Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following information, and using the VC method of valuation, determine the % of the company that needs to be given up for $1.5

Given the following information, and using the VC method of valuation, determine the % of the company that needs to be given up for $1.5 m investment.

Required ROR by investor(s): 25%

Net income in five years: $ 3.2 m

Expected P/E ratio in four years: 12 times

Apply the fundamental method of valuation to the following data in order to find a market value (price) for the venture. Part B. What portion of the company should be given up if there is a need for $1.6 m in venture capital?

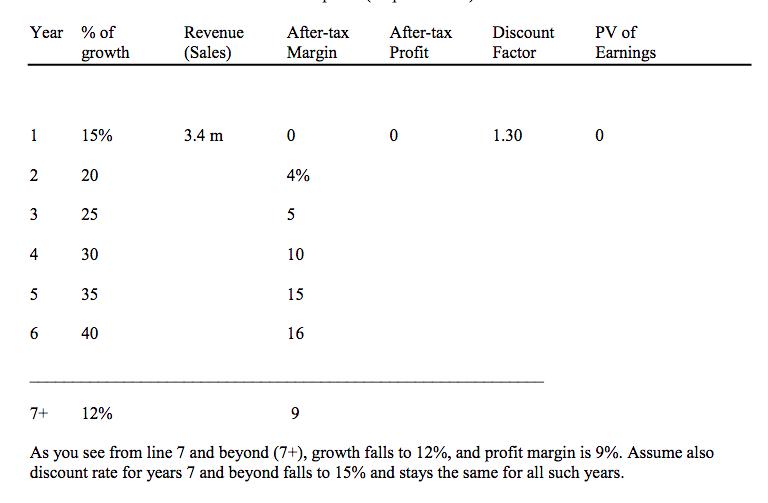

Year % of Revenue growth (Sales) After-tax Margin After-tax Discount PV of Profit Factor Earnings 1 15% 3.4 m 0 0 1.30 0 2 3 20 25 20 4% 25 5 4 30 10 5 35 55 15 6 40 40 16 7+ 12% 9 As you see from line 7 and beyond (7+), growth falls to 12%, and profit margin is 9%. Assume also discount rate for years 7 and beyond falls to 15% and stays the same for all such years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the percentage of the company that needs to be given up for a 15 million investment usi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started