Answered step by step

Verified Expert Solution

Question

1 Approved Answer

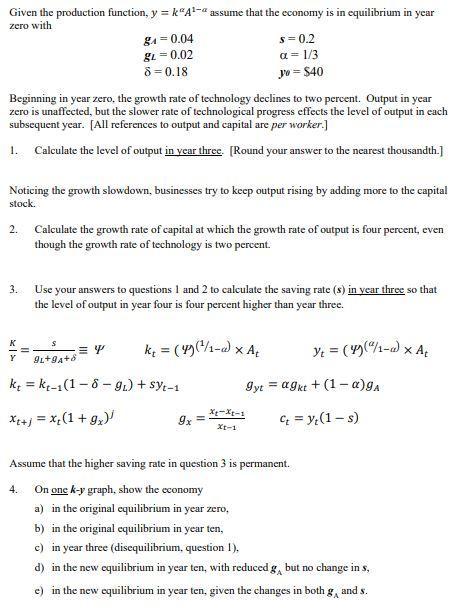

Given the production function, y = kaA- assume that the economy is in equilibrium in year zero with Beginning in year zero, the growth

Given the production function, y = kaA- assume that the economy is in equilibrium in year zero with Beginning in year zero, the growth rate of technology declines to two percent. Output in year zero is unaffected, but the slower rate of technological progress effects the level of output in each subsequent year. [All references to output and capital are per worker.] 1. Calculate the level of output in year three. [Round your answer to the nearest thousandth.] g=0.04 gL=0.02 8 = 0.18 Noticing the growth slowdown, businesses try to keep output rising by adding more to the capital stock. 3. 2. Calculate the growth rate of capital at which the growth rate of output is four percent, even though the growth rate of technology is two percent. K 4. s=0.2 a = 1/3 yv = $40 Use your answers to questions 1 and 2 to calculate the saving rate (s) in year three so that the level of output in year four is four percent higher than year three. S 9L+9A+8 kt = kt-1(1 8 9,)+SYt-1 Xt+j = x(1 + gx) =Y k = (P)(/1-a) x At 9x = X-X-1 XI-1 gytagkt + (1 - )gA Ct = y(1-s) Assume that the higher saving rate in question 3 is permanent. On one k-y graph, show the economy a) in the original equilibrium in year zero, Yt = (4/1-a) x At b) in the original equilibrium in year ten, c) in year three (disequilibrium, question 1). d) in the new equilibrium in year ten, with reduced g, but no change in s, e) in the new equilibrium in year ten, given the changes in both g and s.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions well go step by step 1 To calculate the level of output in year three we need to use the production function and the given parameters The production function is given as y ka A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started