Answered step by step

Verified Expert Solution

Question

1 Approved Answer

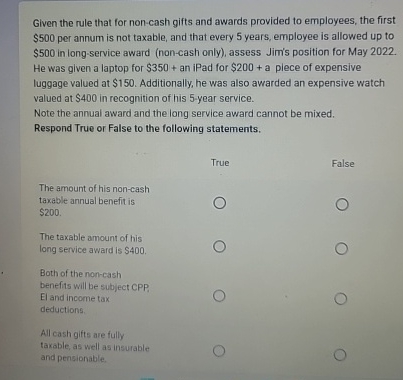

Given the rule that for non - cash gifts and awards provided to employees, the first $ 5 0 0 per annum is not taxable,

Given the rule that for noncash gifts and awards provided to employees, the first

$ per annum is not taxable, and that every years, employee is allowed up to

$ in longservice award noncash only assess Jim's position for May

He was given a laptop for $ an iPad for $ a plece of expensive

luggage valued at $ Additionally, he was also awarded an expensive watch

valued at $ in recognition of his year service.

Note the annual award and the long service award cannot be mixed.

Respond True or False to the following statements.

The amount of his noncash

taxable annual benefit is

$

The taxable amount of his

long service award is $

Both of the noncash

benefits will be subject CPP

El and income tax

deductions.

All cash gifts are fully

taxable, as well as insurable

and pensionable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started