Answered step by step

Verified Expert Solution

Question

1 Approved Answer

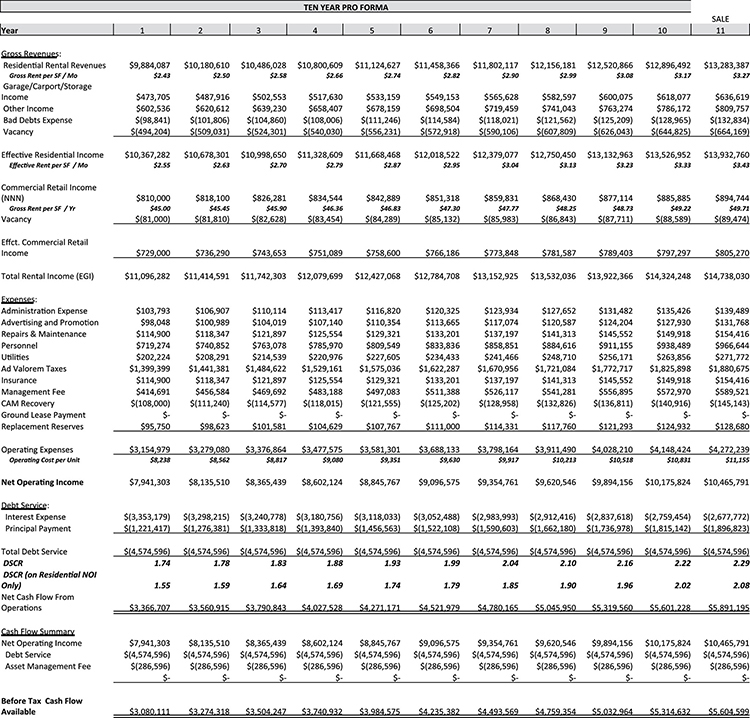

Given the information in the financial statements, calculate the following: ? Present value of the Before Tax Cash flows. Use the following interest rates: 3%

Given the information in the financial statements, calculate the following:

?

Present value of the Before Tax Cash flows.

Use the following interest rates:

- 3%

- 7%

- 9%

?

Net Present Value of the Before Tax Cash flows.

The investment appreciates at 2% per year and sells EOY 10.

Use the following interest rates:

- 3%

- 7%

- 9%

?

- Calculate the levered IRR.

?

- Calculate the unlevered IRR.

?

- Calculate the Equity Multiple.

Year Gross Revenues: Residential Rental Revenues Gross Rent per SF/Mo Garage/Carport/Storage Income Other Income Bad Debts Expense Vacancy Effective Residential Income Effective Rent per SF / Mo Commercial Retail Income (NNN) Gross Rent per SF / Yr Vacancy Effet. Commercial Retail Income Total Rental Income (EGI) Expenses: Administration Expense Advertising and Promotion Repairs & Maintenance Personnel Utilities Ad Valorem Taxes Insurance Management Fee CAM Recovery Ground Lease Payment Replacement Reserves Operating Expenses Operating cost per Unit Net Operating Income Debt Service: Interest Expense Principal Payment Total Debt Service DSCR DSCR (on Residential NOI Only) Net Cash Flow From Operations Cash Flow Summary Net Operating Income Debt Service Asset Management Fee Before Tax Cash Flow Available $9,884,087 $10,180,610 $10,486,028 $10,800,609 $2.43 $2.50 $2.58 $2.66 $10,367,282 $2.55 $487,916 $502,553 $517,630 $473,705 $602,536 $620,612 $639,230 $658,407 $(98,841) $(101,806) $(104,860) $(108,006) $(494,204) $(509,031) $(524,301) $(540,030) $810,000 $45.00 $(81,000) $729,000 $11,096,282 $103,793 $98,048 $114,900 $719,274 $202,224 $1,399,399 $114,900 $414,691 $(108,000) $- $95.750 $3,154,979 $8,238 $7,941,303 1.55 $3.366.707 $818,100 $826,281 $45.45 $45.90 $(81,810) $(82,628) $3.080.111 $- $98,623 $10,678,301 $10,998,650 $11,328,609 $11,668,468 $2.63 $2.70 $2.79 $2.87 $736,290 $743,653 $751,089 $11,414,591 $3,279,080 $8,562 TEN YEAR PRO FORMA $8,135,510 4 1.59 $3,376,864 $8,817 $8,365,439 1.64 5 $11,124,627 $2.74 $834,544 $842,889 $46.36 $46.83 $(83,454) $(84,289) $11,742,303 $12,079,699 $12,427,068 $533,159 $678,159 $(111,246) $(556,231) $3,477,575 $9,000 $8,602,124 1.69 $758,600 $106,907 $110,114 $113,417 $116,820 $120,325 $123,934 $100,989 $104,019 $107,140 $110,354 $113,665 $117,074 $118,347 $121,897 $125,554 $129,321 $133,201 $137,197 $740,852 $763,078 $785,970 $809,549 $833,836 $858,851 $208,291 $214,539 $220,976 $227,605 $234,433 $1,441,381 $1,484,622 $1,529,161 $1,575,036 $1,622,287 $118,347 $121,897 $125,554 $129,321 $133,201 $456,584 $469,692 $483,188 $497,083 $511,388 $(111,240) $(114,577) $(118,015) $(121,555) $(125,202) $- $. $- $. $101.581 $104,629 $107,767 $111,000 $3,688,133 $9,630 $3,581,301 $9,351 $8,845,767 1.74 $3.560.915 $3.790.843 $4.027.528 $4.271.171 303 $8,135,510 $8,365,439 $8,602,124 845,767 $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) $(286,596) $(286,596) $(286,596) $(286,596) $(286,596) $- $- $- $- 6 $11,458,366 $2.82 $3.274.318 $3.504.247 $3.740.932 $3.984.575 $851,318 $47.30 $859,831 $47.77 $(85,132) $(85,983) $766,186 $12,784,708 7 $549,153 $565,628 $582,597 $600,075 $618,077 $636,619 $698,504 $719,459 $741,043 $763,274 $786,172 $809,757 $(114,584) $(118,021) $(121,562) $(125,209) $(128,965) $(132,834) $(572,918) $(590,106) $(607,809) $(626,043) $(644,825) $(664,169) $12,018,522 $12,379,077 $12,750,450 $13,132,963 $13,526,952 $13,932,760 $2.95 $3.04 53.13 53.23 53.33 $9,096,575 $11,802,117 $12,156,181 $12,520,866 $12,896,492 $2.90 $2.99 $3.08 $3.17 1.79 $773,848 $13,152,925 $4.521.979 $9,354,761 $(3,353,179) $(3,298,215) $(3,240,778) $(3,180,756) $(3,118,033) $(3,052,488) $(2,983,993) $(2,912,416) $(2,837,618) $(2,759,454) $(2,677,772) $(1,221,417) $(1,276,381) $(1,333,818) $(1,393,840) $(1,456,563) $(1,522,108) $(1,590,603) $(1,662,180) $(1,736,978) $(1,815,142) $(1,896,823) $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) 1.74 1.83 1.88 1.78 1.93 $868,430 $877,114 $885,885 $48.25 $48.73 $49.22 $(86,843) $(87,711) $(88,589) 1.85 $4.780.165 10 $127,652 $131,482 $135,426 $120,587 $124,204 $127,930 $141,313 $145,552 $149,918 $884,616 $911,155 $938,489 $241,466 $248,710 $256,171 $263,856 $1,670,956 $1,721,084 $1,772,717 $1,825,898 $137,197 $141,313 $145,552 $149,918 $526,117 $541,281 $556,895 $572,970 $(128,958) $(132,826) $(136,811) $(140,916) $- $- $- $. $114,331 $117.760 $121,293 $124,932 $3,798,164 $3,911,490 $9,917 $10,213 $9,620,546 $9,894,156 $10,175,824 $10,465,791 $781,587 $789,403 $797,297 $13,532,036 $13,922,366 $14,324,248 $14,738,030 2.10 1.90 $4,028,210 $4,148,424 $10,518 $10,831 SALE 11 $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) 1.99 2.04 2.29 2.16 $4.235.382 $4.493.569 $4.759.354 $13,283,387 $3.27 1.96 $894,744 $49.71 $(89,474) 2.22 $5.032.964 $805,270 2.02 $139,489 $131,768 $154,416 $966,644 $271,772 $1,880,675 $154,416 $589,521 $(145,143) $- $128,680 $4,272,239 $11,155 $5.045.950 $5.319.560 $5.601.228 $5.891.195 2.08 $9,096 354,761 $9,620,546 $9,894,156 $10,175,824 $10,465,791 $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) $(4,574,596) $(286,596) $(286,596) $(286,596) $(286,596) $(286,596) $(286,596) $- $- $ $5.314.632 $5.604.599

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets calculate the requested metrics stepbystep 1 Presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started