Answered step by step

Verified Expert Solution

Question

1 Approved Answer

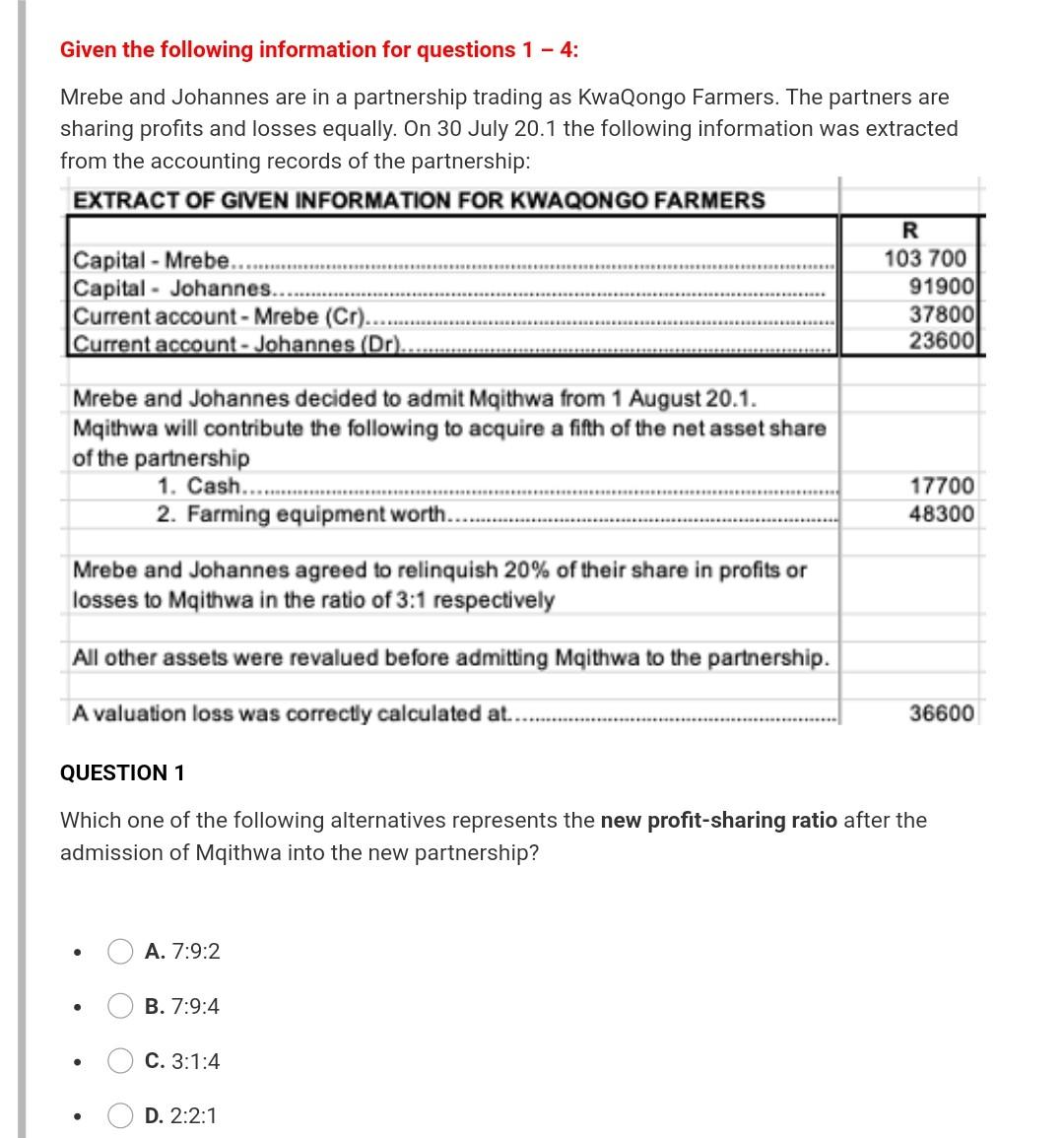

Given the following information for questions 1 - 4: Mrebe and Johannes are in a partnership trading as KwaQongo Farmers. The partners are sharing profits

Given the following information for questions 1 - 4: Mrebe and Johannes are in a partnership trading as KwaQongo Farmers. The partners are sharing profits and losses equally. On 30 July 20.1 the following information was extracted from the accounting records of the partnership: EXTRACT OF GIVEN INFORMATION FOR KWAQONGO FARMERS R Capital - Mrebe. 103 700 Capital - Johannes.. 91900 Current account - Mrebe (Cr).. 37800 Current account - Johannes (Dr). 23600 Mrebe and Johannes decided to admit Mgithwa from 1 August 20.1. Maithwa will contribute the following to acquire a fifth of the net asset share of the partnership 1. Cash... 2. Farming equipment worth... 17700 48300 Mrebe and Johannes agreed to relinquish 20% of their share in profits or losses to Maithwa in the ratio of 3:1 respectively All other assets were revalued before admitting Mgithwa to the partnership. A valuation loss was correctly calculated at.. 36600 QUESTION 1 Which one of the following alternatives represents the new profit-sharing ratio after the admission of Maithwa into the new partnership? A. 7:9:2 B. 7:9:4 C. 3:1:4 D. 2:2:1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started