Question

Given the following information for Huntington Power Co., find the WACC. Assume the companys tax rate is 35 percent. (Find the weights, cost of each

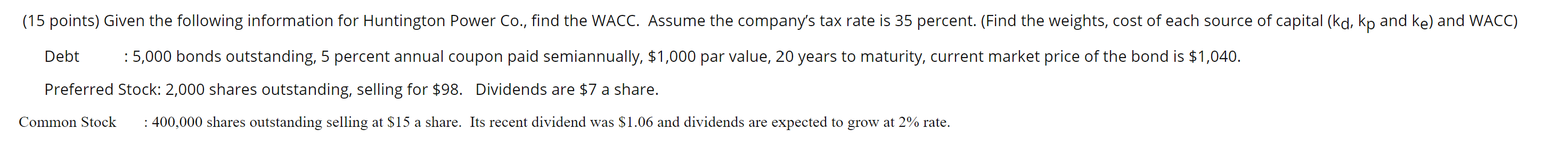

Given the following information for Huntington Power Co., find the WACC. Assume the companys tax rate is 35 percent. (Find the weights, cost of each source of capital (kd, kp and ke) and WACC) Debt : 5,000 bonds outstanding, 5 percent annual coupon paid semiannually, $1,000 par value, 20 years to maturity, current market price of the bond is $1,040. Preferred Stock: 2,000 shares outstanding, selling for $98. Dividends are $7 a share. Common Stock : 400,000 shares outstanding selling at $15 a share. Its recent dividend was $1.06 and dividends are expected to grow at 2% rate.

(15 points) Given the following information for Huntington Power Co., find the WACC. Assume the company's tax rate is 35 percent. (Find the weights, cost of each source of capital (kd, kp and ke) and WACC) Debt :5,000 bonds outstanding, 5 percent annual coupon paid semiannually, $1,000 par value, 20 years to maturity, current market price of the bond is $1,040. Preferred Stock: 2,000 shares outstanding, selling for $98. Dividends are $7 a share. Common Stock : 400,000 shares outstanding selling at $15 a share. Its recent dividend was $1.06 and dividends are expected to grow at 2% rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started