Answered step by step

Verified Expert Solution

Question

1 Approved Answer

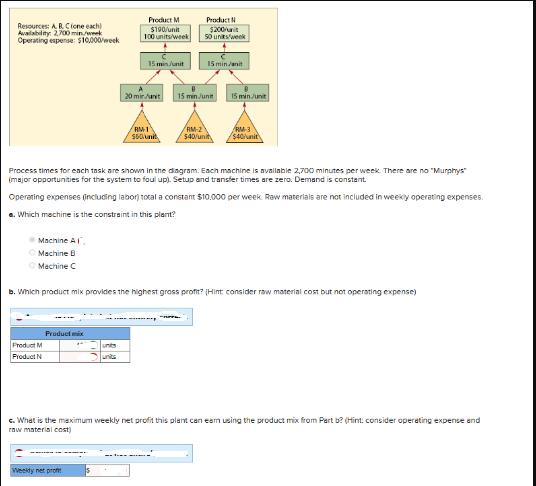

Given the information answer the questions. Resources: A. R. C (one each) Availability 2,700 min/week Operating expense: $10,000/week Product M $190/unit 100 units/week Product N

Given the information answer the questions.

Resources: A. R. C (one each) Availability 2,700 min/week Operating expense: $10,000/week Product M $190/unit 100 units/week Product N $200 50 units week 15 min Juni 15 min/nit 20 mirant 15 min Junit 15 min/unit RM-1 560uni RM-2 $40/uni RM-3 $40/unit Process times for each task are shown in the diagram. Each machine is available 2,700 minutes per week. There are no "Murphys" (major opportunities for the system to foul up). Setup and transfer times are zero. Demand is constant Operating expenses (including labor total a constant $10,000 per week. Raw materials are not included in weekly operating expenses. e. Which machine is the constraint in this plant? Machine A Machine B Machine C b. Which product mix provides the highest gross profit? (Hint consider raw material cost but not operating expense) Product mix Product M Product N units c. What is the maximum weekly net profit this plant can eam using the product mix from Part b? (Hint: consider operating expense and raw material cost) Weeldy net prof

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started