Answered step by step

Verified Expert Solution

Question

1 Approved Answer

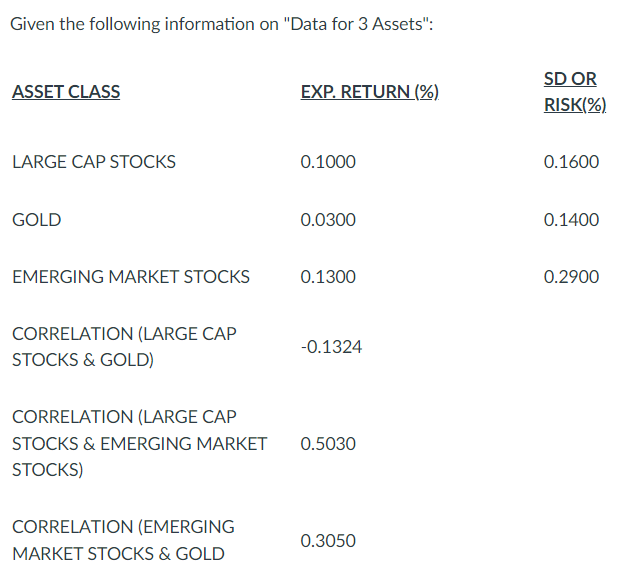

Given the following information on Data for 3 Assets: ASSET CLASS LARGE CAP STOCKS GOLD EMERGING MARKET STOCKS CORRELATION (LARGE CAP STOCKS & GOLD)

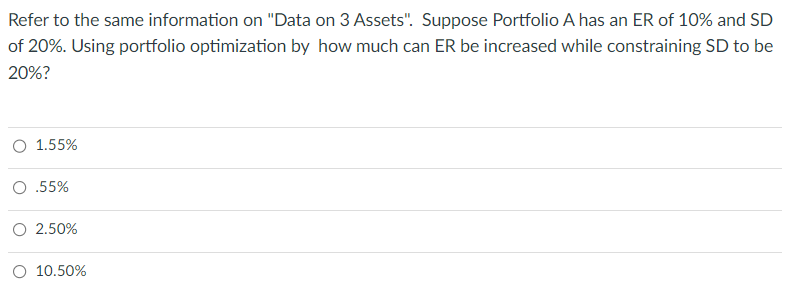

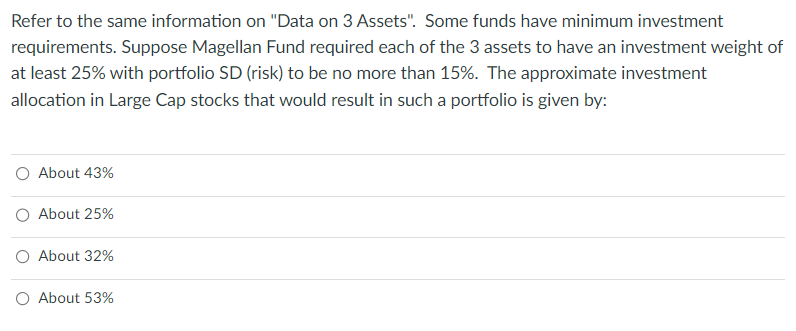

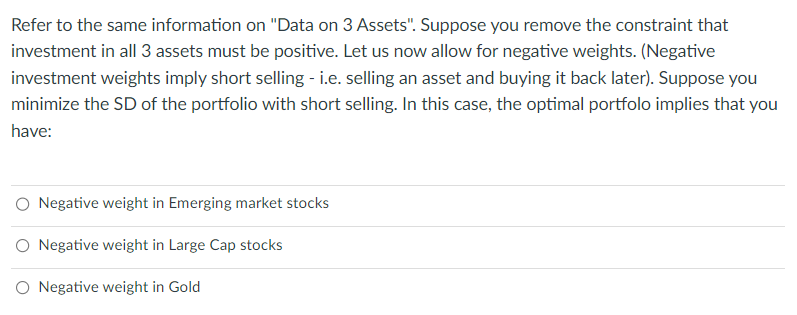

Given the following information on "Data for 3 Assets": ASSET CLASS LARGE CAP STOCKS GOLD EMERGING MARKET STOCKS CORRELATION (LARGE CAP STOCKS & GOLD) EXP. RETURN (%) CORRELATION (EMERGING MARKET STOCKS & GOLD 0.1000 0.0300 0.1300 -0.1324 CORRELATION (LARGE CAP STOCKS & EMERGING MARKET 0.5030 STOCKS) 0.3050 SD OR RISK(%) 0.1600 0.1400 0.2900 Refer to the same information on "Data on 3 Assets". Suppose Portfolio A has an ER of 10% and SD of 20%. Using portfolio optimization by how much can ER be increased while constraining SD to be 20%? O 1.55% O .55% O 2.50% O 10.50% Refer to the same information on "Data on 3 Assets". Some funds have minimum investment requirements. Suppose Magellan Fund required each of the 3 assets to have an investment weight of at least 25% with portfolio SD (risk) to be no more than 15%. The approximate investment allocation in Large Cap stocks that would result in such a portfolio is given by: O About 43% About 25% O About 32% O About 53% Refer to the same information on "Data on 3 Assets". Suppose you remove the constraint that investment in all 3 assets must be positive. Let us now allow for negative weights. (Negative investment weights imply short selling - i.e. selling an asset and buying it back later). Suppose you minimize the SD of the portfolio with short selling. In this case, the optimal portfolo implies that you have: O Negative weight in Emerging market stocks O Negative weight in Large Cap stocks O Negative weight in Gold

Step by Step Solution

★★★★★

3.27 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 To determine the increase in expected return ER for Portfolio A while constraining standard deviation SD to 20 you can use the formula textSharpe Ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started