Question

Given the following Treasury securities and their current prices: 1 Security 1 2 3 4 5 6 2 Type T-bill T-bill T-note T-note T-note

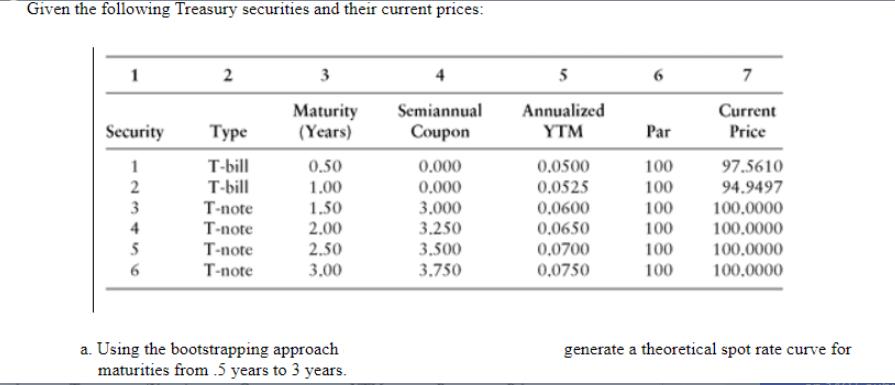

Given the following Treasury securities and their current prices: 1 Security 1 2 3 4 5 6 2 Type T-bill T-bill T-note T-note T-note T-note 3 Maturity (Years) 0.50 1.00 1.50 2.00 2.50 3.00 a. Using the bootstrapping approach maturities from .5 years to 3 years. 4 Semiannual Coupon 0.000 0.000 3.000 3.250 3.500 3.750 5 Annualized YTM 0.0500 0,0525 0,0600 0.0650 0,0700 0,0750 6 Par 100 100 100 100 100 100 7 Current Price 97.5610 94.9497 100,0000 100,0000 100,0000 100.0000 generate a theoretical spot rate curve for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To generate a theoretical spot rate curve for maturities from 05 years to 3 years using the bootstrapping approach we need to follow the steps outlined below 1 Step 1 Start with the given Treasury sec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

A Pathway To Introductory Statistics

Authors: Jay Lehmann

1st Edition

0134107179, 978-0134107172

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App