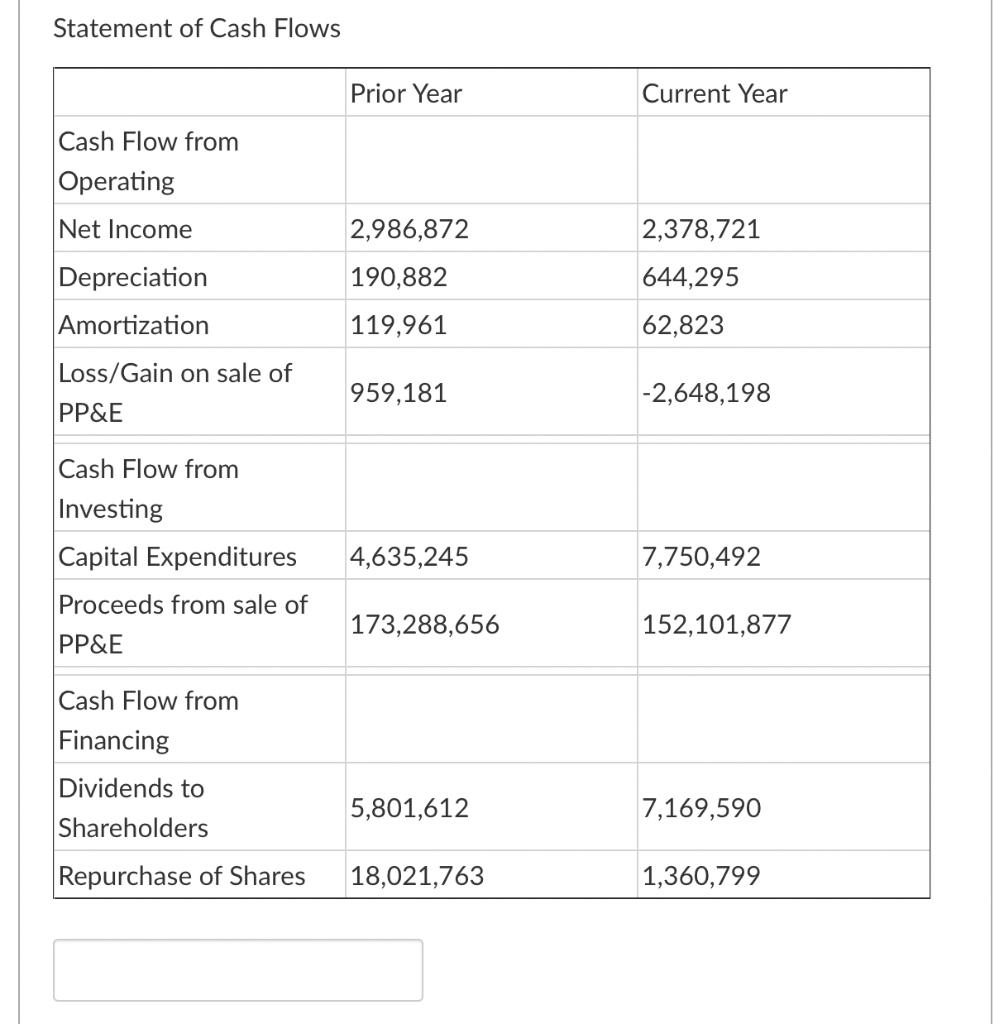

Given the following (fake) financial statements calculate the Depreciation Shield for the firm for the current year. Additionally the firm is currently trading at

Given the following (fake) financial statements calculate the Depreciation Shield for the firm for the current year. Additionally the firm is currently trading at $217.9, has an EPS of $2.16, and a Market cap of $898,172,551. Balance Sheet Cash Accounts Receivable Inventory 4,148,238 Current Assets PP&E, net 22,879,623 Goodwill 4,894,425 Other assets 394,897 Accounts Payable Short term portion of debt Deferred Dividends Current Liabilities Prior Year Long Term debt 6,876,294 426,192 722,804 1,443,859 6,876,294+426,192+4,148,238 5,785,387+566,352+5,362,378 6,438,277 Current Year 5,785,387 566,352 27,147,391 5,362,378 18,083,907 5,489,223 553,782 278,607 354,134 2,547,966 722,804+1,443,859+6,438,277 278,607+354,134+2,547,966 34,495,356 Shareholder's Equity (9,121,578 shares outstanding for prior year; 14,225,682 shares outstanding for current year) 41,330,334 Income Statement Revenue COGS SG&A expenses Operating Income Interest Expense Income Taxes Paid Prior Year 25,694,540 17,137,478 2,112,838 ?? 122,817 380,429 84,394,042 Current Year 32,882,307 22,598,242 6,832,023 ?? 162,764 488,825 Statement of Cash Flows Cash Flow from Operating Net Income Depreciation Amortization Loss/Gain on sale of PP&E Cash Flow from Investing Capital Expenditures Proceeds from sale of PP&E Cash Flow from Financing Dividends to Shareholders Repurchase of Shares Prior Year 2,986,872 190,882 119,961 959,181 4,635,245 173,288,656 5,801,612 18,021,763 Current Year 2,378,721 644,295 62,823 -2,648,198 7,750,492 152,101,877 7,169,590 1,360,799

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started