Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the information above, calculate the following: i. Profits for the periods ii. Weighted average cost of capital iii. Net present value of the proposed

Given the information above, calculate the following: i. Profits for the periods ii. Weighted average cost of capital iii. Net present value of the proposed project iv. Recommendation on the acceptance or rejection of the project with justifications.

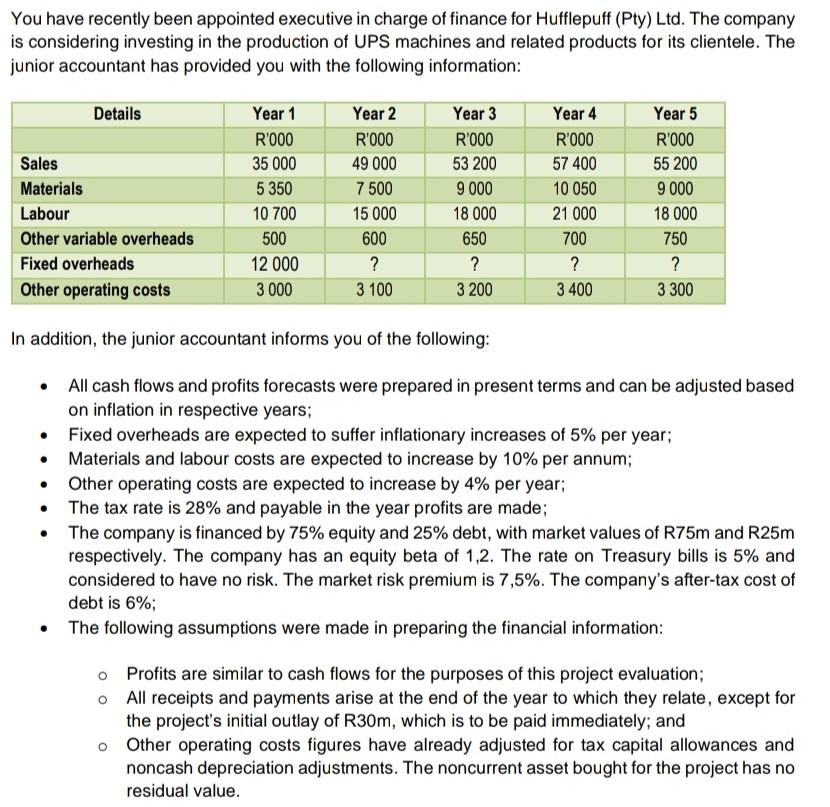

You have recently been appointed executive in charge of finance for Hufflepuff (Pty) Ltd. The company is considering investing in the production of UPS machines and related products for its clientele. The junior accountant has provided you with the following information: In addition, the junior accountant informs you of the following: - All cash flows and profits forecasts were prepared in present terms and can be adjusted based on inflation in respective years; - Fixed overheads are expected to suffer inflationary increases of 5% per year; - Materials and labour costs are expected to increase by 10% per annum; - Other operating costs are expected to increase by 4% per year; - The tax rate is 28% and payable in the year profits are made; - The company is financed by 75% equity and 25% debt, with market values of R75m and R25m respectively. The company has an equity beta of 1,2 . The rate on Treasury bills is 5% and considered to have no risk. The market risk premium is 7,5%. The company's after-tax cost of debt is 6%; - The following assumptions were made in preparing the financial information: Profits are similar to cash flows for the purposes of this project evaluation; All receipts and payments arise at the end of the year to which they relate, except for the project's initial outlay of R30m, which is to be paid immediately; and Other operating costs figures have already adjusted for tax capital allowances and noncash depreciation adjustments. The noncurrent asset bought for the project has noStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started