Answered step by step

Verified Expert Solution

Question

1 Approved Answer

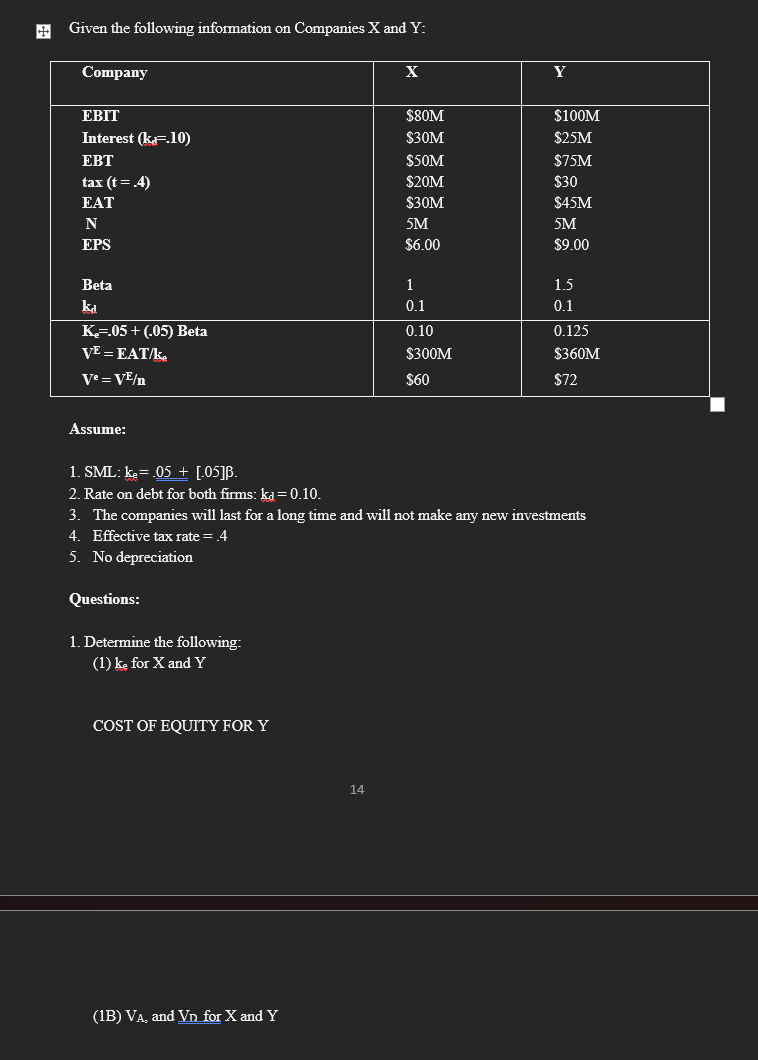

Given the following information on Companies X and Y : ( 1 C ) Using the equity valuation approach, determine the combined asset value and

Given the following information on Companies X and Y : C Using the equity valuation approach, determine the combined asset value and equity value if X

acquired Y and their combined EBIT were estimated to be $ million:

D What is the equity merger premium?

E What is the maximum cash price per share that X could offer to buy Y s equity?

tableCompanyxYEBIT$M$MInterest kd$M$MEBT$M$Mtax t$M$EAT$M$MN M MEPS$$BetaksdKe Beta,VEEATse $M$MVeVEn$$

Assume:

SML:

Rate on debt for both firms:

The companies will last for a long time and will not make any new investments

Effective tax rate

No depreciation

Questions:

Determine the following:

for X and Y

COST OF EQUITY FOR Y

B and for X and Y

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started