Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following information, please fill in the highlighted boxes. Also, if you could show your work so I can follow along that would be

Given the following information, please fill in the highlighted boxes. Also, if you could show your work so I can follow along that would be appreciated.

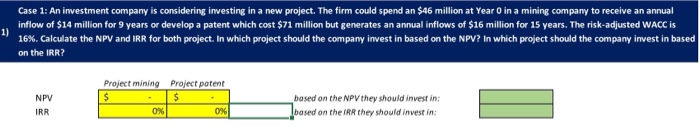

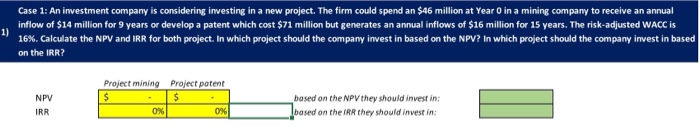

Case 1: Anim estment company is considering investing in a new project. The firm could spend an $46 million at Year 0 i inflow of $14 million for 9 years or develop a patent which cost $71 million but The risk-adjusted WACC is 16%. Calculate the NPV and IRR for both project. In which project should the company invest in based on the NPV? In which project should the company invest in based on the IRR? n a mining company to receive an annual generates an annual inflows of $16 million for 15 years 1) Project mining Project potent NPV IRR based on the NPV they should invest in based on the IRR they should invest in 0% 0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started