Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the information below answer the question. Sales Barista International Pty Ltd imports, exports, wholesales and retails coffee beans, coffee machines and accessories. The company

Given the information below answer the question.

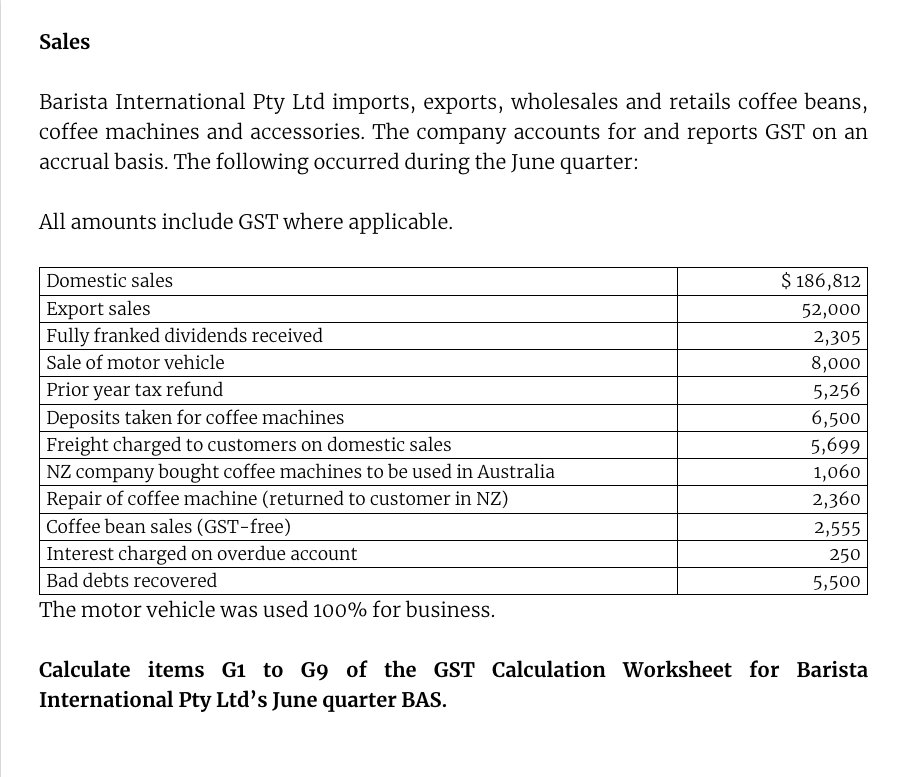

Sales Barista International Pty Ltd imports, exports, wholesales and retails coffee beans, coffee machines and accessories. The company accounts for and reports GST on an accrual basis. The following occurred during the June quarter: All amounts include GST where applicable. Domestic sales Export sales Fully franked dividends received Sale of motor vehicle Prior year tax refund Deposits taken for coffee machines Freight charged to customers on domestic sales NZ company bought coffee machines to be used in Australia Repair of coffee machine (returned to customer in NZ) Coffee bean sales (GST-free) Interest charged on overdue account Bad debts recovered The motor vehicle was used 100% for business. $ 186,812 52,000 2,305 8,000 5,256 6,500 5,699 1,060 2,360 2,555 250 5,500 Calculate items G1 to G9 of the GST Calculation Worksheet for Barista International Pty Ltd's June quarter BAS.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer lets complete each calculation G1 Total sales Domestic sales 186812 Export sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started