Answered step by step

Verified Expert Solution

Question

1 Approved Answer

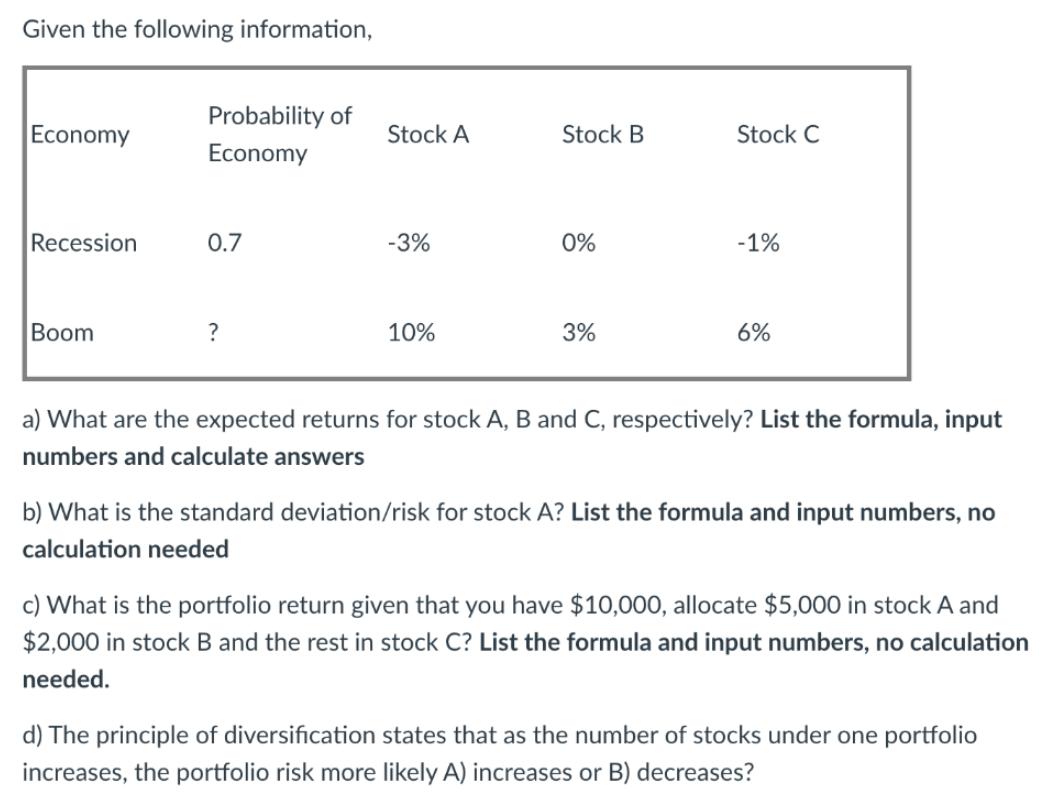

Given the following information, Probability of Economy Stock A Stock B Stock C Economy Recession 0.7 -3% 0% -1% Boom ? 10% 3% 6%

Given the following information, Probability of Economy Stock A Stock B Stock C Economy Recession 0.7 -3% 0% -1% Boom ? 10% 3% 6% a) What are the expected returns for stock A, B and C, respectively? List the formula, input numbers and calculate answers b) What is the standard deviation/risk for stock A? List the formula and input numbers, no calculation needed c) What is the portfolio return given that you have $10,000, allocate $5,000 in stock A and $2,000 in stock B and the rest in stock C? List the formula and input numbers, no calculation needed. d) The principle of diversification states that as the number of stocks under one portfolio increases, the portfolio risk more likely A) increases or B) decreases?

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Expected Returns for stocks A ProbabilityExpected return Recession and boom 07000303010090 B ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started