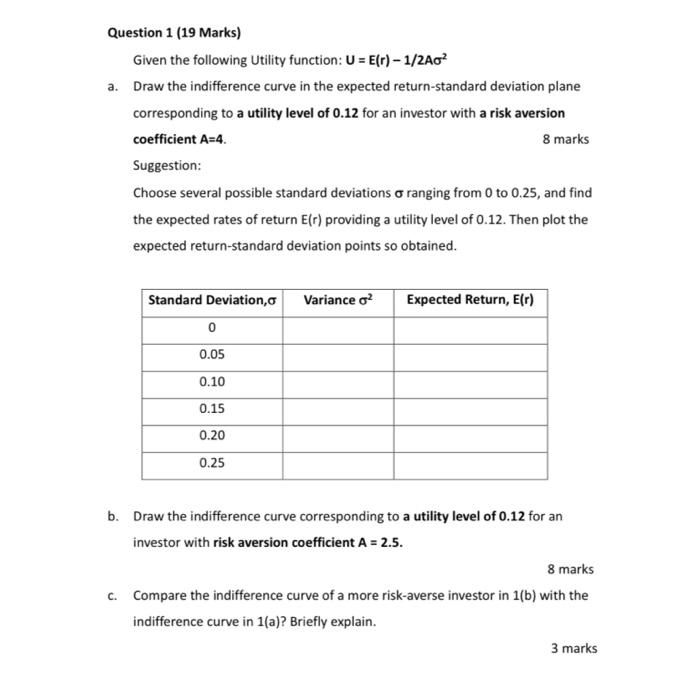

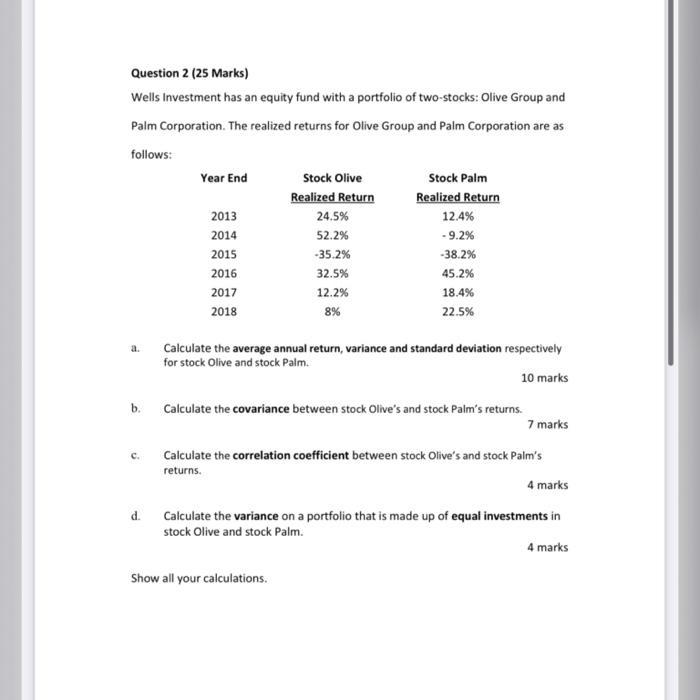

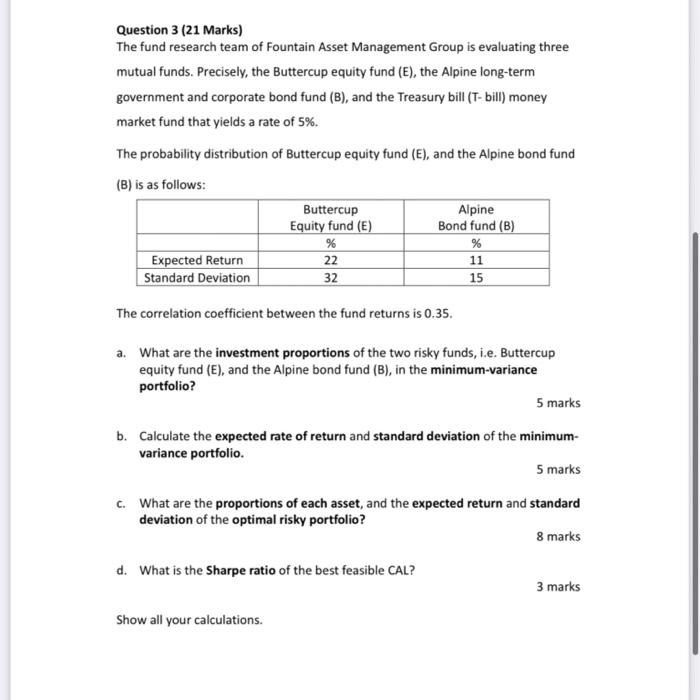

Given the following Utility function: U=E(r)1/2A2 a. Draw the indifference curve in the expected return-standard deviation plane corresponding to a utility level of 0.12 for an investor with a risk aversion coefficient A=4. 8 marks Suggestion: Choose several possible standard deviations ranging from 0 to 0.25, and find the expected rates of return E(r) providing a utility level of 0.12. Then plot the expected return-standard deviation points so obtained. b. Draw the indifference curve corresponding to a utility level of 0.12 for an investor with risk aversion coefficient A=2.5. 8 marks c. Compare the indifference curve of a more risk-averse investor in 1 (b) with the indifference curve in 1(a)? Briefly explain. Question 2 (25 Marks) Wells Investment has an equity fund with a portfolio of two-stocks: Olive Group and Palm Corporation. The realized returns for Olive Group and Palm Corporation are as follows: a. Calculate the average annual return, variance and standard deviation respectively for stock Olive and stock Palm. 10 marks b. Calculate the covariance between stock Olive's and stock Paim's returns. 7 marks c. Calculate the correlation coefficient between stock Olive's and stock Palm's returns. 4 marks d. Calculate the variance on a portfolio that is made up of equal investments in stock Olive and stock Palm. 4 marks Show all your calculations. Question 3 (21 Marks) The fund research team of Fountain Asset Management Group is evaluating three mutual funds. Precisely, the Buttercup equity fund (E), the Alpine long-term government and corporate bond fund (B), and the Treasury bill (T-bill) money market fund that yields a rate of 5%. The probability distribution of Buttercup equity fund (E), and the Alpine bond fund (B) is as follows: The correlation coefficient between the fund returns is 0.35. a. What are the investment proportions of the two risky funds, i.e. Buttercup equity fund (E), and the Alpine bond fund (B), in the minimum-variance portfolio? 5marks b. Calculate the expected rate of return and standard deviation of the minimumvariance portfolio. 5marks c. What are the proportions of each asset, and the expected return and standard deviation of the optimal risky portfolio? 8marks d. What is the Sharpe ratio of the best feasible CAL? 3marks Show all your calculations