Answered step by step

Verified Expert Solution

Question

1 Approved Answer

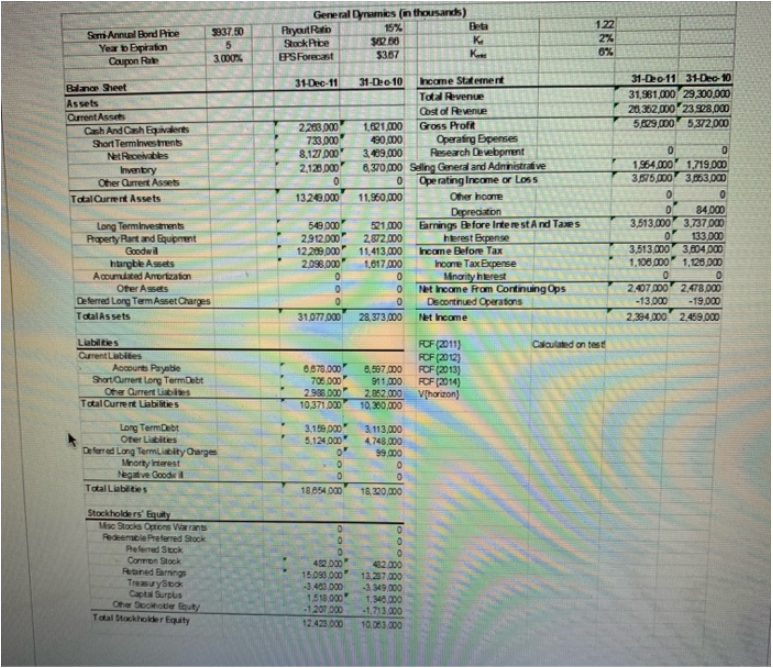

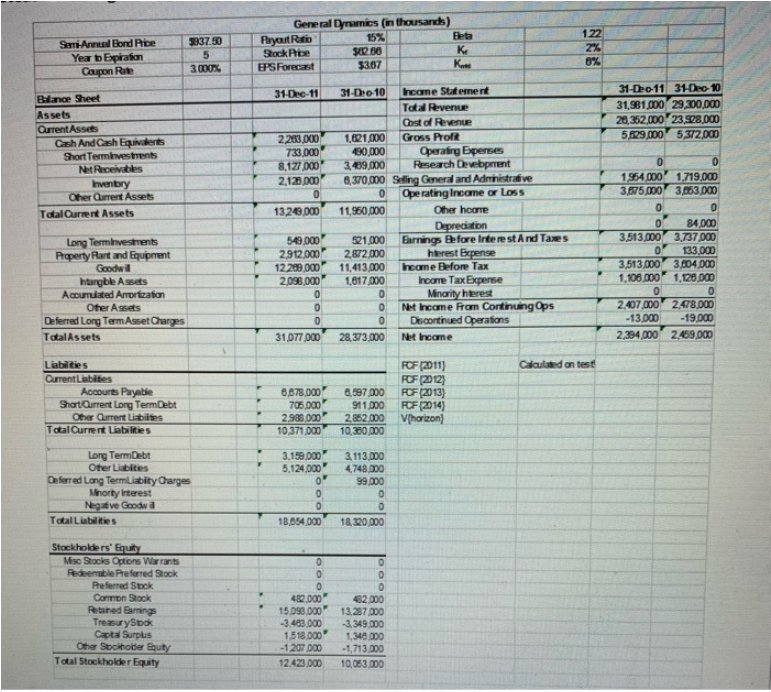

Given the precious values you calculated, what is the WACC for general dynamics? Semi Annual Bond Price Year Expiration Capon Rate 5837.50 5 300 General

Given the precious values you calculated, what is the WACC for general dynamics?

Semi Annual Bond Price Year Expiration Capon Rate 5837.50 5 300 General Dynamics (in thousands) Payout Ratio 15% Stockice K PS Forecast $3.67 K. 122 2% 0% 31-Dec-11 31-Dec 11 31-Dec-10 31,981.000 29300.000 20.302.000 23.928,000 5.629,000 5,372.000 Bilance Sheet Assets Current Assets Cash And Cash Eques Short Terminvestments NetReceivables Inventory Other Current Assets Total Current Assets 2.263.000 733.000 8,127 DOO 2,120.000 0 1320.000 31-Dec 10 Income Statement Total Revenue Cost of Revenue 1.621.000 Gross Profit 490,000 Operating Epenses 3.469.000 Research Deveborrent 6.370,000 Selling General and Administrative 0 Operating Income or Loss 11.960,000 Other hoone Depreciation 521.000 Earnings Before Interest And Taxes 2,872.000 hterest Expense 11.413.000 Income Before Tax 1,017.000 Income Tax Expense 0 Minority herest 0 Net Income from Continuing Ops 0 Decortnued Operations 28,373,000 Net Income 549 000 2912.000 12 209000 2.098.000 Long Terminvestments Property Rart and Equipment Goodwi harble Assets Acoumisted Anortation Other Assets Deferred Long Term Asset Charges Total Assets 0 0 1964 000 1,719.000 3,575.000 3.683.000 0 0 0 84000 3,513.000 3,737 000 0 133 000 3,513.000 3.604.000 1.100.000 1.128.000 0 0 2.407.000 2.478,000 -13.000 - 19,000 2.394,000 2,459,000 0 31,077.000 Calculated on test Liabilities CurrentLabites Accounts Payable Short Qurrent Long Term Debt Other Current bies Total Current Liabilities 6.875.000 706.000 2988000 10.371.000 6,507.000 911,000 2.862000 10.300.000 FCF (2011) FCF (2012) FCF (2013) FOF2014 Vphorizon) Long Term Debt Other sites Deferred Long Term city arges Minority interest Negative Good Total Labites 3.150.000 5.124.000 o' 0 O 18.854 000 3.113,000 4748,000 99.000 0 0 18. 220,000 0 Stockholders' Misc Stocks Opton Wars Remco Preferred Stock Referred Stock Common Stock Runed Gang Treasuyo Cat Surpus 482,000 15.090.000 -3.400.000 1.518,000 -1 201 000 12.423.000 12.237.000 -3.349,000 1.348.000 1,713.000 10.083.000 Total Stockholder Equity Sami Annu Bord Ribe Year Espiration Caipon Rate 3337.50 5 3000% General Dynamics (in thousands) Payout R. 15% Stockice $2.50 K PPS Forecast $3.67 K. 122 2% 0% 31-Dec-11 31-Dec-11 31-Dec-10 31,961.000 29,300,000 20,352,000 23,928,000 5,829,000 5,372,000 Balance Sheet Assets Current Asset Cash And Cash Equivalents Short Terminvestments Net Receivables Inventory Oher Current Assets Total Current Assets 2.283,000 733.000 8,127 000 2,128.00 0 1329.000 31-Do 10 Income Statement Total Revenue Cost of Revenue 1,621,000 Gross Profi 180.000 Operating perses 3.489.000 Research Deveborrent 6,370,000 Selling General and Administrative 0 Operating Income or loss 11,950,000 Other hoone Depreciation 521.000 Earnings Before Interest And Taxes 2,872.000 hterest Expense 11,413,000 Income Before Tax 1,817.000 Income Tax Expense 0 Minority terest 0 Net Income from Continuing Ops 0 Discontinued Operations 28,373,000 Net Income 549.000 2,912,000 12 209,000 2,098,000 Long Terminvestments Property Rart and Equipment Goodwid hargble Assets Accumulated Anortation Other Assets Deferred Long Term Asset Charges TotalAssets 0 0 1964,000' 1,719,000 3,875,000 3,063.000 0 0 0 84,000 3,513,000 3,737,000 133.000 3,513.000 3.604.000 1.108.000 1,120.000 0 0 2,407 000 2.478,000 -13.000 - 19.000 2,394,000 2,469,000 0 0 0 31,077.000 Calculated on test Liabilities Current Liabites Accounts Payable Short Current Long Term Debt Other Qurrent li bites Total Current Liabilities 6,678,000 705.000 2.988.000 10,371.000 FCF (2011) FCF (2012) 6,597.000 FCF (2013) 911,000 FCF (2014) 2862.000 Vfhorizon 10,380,000 3,150.000 5.124.000 0 Long TermDebt Other Libities Deferred Long TermLiabity Charges Minority interest Negative Good Total Liabilities 3.113,000 4,748.000 99.000 0 0 18,320,000 O 0 18,654,000 0 OO Stockholders' Equit Misc Stocks Options Warrants Redeemable Preferred Stock Preferred Sock Cortion Stock Retained Earrings Treasury Sook Captal Surplus Other Sockhober Euty Total Stockholder Equity 0 0 0 482.000 15.090.000 -3.483.000 1518.000 -1207 000 12.423.000 482.000 13,287.000 -3,349.000 1,340.000 - 1,713.000 10,053,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started