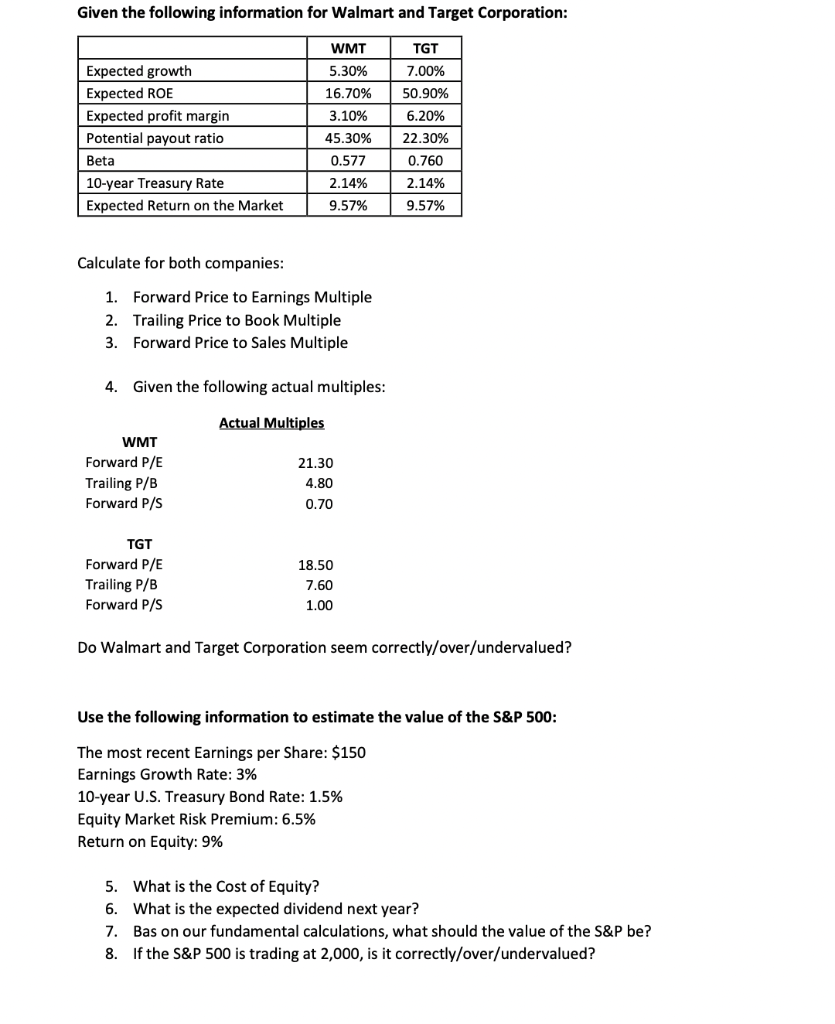

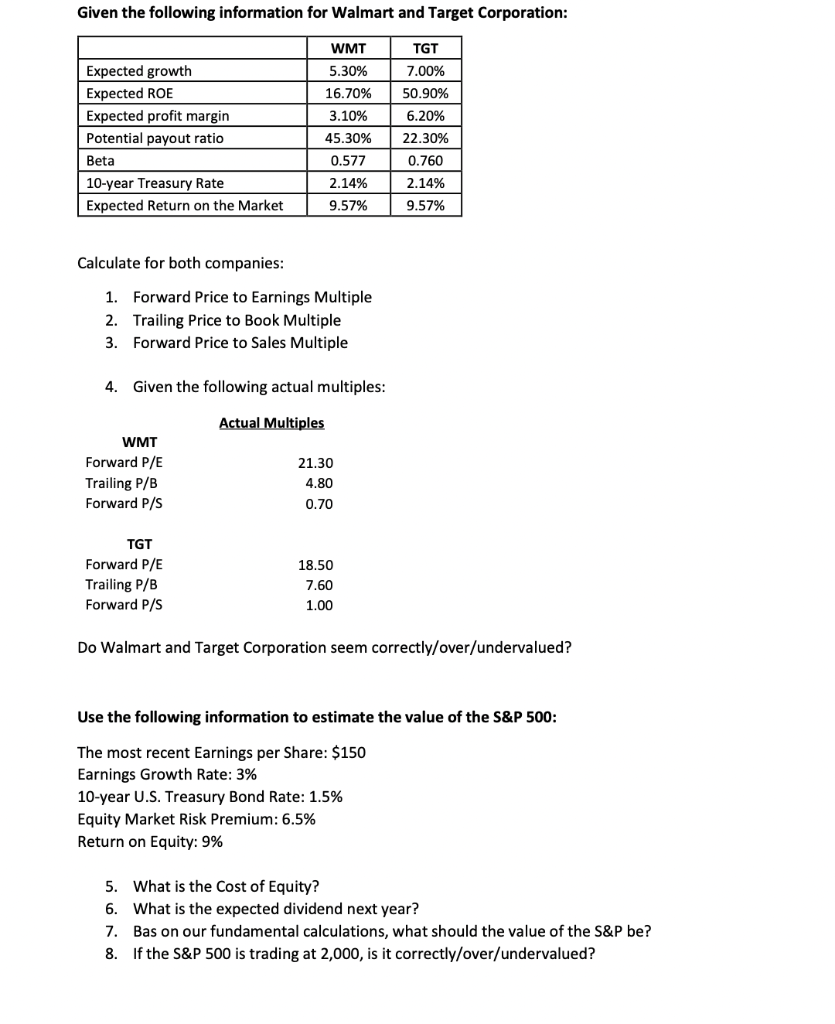

Given the following information for Walmart and Target Corporation: Expected growth Expected ROE Expected profit margin Potential payout ratio Beta 10-year Treasury Rate Expected Return on the Market WMT 5.30% 16.70% 3.10% 45.30% 0.577 2.14% 9.57% TGT 7.00% 50.90% 6.20% 22.30% 0.760 2.14% 9.57% Calculate for both companies: 1. Forward Price to Earnings Multiple 2. Trailing Price to Book Multiple 3. Forward Price to Sales Multiple 4. Given the following actual multiples: Actual Multiples WMT Forward P/E Trailing P/B Forward P/S 21.30 4.80 0.70 TGT Forward P/E Trailing P/B Forward P/S 18.50 7.60 1.00 Do Walmart and Target Corporation seem correctly/over/undervalued? Use the following information to estimate the value of the S&P 500: The most recent Earnings per Share: $150 Earnings Growth Rate: 3% 10-year U.S. Treasury Bond Rate: 1.5% Equity Market Risk Premium: 6.5% Return on Equity: 9% 5. What is the Cost of Equity? 6. What is the expected dividend next year? 7. Bas on our fundamental calculations, what should the value of the S&P be? 8. If the S&P 500 is trading at 2,000, is it correctly/over/undervalued? Given the following information for Walmart and Target Corporation: Expected growth Expected ROE Expected profit margin Potential payout ratio Beta 10-year Treasury Rate Expected Return on the Market WMT 5.30% 16.70% 3.10% 45.30% 0.577 2.14% 9.57% TGT 7.00% 50.90% 6.20% 22.30% 0.760 2.14% 9.57% Calculate for both companies: 1. Forward Price to Earnings Multiple 2. Trailing Price to Book Multiple 3. Forward Price to Sales Multiple 4. Given the following actual multiples: Actual Multiples WMT Forward P/E Trailing P/B Forward P/S 21.30 4.80 0.70 TGT Forward P/E Trailing P/B Forward P/S 18.50 7.60 1.00 Do Walmart and Target Corporation seem correctly/over/undervalued? Use the following information to estimate the value of the S&P 500: The most recent Earnings per Share: $150 Earnings Growth Rate: 3% 10-year U.S. Treasury Bond Rate: 1.5% Equity Market Risk Premium: 6.5% Return on Equity: 9% 5. What is the Cost of Equity? 6. What is the expected dividend next year? 7. Bas on our fundamental calculations, what should the value of the S&P be? 8. If the S&P 500 is trading at 2,000, is it correctly/over/undervalued