Question

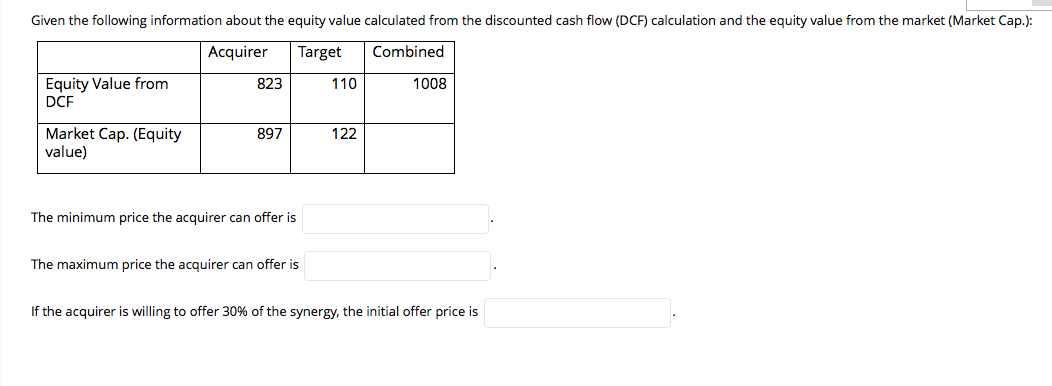

Given the following information about the equity value calculated from the discounted cash flow (DCF) calculation and the equity value from the market (Market

Given the following information about the equity value calculated from the discounted cash flow (DCF) calculation and the equity value from the market (Market Cap.): Equity Value from Acquirer 823 Target Combined 110 1008 DCF Market Cap. (Equity value) 897 122 The minimum price the acquirer can offer is The maximum price the acquirer can offer is If the acquirer is willing to offer 30% of the synergy, the initial offer price is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost management a strategic approach

Authors: Edward J. Blocher, David E. Stout, Gary Cokins

5th edition

73526940, 978-0073526942

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App