Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following information and the answer to part a)... answer part b). Marigold Hardware Store Inc. completed the following merchandising transactions in the month

Given the following information and the answer to part a)...

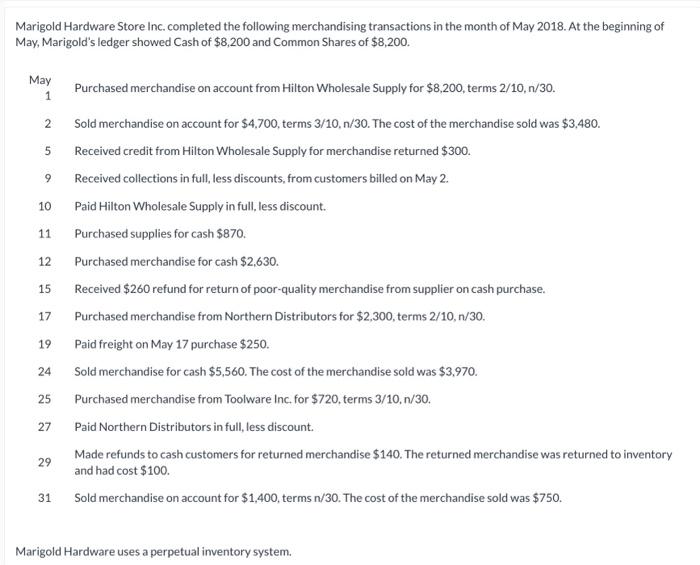

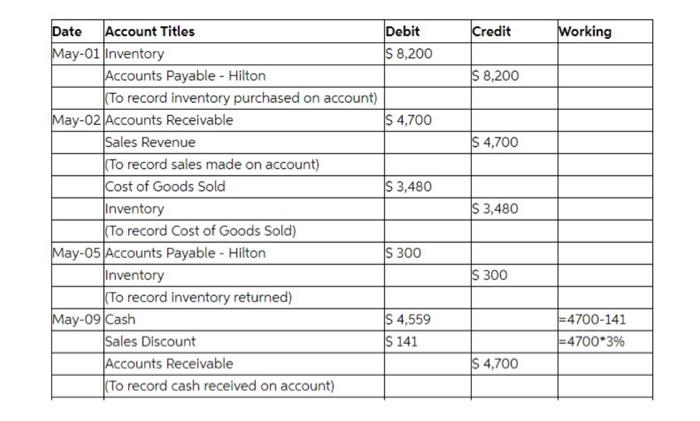

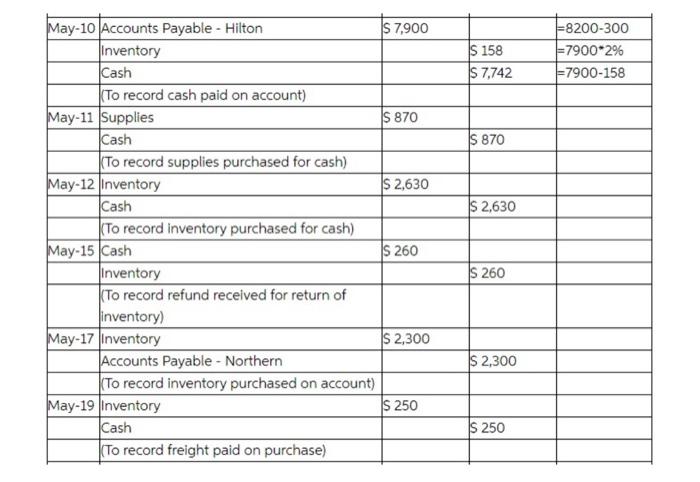

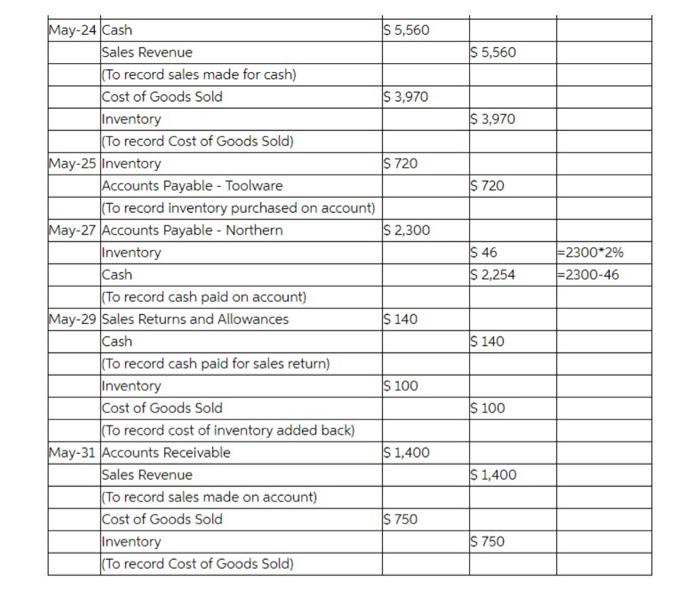

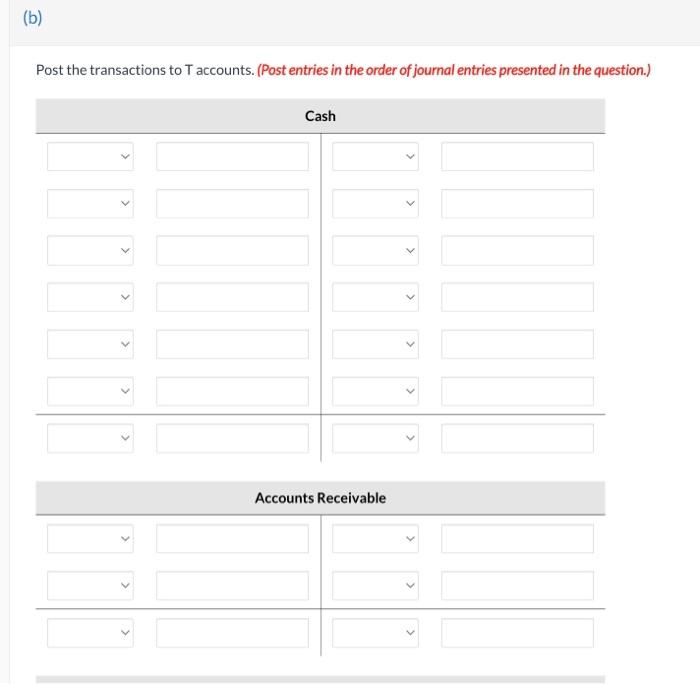

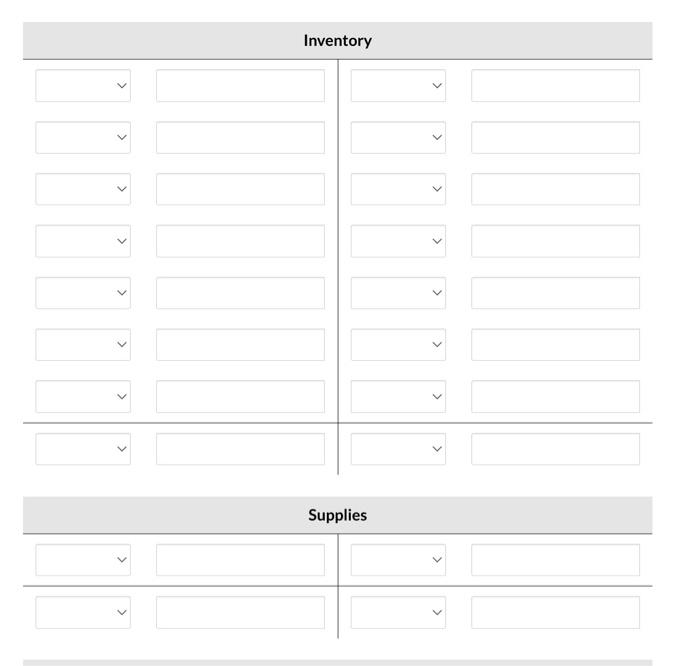

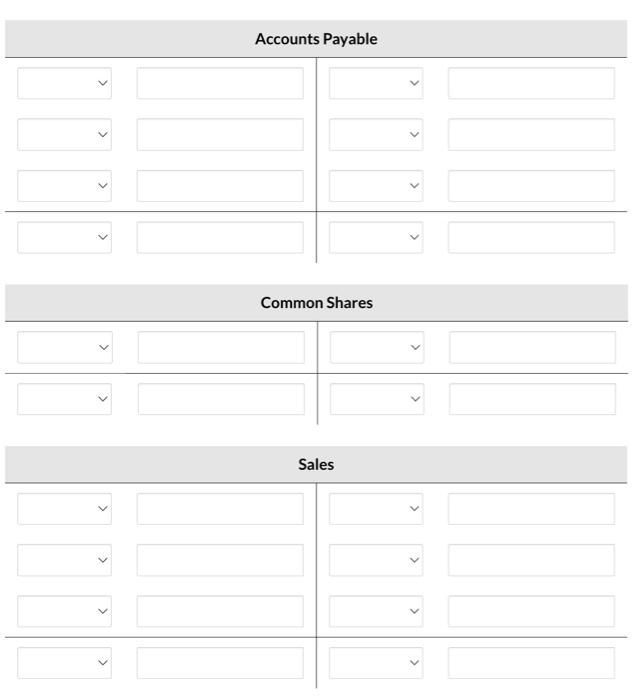

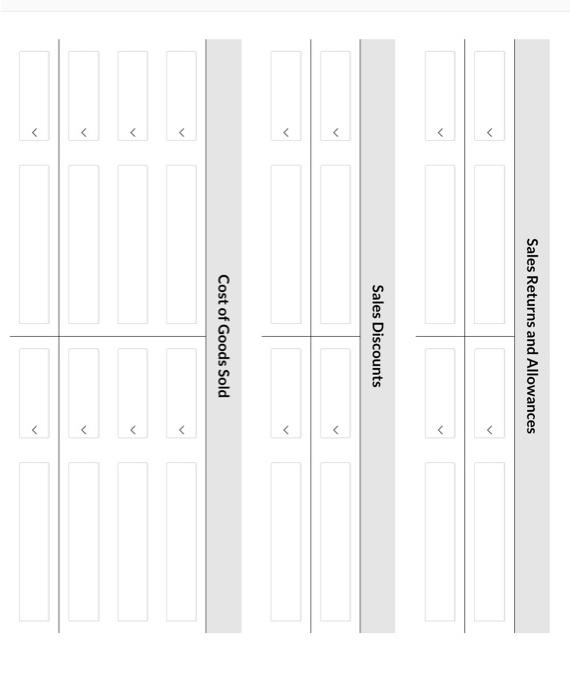

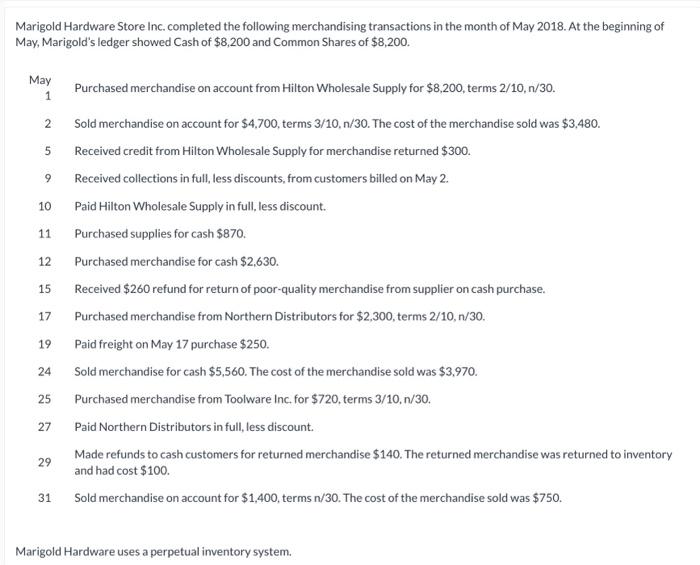

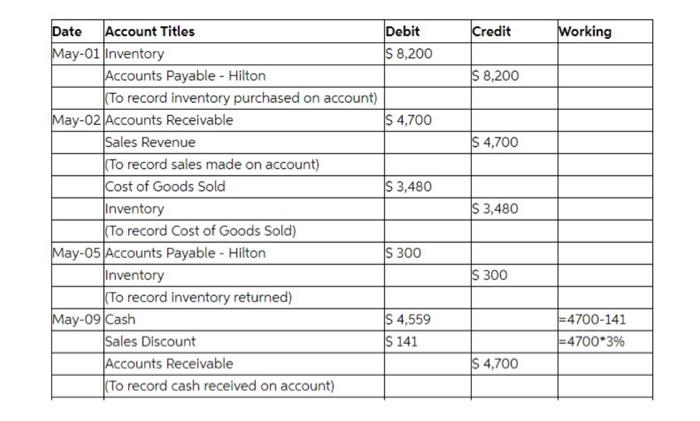

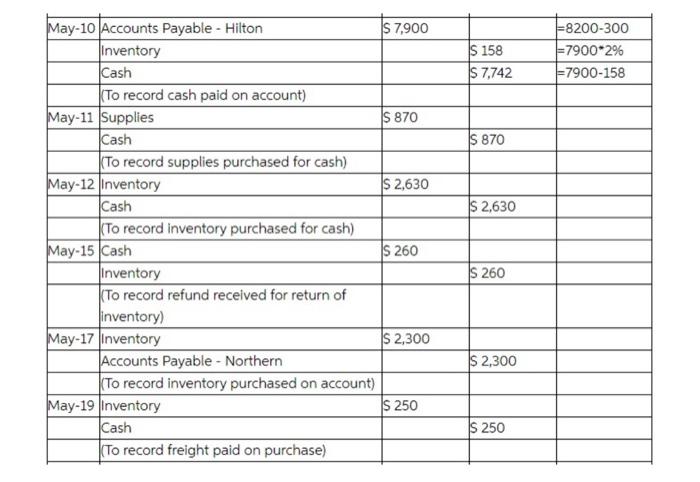

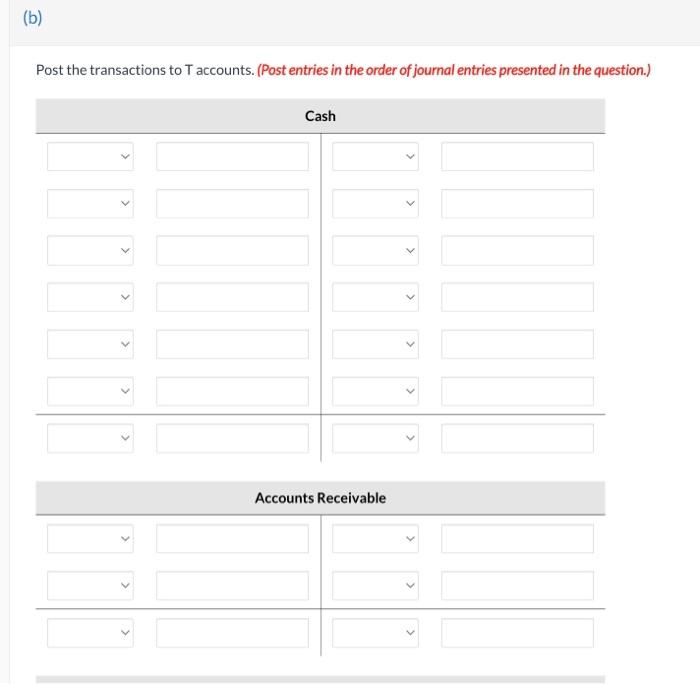

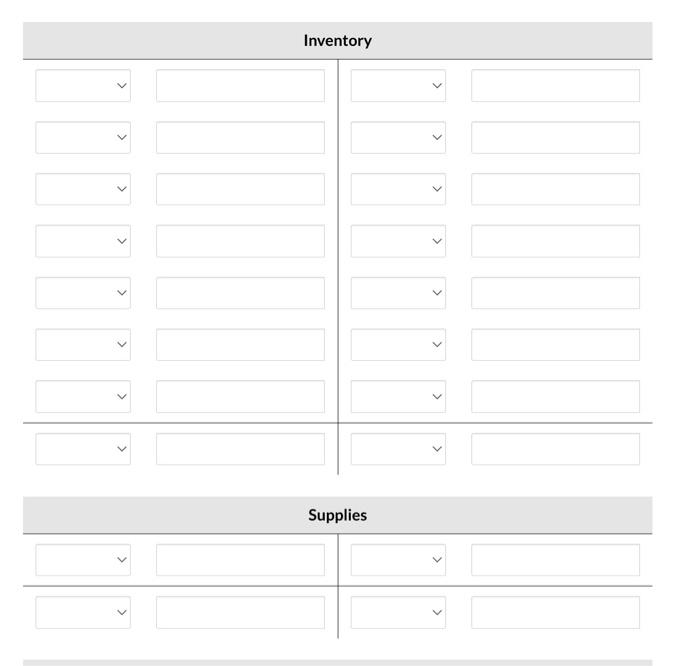

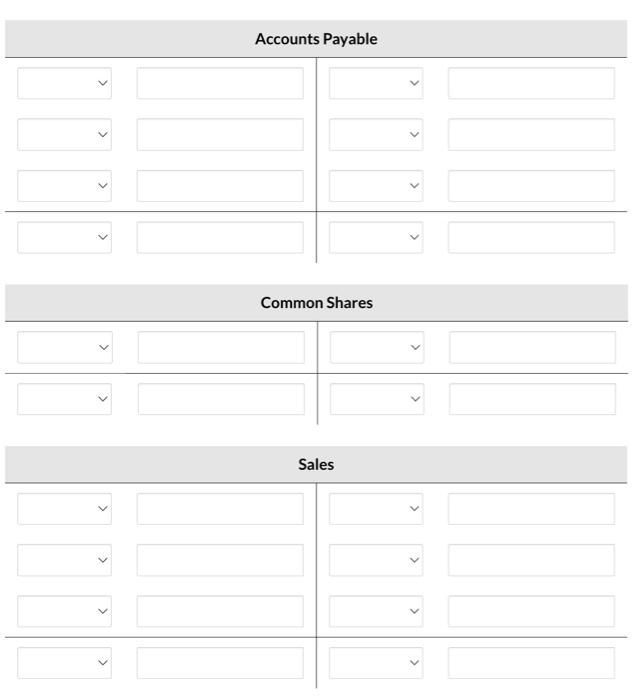

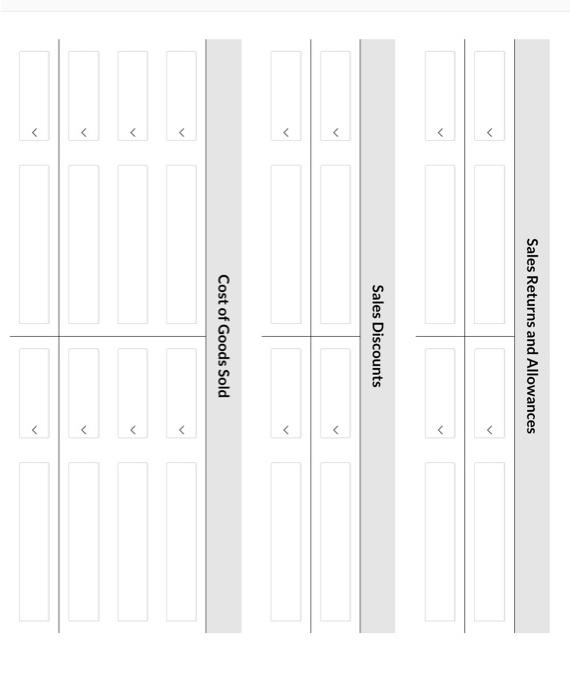

Marigold Hardware Store Inc. completed the following merchandising transactions in the month of May 2018. At the beginning of May, Marigold's ledger showed Cash of $8,200 and Common Shares of $8,200. May Purchased merchandise on account from Hilton Wholesale Supply for $8,200, terms 2/10,n/30. 2 Sold merchandise on account for $4,700, terms 3/10,n/30. The cost of the merchandise sold was $3,480. 5 Received credit from Hilton Wholesale Supply for merchandise returned $300. 9 Received collections in full, less discounts, from customers billed on May 2. 10 Paid Hilton Wholesale Supply in full, less discount. 11 Purchased supplies for cash $870. 12 Purchased merchandise for cash $2,630. 15 Received $260 refund for return of poor-quality merchandise from supplier on cash purchase. 17 Purchased merchandise from Northern Distributors for $2,300, terms 2/10,n/30, 19 Paid freight on May 17 purchase $250. 24 Sold merchandise for cash $5,560. The cost of the merchandise sold was $3,970. 25 Purchased merchandise from Toolware Inc, for $720, terms 3/10,n/30. 27 Paid Northern Distributors in full, less discount. 29 Made refunds to cash customers for returned merchandise $140. The returned merchandise was returned to inventory and had cost $100. 31 Sold merchandise on account for $1,400, terms n/30. The cost of the merchandise sold was $750. Marigold Hardware uses a perpetual inventory system. \begin{tabular}{|l|l|l|l|l|} \hline Date & Account Titles & Debit & Credit & Working \\ \hline May-01 & Inventory & $8,200 & & \\ \hline & Accounts Payable - Hilton & & $8,200 & \\ \hline & (To record inventory purchased on account) & & & \\ \hline May-02 & Accounts Receivable & $4,700 & & \\ \hline & Sales Revenue & & $4,700 & \\ \hline & (To record sales made on account) & & & \\ \hline & Cost of Goods Sold & $3,480 & & \\ \hline & Inventory & & $3,480 & \\ \hline & (To record Cost of Goods Sold) & & & \\ \hline May-05 & Accounts Payable - Hilton & $300 & & \\ \hline & Inventory & & $300 & \\ \hline & (To record inventory returned) & & & \\ \hline May-09 & Cash & $4,559 & & =4700141 \\ \hline & Sales Discount & $141 & & =47003% \\ \hline & Accounts Receivable & & $4,700 & \\ \hline & (To record cash received on account) & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline May-10 & Accounts Payable - Hilton & $7,900 & & =8200300 \\ \hline & Inventory & & $158 & =79002% \\ \hline & Cash & & $7,742 & =7900158 \\ \hline & (To record cash paid on account) & & & \\ \hline May-11 & Supplies & $870 & & \\ \hline & Cash & & $870 & \\ \hline & (To record supplies purchased for cash) & & & \\ \hline May-12 & Inventory & $2,630 & & \\ \hline & Cash & & $2,630 & \\ \hline & (To record inventory purchased for cash) & & & \\ \hline May-15 & Cash & $260 & & \\ \hline & Inventory & & $260 & \\ \hline & (Torecordrefundreceivedforreturnofinventory) & & & \\ \hline May-17 & Inventory & $2,300 & & \\ \hline & Accounts Payable - Northern & & $2,300 & \\ \hline & (To record inventory purchased on account) & & & \\ \hline May-19 & Inventory & S250 & & \\ \hline & Cash & & $250 & \\ \hline & (To record freight paid on purchase) & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline May-24 & Cash & $5,560 & & \\ \hline & Sales Revenue & & $5,560 & \\ \hline & (To record sales made for cash) & & & \\ \hline & Cost of Goods Sold & $3,970 & & \\ \hline & Inventory & & $3,970 & \\ \hline & (To record Cost of Goods Sold) & & & \\ \hline May-25 & Inventory & $720 & & \\ \hline & Accounts Payable - Toolware & & $720 & \\ \hline & (To record inventory purchased on account) & & & \\ \hline May-27 & Accounts Payable - Northern & $2,300 & & \\ \hline & Inventory & & $46 & =23002% \\ \hline & Cash & & $2,254 & =230046 \\ \hline & (To record cash paid on account) & & & \\ \hline May-29 & Sales Returns and Allowances & $140 & & \\ \hline & Cash & & $140 & \\ \hline & (To record cash paid for sales return) & & & \\ \hline & Inventory & $100 & & \\ \hline & Cost of Goods Sold & & $100 & \\ \hline & (To record cost of inventory added back) & & & \\ \hline May-31 & Accounts Receivable & $1,400 & & \\ \hline & Sales Revenue & & $1,400 & \\ \hline & (To record sales made on account) & & & \\ \hline & Cost of Goods Sold & $750 & & \\ \hline & Inventory & (To record Cost of Goods Sold) & & \\ \hline \end{tabular} Post the transactions to T accounts. (Post entries in the order of journal entries presented in the question.) Inventory Supplies Accounts Payable Common Shares Sales Sales Returns and Allowances Sales Discounts Cost of Goods Sold

answer part b).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started