Answered step by step

Verified Expert Solution

Question

1 Approved Answer

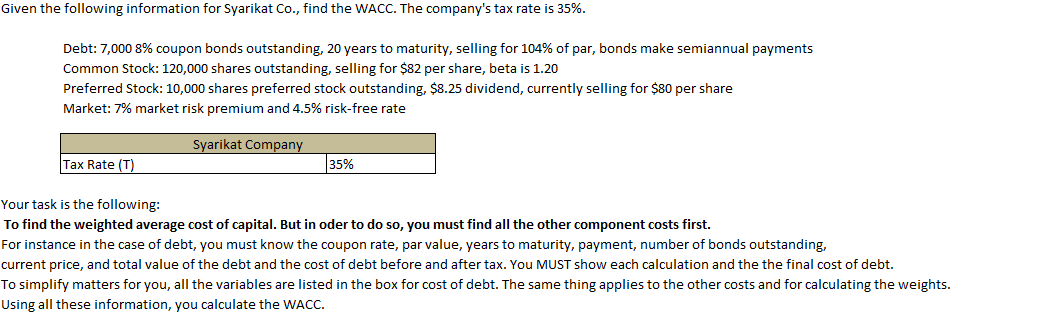

Given the following information for Syarikat Co., find the WACC. The company's tax rate is 35%. Debt: 7,000 8% coupon bonds outstanding, 20 years

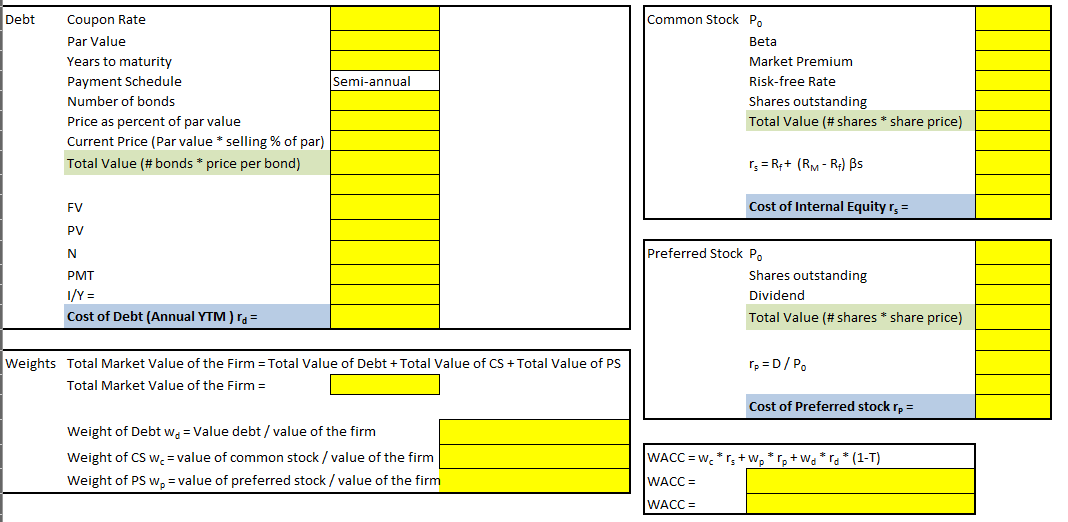

Given the following information for Syarikat Co., find the WACC. The company's tax rate is 35%. Debt: 7,000 8% coupon bonds outstanding, 20 years to maturity, selling for 104% of par, bonds make semiannual payments Common Stock: 120,000 shares outstanding, selling for $82 per share, beta is 1.20 Preferred Stock: 10,000 shares preferred stock outstanding, $8.25 dividend, currently selling for $80 per share Market: 7% market risk premium and 4.5% risk-free rate Syarikat Company Tax Rate (T) 35% Your task is the following: To find the weighted average cost of capital. But in oder to do so, you must find all the other component costs first. For instance in the case of debt, you must know the coupon rate, par value, years to maturity, payment, number of bonds outstanding, current price, and total value of the debt and the cost of debt before and after tax. You MUST show each calculation and the the final cost of debt. To simplify matters for you, all the variables are listed in the box for cost of debt. The same thing applies to the other costs and for calculating the weights. Using all these information, you calculate the WACC. Debt Coupon Rate Par Value Years to maturity Payment Schedule Number of bonds Price as percent of par value Current Price (Par value * selling % of par) Total Value (#bonds * price per bond) FV PV N PMT I/Y= Semi-annual Common Stock P Beta Market Premium Risk-free Rate Shares outstanding Total Value (#shares * share price) r = R++ (RM - R+) s Cost of Internal Equity r = Preferred Stock Po Shares outstanding Cost of Debt (Annual YTM) rd = Weights Total Market Value of the Firm = Total Value of Debt + Total Value of CS + Total Value of PS Total Market Value of the Firm = Weight of Debt w = Value debt/value of the firm Weight of CS w = value of common stock/value of the firm Weight of PS w = value of preferred stock/value of the firm Dividend Total Value (# shares * share price) rp =D / Po Cost of Preferred stock rp = WACC = wc *rs + Wp * rp +Wa *ra * (1-T) WACC = WACC =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started