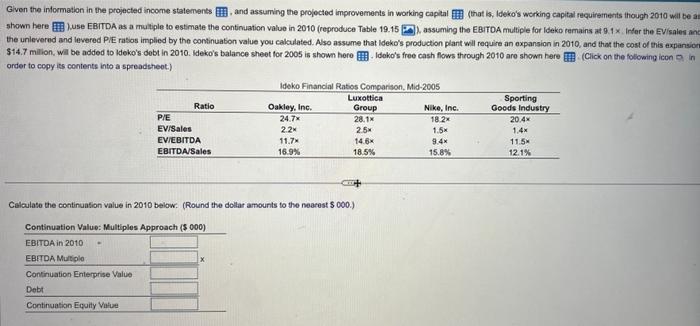

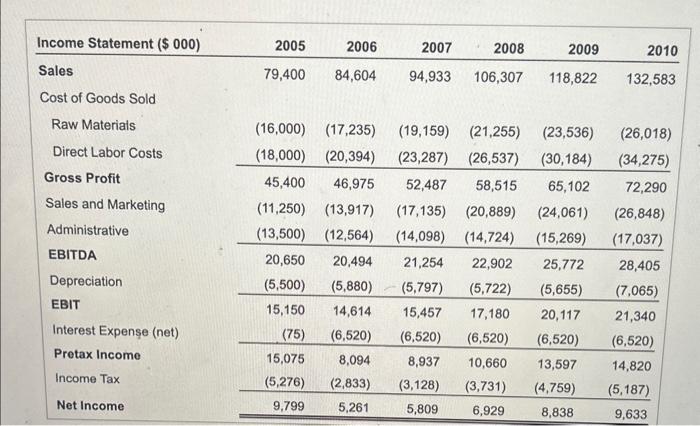

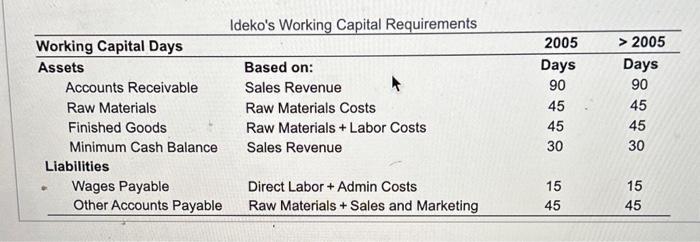

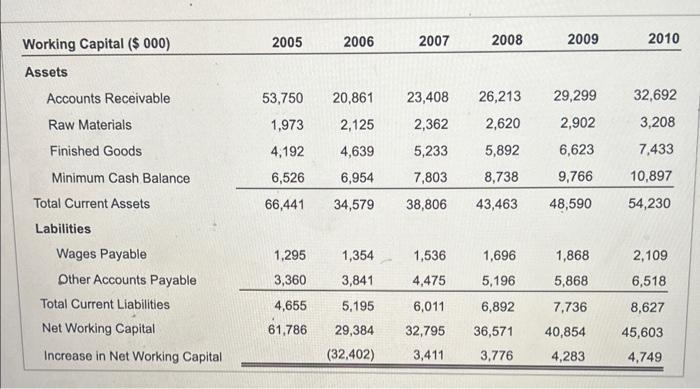

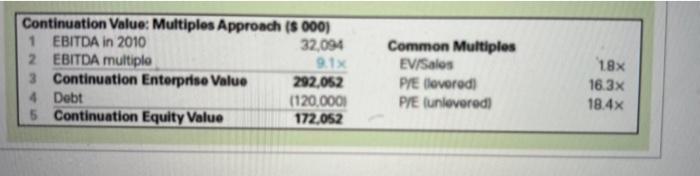

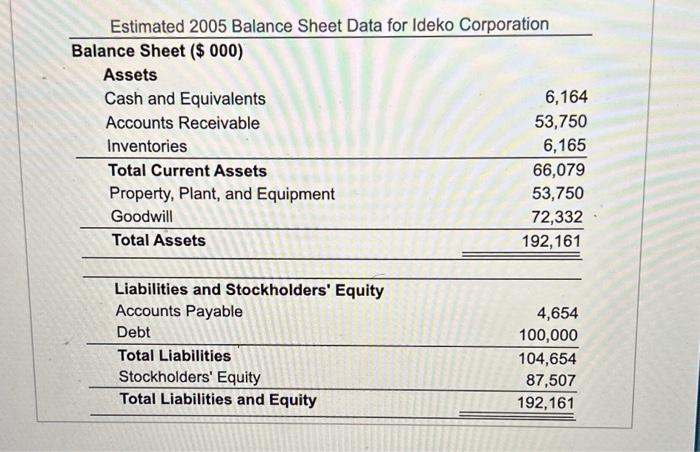

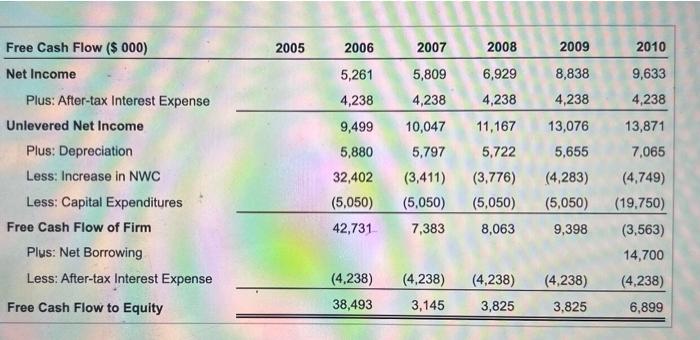

Given the intormation in the projected income statements , and assuming the projocted improvements in working capital (that is, ldeko's werking capital requirements though 2010 wil be at shown here luse EBIDAA as a muliple to estmate the continuation value in 2010 (reproduce Table 19.15 L assuming the EBITDA multiple for ldeko remains at 9.1. Infer the EV/sales anc the unlevered and levered PIE rasos implied by the continuaton value you cakulated. Aso assume that Ideko's production plant will require an oxpansion in 2010 , and that the cost of this expansion $14.7 milion, wil be added to ldeko's dobt in 2010. Ideko's balance sheet for 2005 is shown here . Ideho's free cash flows through 2010 are shown here order to copy iss contents into a spreadsheot.) Calculate the continuation value in 2010 below. (Round the dellar amounts to the nearest $000 ) Ideko's Working Capital Requirements \begin{tabular}{llcc} \hline Working Capital Days & & 2005 & >2005 \\ \hline Assets & Based on: & Days & Days \\ Accounts Receivable & Sales Revenue & 90 & 90 \\ Raw Materials & Raw Materials Costs & 45 & 45 \\ Finished Goods & Raw Materials + Labor Costs & 45 & 45 \\ Minimum Cash Balance & Sales Revenue & 30 & 30 \\ Liabilities & & & \\ Wages Payable & Direct Labor + Admin Costs & 15 & 15 \\ Other Accounts Payable & Raw Materials + Sales and Marketing & 45 & 45 \\ \hline \end{tabular} Working Capital ($000) 2005 2006 2007 2008 2009 2010 Assets \begin{tabular}{lrrrrrr} Accounts Receivable & 53,750 & 20,861 & 23,408 & 26,213 & 29,299 & 32,692 \\ Raw Materials & 1,973 & 2,125 & 2,362 & 2,620 & 2,902 & 3,208 \\ Finished Goods & 4,192 & 4,639 & 5,233 & 5,892 & 6,623 & 7,433 \\ Minimum Cash Balance & 6,526 & 6,954 & 7,803 & 8,738 & 9,766 & 10,897 \\ \cline { 2 - 7 } Total Current Assets & 66,441 & 34,579 & 38,806 & 43,463 & 48,590 & 54,230 \end{tabular} Labilities \begin{tabular}{lrrrrrr} Wages Payable & 1,295 & 1,354 & 1,536 & 1,696 & 1,868 & 2,109 \\ \multicolumn{1}{c}{ Dther Accounts Payable } & 3,360 & 3,841 & 4,475 & 5,196 & 5,868 & 6,518 \\ \hline Total Current Liabilities & 4,655 & 5,195 & 6,011 & 6,892 & 7,736 & 8,627 \\ Net Working Capital & 61,786 & 29,384 & 32,795 & 36,571 & 40,854 & 45,603 \\ Increase in Net Working Capital & & (32,402) & 3,411 & 3,776 & 4,283 & 4,749 \\ \cline { 3 - 8 } \end{tabular} \begin{tabular}{|lrlrr|} \hline Continuation Value: Multiples Approach (s 000) & & & \\ 1 & EBITDA in 2010 & 32.094 & Common Multiples & \\ 2 & EBITDA multiple & 9.1 & EV/Sales & 1.8 \\ 3 & Continuation Enterprise Value & 292.052 & PrE (leveredi & 16.3 \\ 4 & Debt & (120.000 & PFE (unleveredi & 18.4 \\ 5 & Continuation Equity Value & 172.052 & & \\ \hline \end{tabular} Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet ( $000) Assets Cash and Equivalents Accounts Receivable \begin{tabular}{lr} Inventories & 6,165 \\ \hline Total Current Assets & 66,079 \\ Property, Plant, and Equipment & 53,750 \\ Goodwill & 72,332 \\ \hline Total Assets & 192,161 \\ \hline \end{tabular} \begin{tabular}{lr} \hline Liabilities and Stockholders' Equity & \\ Accounts Payable & 4,654 \\ Debt & 100,000 \\ \hline Total Liabilities & 104,654 \\ Stockholders' Equity & 87,507 \\ \hline Total Liabilities and Equity & 192,161 \\ \hline \end{tabular} Free Cash Flow ($000) Given the intormation in the projected income statements , and assuming the projocted improvements in working capital (that is, ldeko's werking capital requirements though 2010 wil be at shown here luse EBIDAA as a muliple to estmate the continuation value in 2010 (reproduce Table 19.15 L assuming the EBITDA multiple for ldeko remains at 9.1. Infer the EV/sales anc the unlevered and levered PIE rasos implied by the continuaton value you cakulated. Aso assume that Ideko's production plant will require an oxpansion in 2010 , and that the cost of this expansion $14.7 milion, wil be added to ldeko's dobt in 2010. Ideko's balance sheet for 2005 is shown here . Ideho's free cash flows through 2010 are shown here order to copy iss contents into a spreadsheot.) Calculate the continuation value in 2010 below. (Round the dellar amounts to the nearest $000 ) Ideko's Working Capital Requirements \begin{tabular}{llcc} \hline Working Capital Days & & 2005 & >2005 \\ \hline Assets & Based on: & Days & Days \\ Accounts Receivable & Sales Revenue & 90 & 90 \\ Raw Materials & Raw Materials Costs & 45 & 45 \\ Finished Goods & Raw Materials + Labor Costs & 45 & 45 \\ Minimum Cash Balance & Sales Revenue & 30 & 30 \\ Liabilities & & & \\ Wages Payable & Direct Labor + Admin Costs & 15 & 15 \\ Other Accounts Payable & Raw Materials + Sales and Marketing & 45 & 45 \\ \hline \end{tabular} Working Capital ($000) 2005 2006 2007 2008 2009 2010 Assets \begin{tabular}{lrrrrrr} Accounts Receivable & 53,750 & 20,861 & 23,408 & 26,213 & 29,299 & 32,692 \\ Raw Materials & 1,973 & 2,125 & 2,362 & 2,620 & 2,902 & 3,208 \\ Finished Goods & 4,192 & 4,639 & 5,233 & 5,892 & 6,623 & 7,433 \\ Minimum Cash Balance & 6,526 & 6,954 & 7,803 & 8,738 & 9,766 & 10,897 \\ \cline { 2 - 7 } Total Current Assets & 66,441 & 34,579 & 38,806 & 43,463 & 48,590 & 54,230 \end{tabular} Labilities \begin{tabular}{lrrrrrr} Wages Payable & 1,295 & 1,354 & 1,536 & 1,696 & 1,868 & 2,109 \\ \multicolumn{1}{c}{ Dther Accounts Payable } & 3,360 & 3,841 & 4,475 & 5,196 & 5,868 & 6,518 \\ \hline Total Current Liabilities & 4,655 & 5,195 & 6,011 & 6,892 & 7,736 & 8,627 \\ Net Working Capital & 61,786 & 29,384 & 32,795 & 36,571 & 40,854 & 45,603 \\ Increase in Net Working Capital & & (32,402) & 3,411 & 3,776 & 4,283 & 4,749 \\ \cline { 3 - 8 } \end{tabular} \begin{tabular}{|lrlrr|} \hline Continuation Value: Multiples Approach (s 000) & & & \\ 1 & EBITDA in 2010 & 32.094 & Common Multiples & \\ 2 & EBITDA multiple & 9.1 & EV/Sales & 1.8 \\ 3 & Continuation Enterprise Value & 292.052 & PrE (leveredi & 16.3 \\ 4 & Debt & (120.000 & PFE (unleveredi & 18.4 \\ 5 & Continuation Equity Value & 172.052 & & \\ \hline \end{tabular} Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet ( $000) Assets Cash and Equivalents Accounts Receivable \begin{tabular}{lr} Inventories & 6,165 \\ \hline Total Current Assets & 66,079 \\ Property, Plant, and Equipment & 53,750 \\ Goodwill & 72,332 \\ \hline Total Assets & 192,161 \\ \hline \end{tabular} \begin{tabular}{lr} \hline Liabilities and Stockholders' Equity & \\ Accounts Payable & 4,654 \\ Debt & 100,000 \\ \hline Total Liabilities & 104,654 \\ Stockholders' Equity & 87,507 \\ \hline Total Liabilities and Equity & 192,161 \\ \hline \end{tabular} Free Cash Flow ($000)