Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following information, evaluate the solvency of this company: Given the following information, evaluate the solvency of this company: Total assets $361,000 Total liabilities

Given the following information, evaluate the solvency of this company:

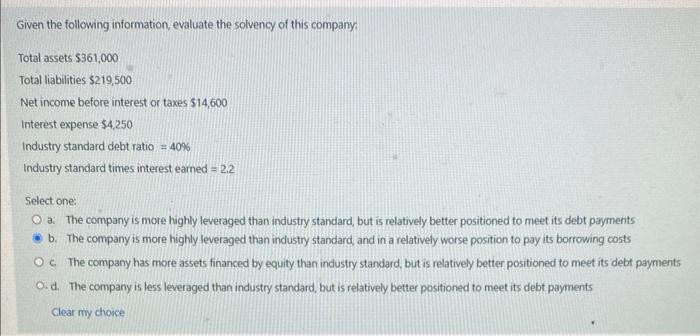

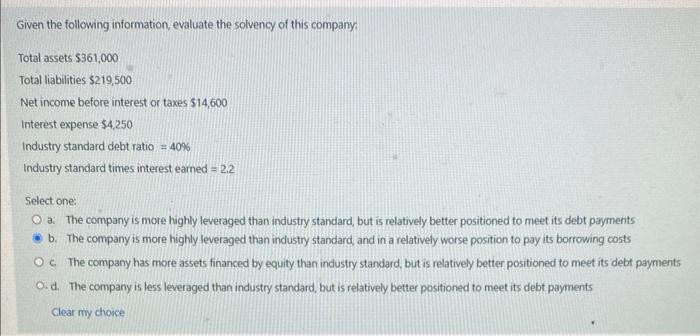

Given the following information, evaluate the solvency of this company: Total assets $361,000 Total liabilities $219,500 Net income before interest or taxes $14,600 Interest expense $4,250 Industry standard debt ratio =40% Industry standard times interest eatned =2.2 Select one: a. The company is more highly leveraged than industry standard, but is relatively better positioned to meet its debt payments b. The company is more highly leveraged than industry standard, and in a relatively worse position to pay its borrowing costs c. The company has more assets financed by equity than industry standard, but is relatively better positioned to meet its debt payments d. The company is less leveraged than industry standard, but is relatively better positioned to meet its debt payments Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started