Answered step by step

Verified Expert Solution

Question

1 Approved Answer

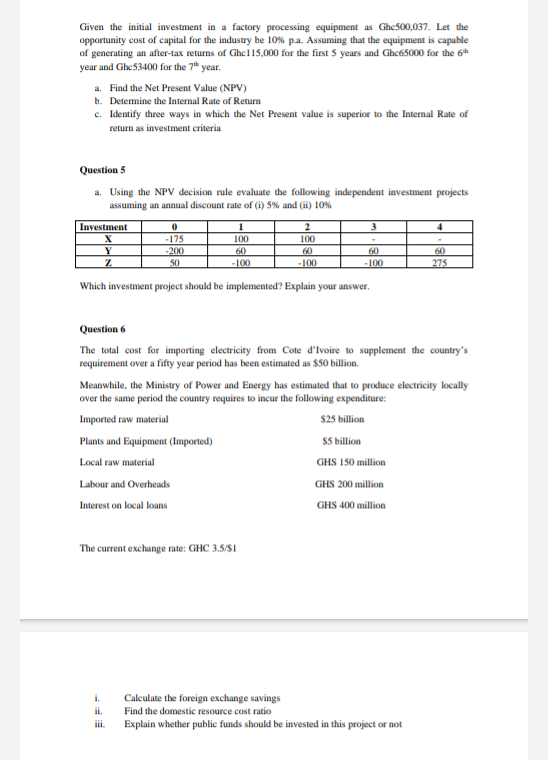

Given the initial investment in a factory processing equipment as Ghe500,037. Let the opportunity cost of capital for the industry he 10% pa. Assuming that

Given the initial investment in a factory processing equipment as Ghe500,037. Let the opportunity cost of capital for the industry he 10% pa. Assuming that the equipment is capable of generating an after-tax returns of Ghe 115,000 for the first 5 years and Ghe65000 for the 6th year and Ghc53400 for the year. a. Find the Net Present Value (NPV) b. Determine the Internal Rate of Return c. Identify three ways in which the Net Present value is superior to the Internal Rate of return as investment criteria Questions a. Using the NPV decision rule evaluate the following independent investment projects assuming an annual discount rate of (1) 5% and (ii) 10% 2 Investment Y Z 0 -175 -200 SO 100 1 100 60 -100 60 60 -100 60 275 -100 Which investment project should be implemented? Explain your answer. Question 6 The total cost for importing electricity from Cote d'Ivoire to supplement the country's requirement over a fifty year period has been estimated as $50 billion. Meanwhile, the Ministry of Power and Energy has estimated that to produce electricity locally over the same period the country requires to incur the following expenditure: Imported raw material $25 billion Plants and Equipment (Imported) $5 billion Local raw material GHS 150 million Labour and Overheads GHS 200 million Interest on local loans GHS 400 million The current exchange rate: GHC 3.5/51 i. ii. Calculate the foreign exchange savings Find the domestic resource cost ratio Explain whether public funds should be invested in this project or not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started