Question

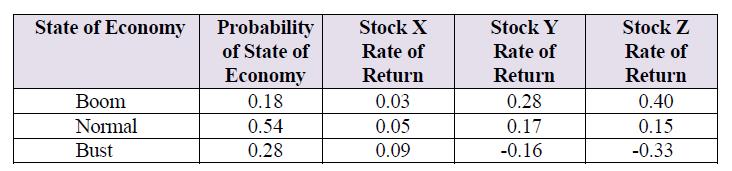

Given the information of a portfolio comprised of three stocks X, Y and Z as shown below: Required: (a) If the portfolio is invested 35

Required:

(a) If the portfolio is invested 35 percent each in Stock X and Y, as well as 30 percent in Stock Z respectively, what are the portfolio's expected return, variance and standard deviation?

(b) If the above portfolio has a positive investment in Stock X, Y and Z, is the expected return of the portfolio always greater than the expected return of each individual Stock of X, Y and Z? Illustrate with relevant calculations and conclude your answer.

(c) Based on CAPM, the expected returns on Stock X, Y and Z are 8.1 percent, 10.5 percent and 16.9 percent, respectively. Assume that the expected rate of return from the Treasury Bill is 2.5 percent and Stock Y's price tends to move with the same magnitude of the overall market. Under the market equilibrium state, calculate the betas of Stock X and Z respectively with explanations.

State of Economy Boom Normal Bust Probability of State of Economy 0.18 0.54 0.28 Stock X Rate of Return 0.03 0.05 0.09 Stock Y Rate of Return 0.28 0.17 -0.16 Stock Z Rate of Return 0.40 0.15 -0.33

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a To calculate the portfolios expected return we need to first calculate the expected return for each stock in each state of the economy Expected return of Stock X 018 x 003 054 x 005 028 x 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started