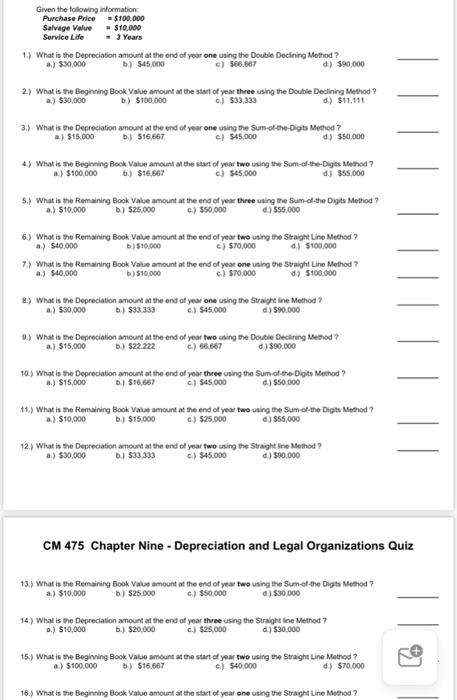

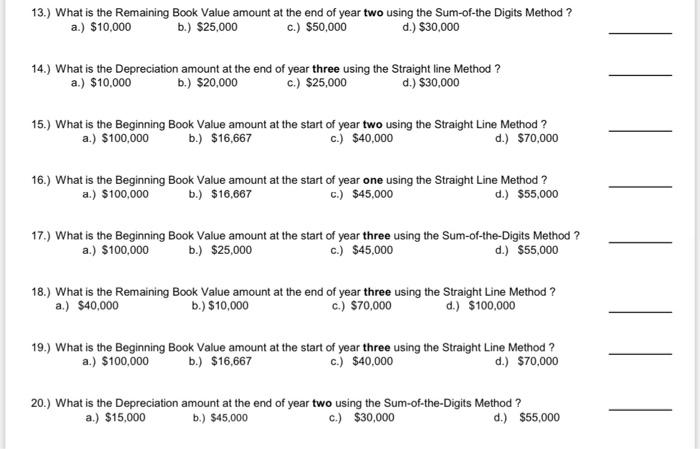

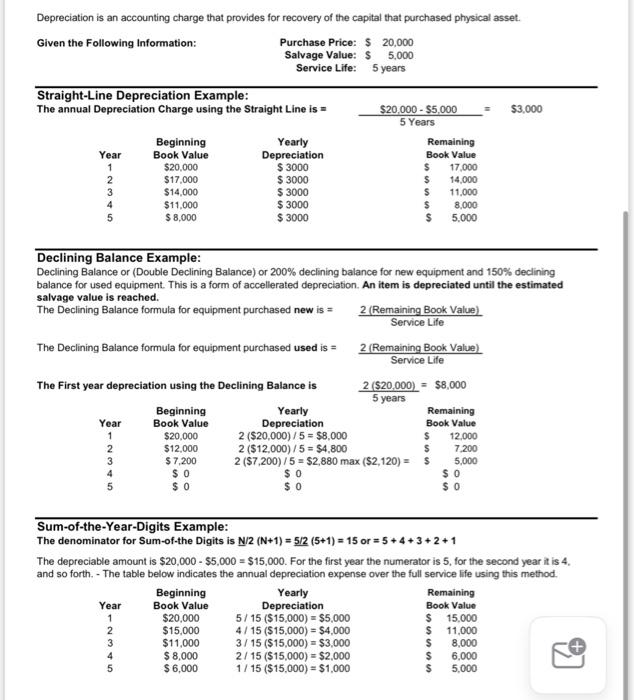

Given the following information: Purchase Price =$100.000 Salvage Value =$10.000 Service Life = 3 Years 1.) What is the Depreciasion amount at the ond of year one using the Double Decining Method? a.) $30,000 b.) 545,000 c) 366.667 d) $90,000 2.) What is the Beginning Book Value amount at the start of year three using the Double Declining Method ? a.) $30,000 b.) $100,000 c.) $33,333 d) $11,111 3.) What is Ehe Depreciation amount at the end of year one using the Sum-ot-the-Digts Method? a.) 515.000 b.) $16,667 c) $45,000 d.) $50.000 4.) What is the Begineing Bock Value amourt at the stact of year two using the Sum-of-the-Digis Method ? a.) $100.000 b.) $16,667 c) 345,000 d.) 35,5,000 5.) What is the Remaining Book Value amount at the end of year three using the 5um-oldthe Dygts Method ? a.) 510,000 b) $24000 c.) 550.000 d) 555.000 6.) What is the Remaining Book Value amount at the end of year two using the Syaight Line Method? a.) $40.000 b) 310 boc c) $70,000 d.) $100.000 7.) What is the Remaining Book Value amount at the end of year one uning the Straight Line Method? a.) $40.000 b) 510,090 c.) $10,000 d.) $100.000 8.) What is the Depreciation amount at the end of yeat one using the Straigh ine Method ? a.) 530,000 b.) $33.333 c.) $45000 d) 590.000 9.) What is the Depreciation amount at the end of year two esing the Double Declining Method ? a.) $15,000 b) $22.222 c) 60 cdT d ) 390,000 10.) What is the Depreciabion amount at the end of year theee using the Sum-of the-Digits Method ? a.) $15,000 b.) 516.65 c.) 945000 d.) 550.000 11.) What is the Remaining Book. Vakue amount at the end of year two using the Sum-of-the Digts Method ? a.) $10,000 b.) $15,000 c.) $25,000 d) $55,000 12.) What is the Depreciation amount at the end of year fwo using the Straight line Method ? a.) $30,000 b.) 533.339 c.) $45000 d) 590.000 CM 475 Chapter Nine - Depreciation and Legal Organizations Quiz 13.) What is the Remaining Book Vatue amount at the end of yeat two using the Sum-of-the Digts Method ? a.) 510,000 b.) $25.000 c) 350000 d) $30,000 14.) What is the Depreciation amount at the end of year three using the Straight line Method 7 a.) 510,000 b.) $20.000 c.) 525,000 d.) 530,000 15.) What is the Beginning Bock Value amount at the stact of year two using the Straight Line Method? a.) $100.000 b.) $16.667 c.) $40.000 d.) $70.000 13.) What is the Remaining Book Value amount at the end of year two using the Sum-of-the Digits Method ? a.) $10,000 b.) $25,000 c.) $50,000 d.) $30,000 14.) What is the Depreciation amount at the end of year three using the Straight line Method ? a.) $10,000 b.) $20,000 c.) $25,000 d.) $30,000 15.) What is the Beginning Book Value amount at the start of year two using the Straight Line Method ? a.) $100,000 b.) $16,667 c.) $40,000 d.) $70,000 16.) What is the Beginning Book Value amount at the start of year one using the Straight Line Method ? a.) $100,000 b.) $16,667 c.) $45,000 d.) $55,000 17.) What is the Beginning Book Value amount at the start of year three using the Sum-of-the-Digits Method? a.) $100,000 b.) $25,000 c.) $45,000 d.) $55,000 18.) What is the Remaining Book Value amount at the end of year three using the Straight Line Method ? a.) $40,000 b.) $10,000 c.) $70,000 d.) $100,000 19.) What is the Beginning Book Value amount at the start of year three using the Straight Line Method? a.) $100,000 b.) $16,667 c.) $40,000 d.) $70,000 20.) What is the Depreciation amount at the end of year two using the Sum-of-the-Digits Method ? a.) $15,000 b.) $45,000 c.) $30,000 d.) $55,000 Depreciation is an accounting charge that provides for recovery of the capital that purchased physical asset. Straight-Line Depreciation Example: The annual Depreciation Charge using the Straight Line is = 5Years$20,000$5,000=$3,000 Declining Balance Example: Declining Balance or (Double Declining Balance) or 200\% declining balance for new equipment and 150% declining balance for used equipment. This is a form of accellerated depreciation. An item is depreciated until the estimated salvage value is reached. The Declining Balance formula for equipment purchased new is =ServiceLife2(RemainingBookValue) The Declining Balance formula for equipment purchased used is =ServiceLife2(RemainingBookValue) The First year depreciation using the Declining Balance is 5vears2($20,000)=$8,000 Sum-of-the-Year-Digits Example: The denominator for Sum-of-the Digits is N/2(N+1)=5/2(5+1)=15 or =5+4+3+2+1 The depreciable amount is $20,000$5,000=$15,000. For the first year the numerator is 5 , for the second year it is 4 . and so forth. - The table below indicates the annual depreciation expense over the full service life using this method