Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following information, calculate the book value per share of the Assets $600,000 Liabilitics-$400,000 Equity $200,000 Net Income Price of stock Number of shares

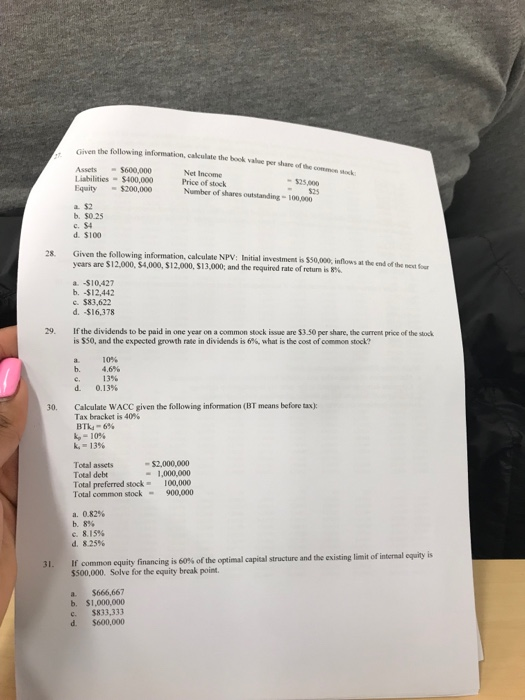

Given the following information, calculate the book value per share of the Assets $600,000 Liabilitics-$400,000 Equity $200,000 Net Income Price of stock Number of shares outstanding-100,000 -$ 25,000 $25 b. $0.25 d. $100 28. Given the following information, calculate NPV: Initial investment is $50,000, inflows at the end of thetor years are $12,000, $4,000, $12,000, $13,000; and the required rate of returm is% a. -$10,427 b. -$12,442 c. $83,622 d. -$16,378 29. If the dividends to be paid in one year on a common stock issue are $3.50 per share, the current price of the stock is S50, and the expected growth rate in dividends is 6%, what is the cost of common stock? 10% 4.6% 13% b, c. d. 0.13% 30. Calculate WACC given the following information (BT means before tax): Tax bracket is 40% k,-10% k,-13% -$2,000,000 -1,000,000 100,000 900,000 Total assets Total debt Total preferred stock Total common stock a. 0.82% b.8% c. 8.15% d. 825% common equity financing is 60%of the optimul capital structure and the existing limit of internal equity is $500,000. Solve for the equity break point 31, 1 a $666,667 b. $1,000,000 C. $833,333 d. $600,000 Given the following information, calculate the book value per share of the Assets $600,000 Liabilitics-$400,000 Equity $200,000 Net Income Price of stock Number of shares outstanding-100,000 -$ 25,000 $25 b. $0.25 d. $100 28. Given the following information, calculate NPV: Initial investment is $50,000, inflows at the end of thetor years are $12,000, $4,000, $12,000, $13,000; and the required rate of returm is% a. -$10,427 b. -$12,442 c. $83,622 d. -$16,378 29. If the dividends to be paid in one year on a common stock issue are $3.50 per share, the current price of the stock is S50, and the expected growth rate in dividends is 6%, what is the cost of common stock? 10% 4.6% 13% b, c. d. 0.13% 30. Calculate WACC given the following information (BT means before tax): Tax bracket is 40% k,-10% k,-13% -$2,000,000 -1,000,000 100,000 900,000 Total assets Total debt Total preferred stock Total common stock a. 0.82% b.8% c. 8.15% d. 825% common equity financing is 60%of the optimul capital structure and the existing limit of internal equity is $500,000. Solve for the equity break point 31, 1 a $666,667 b. $1,000,000 C. $833,333 d. $600,000

Given the following information, calculate the book value per share of the Assets $600,000 Liabilitics-$400,000 Equity $200,000 Net Income Price of stock Number of shares outstanding-100,000 -$ 25,000 $25 b. $0.25 d. $100 28. Given the following information, calculate NPV: Initial investment is $50,000, inflows at the end of thetor years are $12,000, $4,000, $12,000, $13,000; and the required rate of returm is% a. -$10,427 b. -$12,442 c. $83,622 d. -$16,378 29. If the dividends to be paid in one year on a common stock issue are $3.50 per share, the current price of the stock is S50, and the expected growth rate in dividends is 6%, what is the cost of common stock? 10% 4.6% 13% b, c. d. 0.13% 30. Calculate WACC given the following information (BT means before tax): Tax bracket is 40% k,-10% k,-13% -$2,000,000 -1,000,000 100,000 900,000 Total assets Total debt Total preferred stock Total common stock a. 0.82% b.8% c. 8.15% d. 825% common equity financing is 60%of the optimul capital structure and the existing limit of internal equity is $500,000. Solve for the equity break point 31, 1 a $666,667 b. $1,000,000 C. $833,333 d. $600,000 Given the following information, calculate the book value per share of the Assets $600,000 Liabilitics-$400,000 Equity $200,000 Net Income Price of stock Number of shares outstanding-100,000 -$ 25,000 $25 b. $0.25 d. $100 28. Given the following information, calculate NPV: Initial investment is $50,000, inflows at the end of thetor years are $12,000, $4,000, $12,000, $13,000; and the required rate of returm is% a. -$10,427 b. -$12,442 c. $83,622 d. -$16,378 29. If the dividends to be paid in one year on a common stock issue are $3.50 per share, the current price of the stock is S50, and the expected growth rate in dividends is 6%, what is the cost of common stock? 10% 4.6% 13% b, c. d. 0.13% 30. Calculate WACC given the following information (BT means before tax): Tax bracket is 40% k,-10% k,-13% -$2,000,000 -1,000,000 100,000 900,000 Total assets Total debt Total preferred stock Total common stock a. 0.82% b.8% c. 8.15% d. 825% common equity financing is 60%of the optimul capital structure and the existing limit of internal equity is $500,000. Solve for the equity break point 31, 1 a $666,667 b. $1,000,000 C. $833,333 d. $600,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started