Question

Given the Following Information below Create a Balance Sheet for the married couple Nick and Marry. Using the January 2019 asset and liability information, develop

Given the Following Information below Create a Balance Sheet for the married couple Nick and Marry.

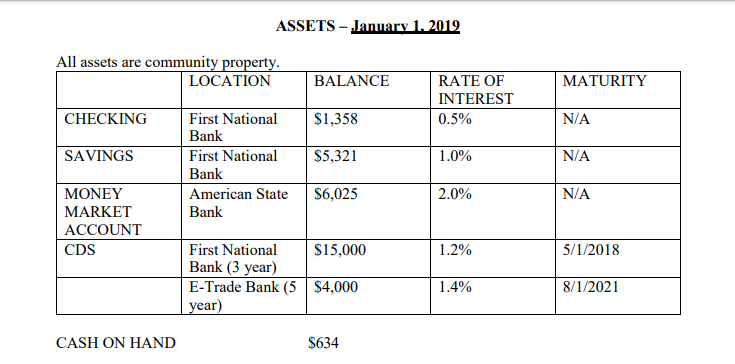

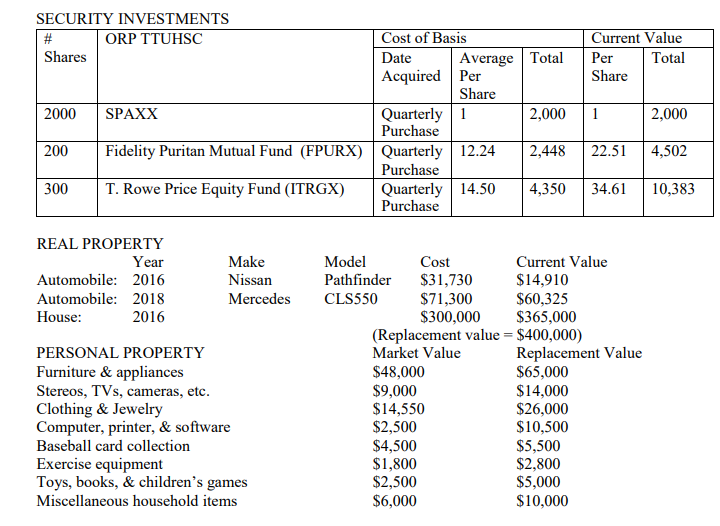

Using the January 2019 asset and liability information, develop a balance sheet for the Gordon family. Regular expenditures for things like utilities, rent, etc. are included on a balance sheet only if there are unpaid bills due. Assume the Gordon family has no unpaid bills. Assets on a balance sheet are listed at their current market value, not the purchase price. Liabilities are listed at the current outstanding balance. What is the Gordon familys net worth?

use the information provided below

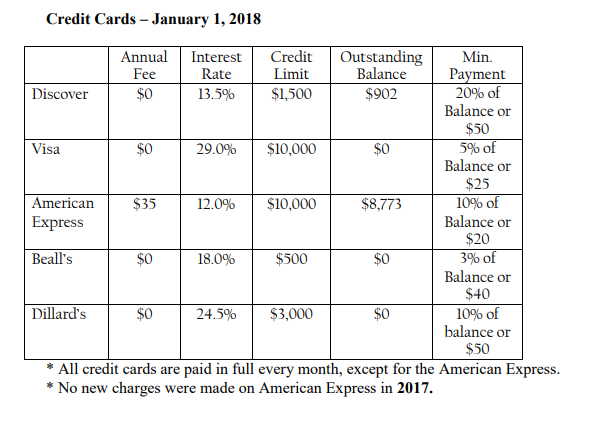

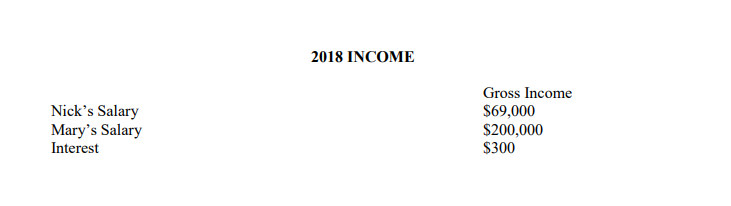

ASSETS - January 1. 2019 All assets are community property. LOCATION BALANCE MATURITY RATE OF INTEREST 0.5% CHECKING $1,358 N/A SAVINGS $5,321 First National Bank First National Bank American State Bank 1.0% N/A $6,025 2.0% N/A MONEY MARKET ACCOUNT CDS $15,000 1.2% 5/1/2018 First National Bank (3 year) E-Trade Bank (5 $4,000 1.4% 8/1/2021 year) CASH ON HAND $634 SECURITY INVESTMENTS ORP TTUHSC Shares Current Value Cost of Basis Date Average Total Acquired Per Per Total Share 2000 SPAXX 2,000 2,000 200 Fidelity Puritan Mutual Fund (FPURX) 12.24 2,448 Quarterly Purchase Quarterly Purchase Quarterly Purchase 22.51 4,502 300 T. Rowe Price Equity Fund (ITRGX) 4,350 34.61 10,383 REAL PROPERTY Year Automobile: 2016 Automobile: 2018 House: Make Nissan Mercedes 2010 PERSONAL PROPERTY Furniture & appliances Stereos, TVs, cameras, etc. Clothing & Jewelry Computer, printer, & software Baseball card collection Exercise equipment Toys, books, & children's games Miscellaneous household items Model Cost Current Value Pathfinder $31,730 $14,910 CLS550 $71,300 $60,325 $300,000 $365,000 (Replacement value = $400,000) Market Value Replacement Value $48,000 $65,000 $9,000 $14,000 $14,550 $26,000 $2,500 $10,500 $4,500 $5,500 $1,800 $2,800 $2,500 $5,000 $6,000 $10,000 LIABILITIES Total # of Date of First Payment of (as of Paymen 9/1/2016 60 12/1/2018 All liabilities are community property debt. To whom Original Property Interes Current Paymen How owed Amount or Service t Rate Balance often Purchased Amount paid Account Jan 2018) GMAC 25,000 Nissan 4.5% Monthly Pathfinder 18,872.27 466.08 Texas Tech 65,000 Mercedes 5.5% Monthly Credit CLS550 Union Nationwide 250,000 House 6.25% Monthly Mortgage 246,052.72 1,539.29 Co. Department | 30,000 Student 7.5% Monthly Loans 5,726.27 356.11 Education Wells Fargo 70,000 Student 5.25% $ Monthly Education 48,006.93 751.04 *Calculate the amounts that are missing using TVM calculations. | 360 9/1/2016 120 6/1/2009 of 120 6/1/2014 Loan Credit Cards - January 1, 2018 Visa Annual Interest Credit Outstanding Min. Fee Rate Limit Balance Payment Discover $0 13.5% $1,500 $902 20% of Balance or $50 29.0% $10,000 5% of Balance or $25 $35 12.0% $10,000 $8,773 10% of Express Balance or $20 Beall's $0 18.0% $500 3% of Balance or $40 Dillard's $0 24.5% $3,000 $0 10% of balance or $50 * All credit cards are paid in full every month, except for the American Express. * No new charges were made on American Express in 2017. 2018 INCOME Nick's Salary Mary's Salary Interest Gross Income $69,000 $200,000 $300 ASSETS - January 1. 2019 All assets are community property. LOCATION BALANCE MATURITY RATE OF INTEREST 0.5% CHECKING $1,358 N/A SAVINGS $5,321 First National Bank First National Bank American State Bank 1.0% N/A $6,025 2.0% N/A MONEY MARKET ACCOUNT CDS $15,000 1.2% 5/1/2018 First National Bank (3 year) E-Trade Bank (5 $4,000 1.4% 8/1/2021 year) CASH ON HAND $634 SECURITY INVESTMENTS ORP TTUHSC Shares Current Value Cost of Basis Date Average Total Acquired Per Per Total Share 2000 SPAXX 2,000 2,000 200 Fidelity Puritan Mutual Fund (FPURX) 12.24 2,448 Quarterly Purchase Quarterly Purchase Quarterly Purchase 22.51 4,502 300 T. Rowe Price Equity Fund (ITRGX) 4,350 34.61 10,383 REAL PROPERTY Year Automobile: 2016 Automobile: 2018 House: Make Nissan Mercedes 2010 PERSONAL PROPERTY Furniture & appliances Stereos, TVs, cameras, etc. Clothing & Jewelry Computer, printer, & software Baseball card collection Exercise equipment Toys, books, & children's games Miscellaneous household items Model Cost Current Value Pathfinder $31,730 $14,910 CLS550 $71,300 $60,325 $300,000 $365,000 (Replacement value = $400,000) Market Value Replacement Value $48,000 $65,000 $9,000 $14,000 $14,550 $26,000 $2,500 $10,500 $4,500 $5,500 $1,800 $2,800 $2,500 $5,000 $6,000 $10,000 LIABILITIES Total # of Date of First Payment of (as of Paymen 9/1/2016 60 12/1/2018 All liabilities are community property debt. To whom Original Property Interes Current Paymen How owed Amount or Service t Rate Balance often Purchased Amount paid Account Jan 2018) GMAC 25,000 Nissan 4.5% Monthly Pathfinder 18,872.27 466.08 Texas Tech 65,000 Mercedes 5.5% Monthly Credit CLS550 Union Nationwide 250,000 House 6.25% Monthly Mortgage 246,052.72 1,539.29 Co. Department | 30,000 Student 7.5% Monthly Loans 5,726.27 356.11 Education Wells Fargo 70,000 Student 5.25% $ Monthly Education 48,006.93 751.04 *Calculate the amounts that are missing using TVM calculations. | 360 9/1/2016 120 6/1/2009 of 120 6/1/2014 Loan Credit Cards - January 1, 2018 Visa Annual Interest Credit Outstanding Min. Fee Rate Limit Balance Payment Discover $0 13.5% $1,500 $902 20% of Balance or $50 29.0% $10,000 5% of Balance or $25 $35 12.0% $10,000 $8,773 10% of Express Balance or $20 Beall's $0 18.0% $500 3% of Balance or $40 Dillard's $0 24.5% $3,000 $0 10% of balance or $50 * All credit cards are paid in full every month, except for the American Express. * No new charges were made on American Express in 2017. 2018 INCOME Nick's Salary Mary's Salary Interest Gross Income $69,000 $200,000 $300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started