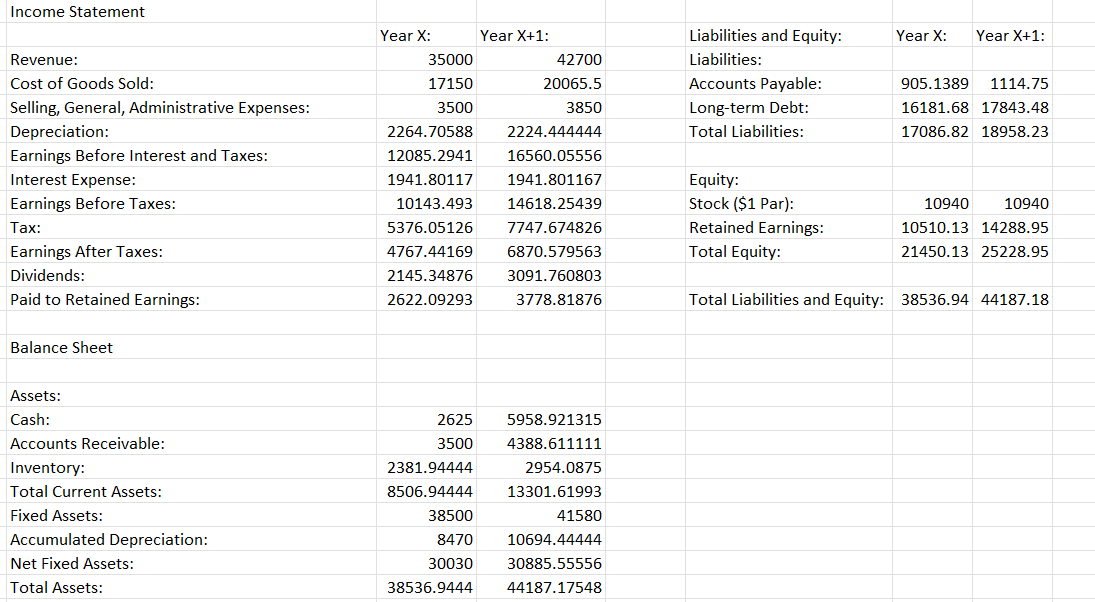

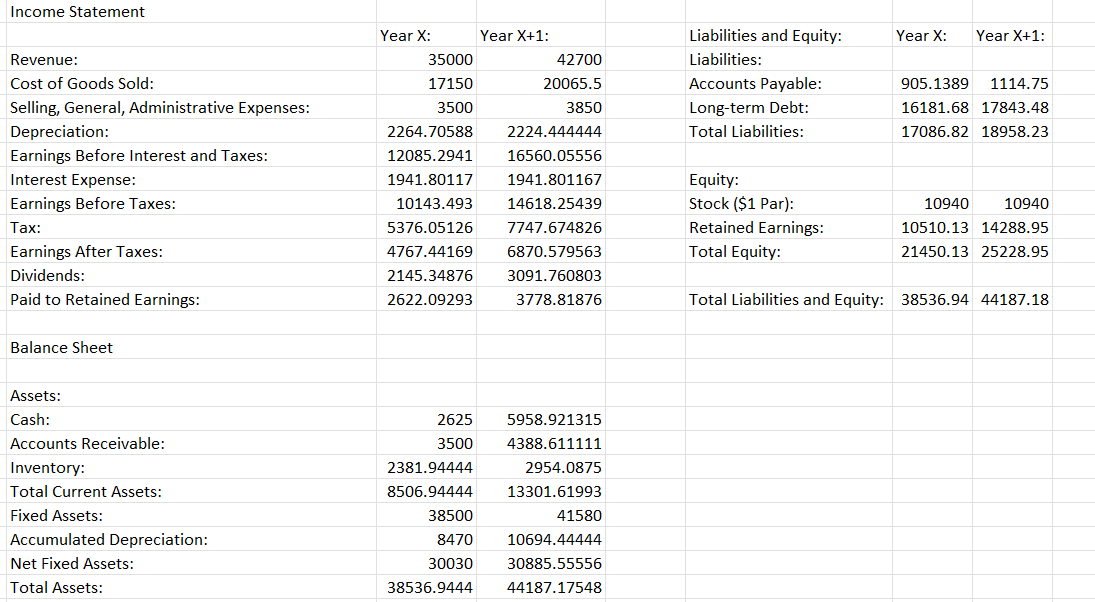

| Given the income statement and balance sheet below, compute the following cash flows for Year X+1. |

| 1- Cash Flow from Operations: |

| 2- Change in Net Working Capital: |

| 3- Change in Fixed Assets: |

| 4- Cash Flow from Assets: |

| 5- Free Cash Flow: |

| 6- Cash Flow to Creditors: |

Income Statement \begin{tabular}{|l|r|r|l|l|l|l|} \hline & Year X: & Year X+1: & \multicolumn{2}{l|}{ Liabilities and Equity: } & Year X: & Year X+1: \\ \hline Revenue: & 35000 & 42700 & Liabilities: & & \\ \hline Cost of Goods Sold: & 17150 & 20065.5 & & Accounts Payable: & 905.1389 & 1114.75 \\ \hline Selling, General, Administrative Expenses: & 3500 & 3850 & Long-term Debt: & 16181.68 & 17843.48 \\ \hline Depreciation: & 2264.70588 & 2224.444444 & Total Liabilities: & 17086.82 & 18958.23 \\ \hline Earnings Before Interest and Taxes: & 12085.2941 & 16560.05556 & & & \\ \hline Interest Expense: & 1941.80117 & 1941.801167 & Equity: & & \\ \hline Earnings Before Taxes: & 10143.493 & 14618.25439 & Stock (\$1 Par): & 10940 & 10940 \\ \hline Tax: & 5376.05126 & 7747.674826 & Retained Earnings: & 10510.13 & 14288.95 \\ \hline Earnings After Taxes: & 4767.44169 & 6870.579563 & Total Equity: & 21450.13 & 25228.95 \\ \hline Dividends: & 2145.34876 & 3091.760803 & & & \\ \hline Paid to Retained Earnings: & 2622.09293 & 3778.81876 & Total Liabilities and Equity: 38536.94 & 44187.18 \\ \hline \end{tabular} Balance Sheet Assets: \begin{tabular}{|l|r|r|} \hline Cash: & 2625 & 5958.921315 \\ \hline Accounts Receivable: & 3500 & 4388.611111 \\ \hline Inventory: & 2381.94444 & 2954.0875 \\ \hline Total Current Assets: & 8506.94444 & 13301.61993 \\ \hline Fixed Assets: & 38500 & 41580 \\ \hline Accumulated Depreciation: & 8470 & 10694.44444 \\ \hline Net Fixed Assets: & 30030 & 30885.55556 \\ \hline Total Assets: & 38536.9444 & 44187.17548 \\ \hline \end{tabular} Income Statement \begin{tabular}{|l|r|r|l|l|l|l|} \hline & Year X: & Year X+1: & \multicolumn{2}{l|}{ Liabilities and Equity: } & Year X: & Year X+1: \\ \hline Revenue: & 35000 & 42700 & Liabilities: & & \\ \hline Cost of Goods Sold: & 17150 & 20065.5 & & Accounts Payable: & 905.1389 & 1114.75 \\ \hline Selling, General, Administrative Expenses: & 3500 & 3850 & Long-term Debt: & 16181.68 & 17843.48 \\ \hline Depreciation: & 2264.70588 & 2224.444444 & Total Liabilities: & 17086.82 & 18958.23 \\ \hline Earnings Before Interest and Taxes: & 12085.2941 & 16560.05556 & & & \\ \hline Interest Expense: & 1941.80117 & 1941.801167 & Equity: & & \\ \hline Earnings Before Taxes: & 10143.493 & 14618.25439 & Stock (\$1 Par): & 10940 & 10940 \\ \hline Tax: & 5376.05126 & 7747.674826 & Retained Earnings: & 10510.13 & 14288.95 \\ \hline Earnings After Taxes: & 4767.44169 & 6870.579563 & Total Equity: & 21450.13 & 25228.95 \\ \hline Dividends: & 2145.34876 & 3091.760803 & & & \\ \hline Paid to Retained Earnings: & 2622.09293 & 3778.81876 & Total Liabilities and Equity: 38536.94 & 44187.18 \\ \hline \end{tabular} Balance Sheet Assets: \begin{tabular}{|l|r|r|} \hline Cash: & 2625 & 5958.921315 \\ \hline Accounts Receivable: & 3500 & 4388.611111 \\ \hline Inventory: & 2381.94444 & 2954.0875 \\ \hline Total Current Assets: & 8506.94444 & 13301.61993 \\ \hline Fixed Assets: & 38500 & 41580 \\ \hline Accumulated Depreciation: & 8470 & 10694.44444 \\ \hline Net Fixed Assets: & 30030 & 30885.55556 \\ \hline Total Assets: & 38536.9444 & 44187.17548 \\ \hline \end{tabular}