Question

Given the following information for Blue Bell Company for last year: Net sales (all on account) Cost of goods sold Interest expense Income tax

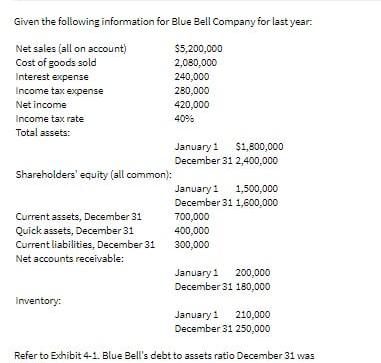

Given the following information for Blue Bell Company for last year: Net sales (all on account) Cost of goods sold Interest expense Income tax expense Net income Income tax rate Total assets: Shareholders' equity (all common): Current assets, December 31 Quick assets, December 31 Current liabilities, December 31 Net accounts receivable: Inventory: $5,200,000 2,080,000 240,000 280,000 420,000 40% $1,800,000 January 1 December 31 2,400,000 January 1 1,500,000 December 31 1,600,000 700,000 400,000 300,000 January 1 200,000 December 31 180,000 January 1 210,000 December 31 250,000 Refer to Exhibit 4-1. Blue Bell's debt to assets ratio December 31 was

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Total Liabilities Current Liabilities LongTerm Debt Current Liabilities December 31 300000 Lon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting IFRS

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

2nd edition

1118285909, 1118285905, 978-1118285909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App