Answered step by step

Verified Expert Solution

Question

1 Approved Answer

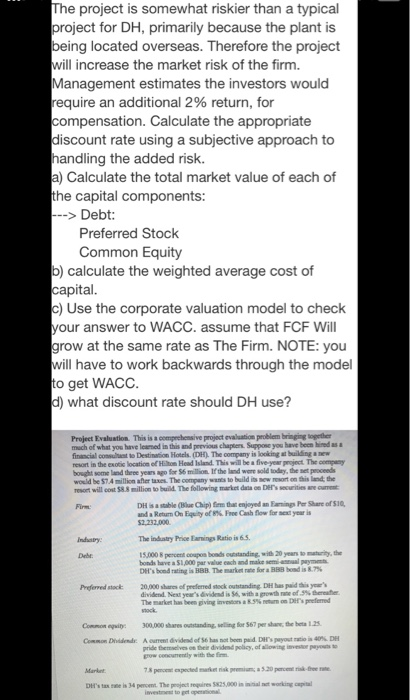

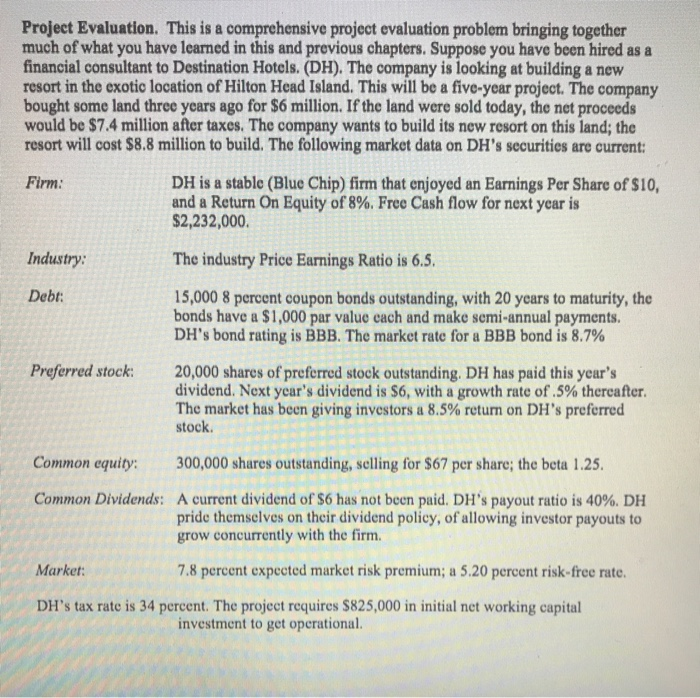

given the information in the project evaluation picture, we need to answer what the total market value of each of the capital components is. debt

given the information in the project evaluation picture, we need to answer what the total market value of each of the capital components is.

The project is somewhat riskier than a typical project for DH, primarily because the plant is being located overseas. Therefore the project will increase the market risk of the firm. Management estimates the investors would require an additional 2% return, for compensation. Calculate the appropriate discount rate using a subjective approach to handling the added risk. a) Calculate the total market value of each of the capital components: ---> Debt: Preferred Stock Common Equity b) calculate the weighted average cost of capital. c) Use the corporate valuation model to check your answer to WACC. assume that FCF Will grow at the same rate as The Firm. NOTE: you will have to work backwards through the model to get WACC. d) what discount rate should DH use? Project Evaluation. This is a comprehensive project evaluation problem bring the much of what you have made this and previous chap . See you have bem financial Destination Hotel The company is looking wat is the location of the Head Island. This will be five ye t The bowme you for the wee s H . DH4H CHI Ortowe 52.232.000 Durbo The 20 howed his 300.000 d o 567 C D A divided of e beiden dividendy , of pride th Market 4 . The 25,000 Project Evaluation. This is a comprehensive project evaluation problem bringing together much of what you have learned in this and previous chapters. Suppose you have been hired as a financial consultant to Destination Hotels. (DH). The company is looking at building a new resort in the exotic location of Hilton Head Island. This will be a five-year project. The company bought some land three years ago for $6 million. If the land were sold today, the net proceeds would be $7.4 million after taxes. The company wants to build its new resort on this land; the resort will cost $8.8 million to build. The following market data on DH's securities are current: Firm: DH is a stable (Blue Chip) firm that enjoyed an Earnings Per Share of $10, and a Return On Equity of 8%. Free Cash flow for next year is $2,232,000. Industry: The industry Price Earnings Ratio is 6.5. Debt: 15,000 8 percent coupon bonds outstanding, with 20 years to maturity, the bonds have a $1,000 par value each and make semi-annual payments. DH's bond rating is BBB. The market rate for a BBB bond is 8.7% Preferred stock: 20,000 shares of preferred stock outstanding, DH has paid this year's dividend. Next year's dividend is $6, with a growth rate of 5% thereafter, The market has been giving investors a 8.5% return on DH's preferred stock. Common equity: 300,000 shares outstanding, selling for $67 per share; the beta 1.25. Common Dividends: A current dividend of $6 has not been paid. DH's payout ratio is 40%. DH pride themselves on their dividend policy, of allowing investor payouts to grow concurrently with the firm. Market: 7.8 percent expected market risk premium; a 5.20 percent risk-free rate. DH's tax rate is 34 percent. The project requires $825,000 in initial net working capital investment to get operational The project is somewhat riskier than a typical project for DH, primarily because the plant is being located overseas. Therefore the project will increase the market risk of the firm. Management estimates the investors would require an additional 2% return, for compensation. Calculate the appropriate discount rate using a subjective approach to handling the added risk. a) Calculate the total market value of each of the capital components: ---> Debt: Preferred Stock Common Equity b) calculate the weighted average cost of capital. c) Use the corporate valuation model to check your answer to WACC. assume that FCF Will grow at the same rate as The Firm. NOTE: you will have to work backwards through the model to get WACC. d) what discount rate should DH use? Project Evaluation. This is a comprehensive project evaluation problem bring the much of what you have made this and previous chap . See you have bem financial Destination Hotel The company is looking wat is the location of the Head Island. This will be five ye t The bowme you for the wee s H . DH4H CHI Ortowe 52.232.000 Durbo The 20 howed his 300.000 d o 567 C D A divided of e beiden dividendy , of pride th Market 4 . The 25,000 Project Evaluation. This is a comprehensive project evaluation problem bringing together much of what you have learned in this and previous chapters. Suppose you have been hired as a financial consultant to Destination Hotels. (DH). The company is looking at building a new resort in the exotic location of Hilton Head Island. This will be a five-year project. The company bought some land three years ago for $6 million. If the land were sold today, the net proceeds would be $7.4 million after taxes. The company wants to build its new resort on this land; the resort will cost $8.8 million to build. The following market data on DH's securities are current: Firm: DH is a stable (Blue Chip) firm that enjoyed an Earnings Per Share of $10, and a Return On Equity of 8%. Free Cash flow for next year is $2,232,000. Industry: The industry Price Earnings Ratio is 6.5. Debt: 15,000 8 percent coupon bonds outstanding, with 20 years to maturity, the bonds have a $1,000 par value each and make semi-annual payments. DH's bond rating is BBB. The market rate for a BBB bond is 8.7% Preferred stock: 20,000 shares of preferred stock outstanding, DH has paid this year's dividend. Next year's dividend is $6, with a growth rate of 5% thereafter, The market has been giving investors a 8.5% return on DH's preferred stock. Common equity: 300,000 shares outstanding, selling for $67 per share; the beta 1.25. Common Dividends: A current dividend of $6 has not been paid. DH's payout ratio is 40%. DH pride themselves on their dividend policy, of allowing investor payouts to grow concurrently with the firm. Market: 7.8 percent expected market risk premium; a 5.20 percent risk-free rate. DH's tax rate is 34 percent. The project requires $825,000 in initial net working capital investment to get operational debt

preferred stock

common equity

WACC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started