Answered step by step

Verified Expert Solution

Question

1 Approved Answer

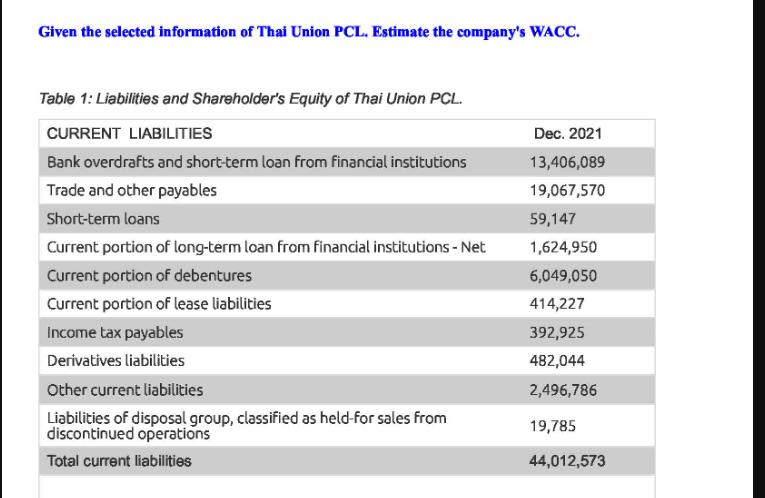

Given the selected information of Thai Union PCL. Estimate the company's WACC. Table 1: Liabilities and Shareholder's Equity of Thai Union PCL. CURRENT LIABILITIES

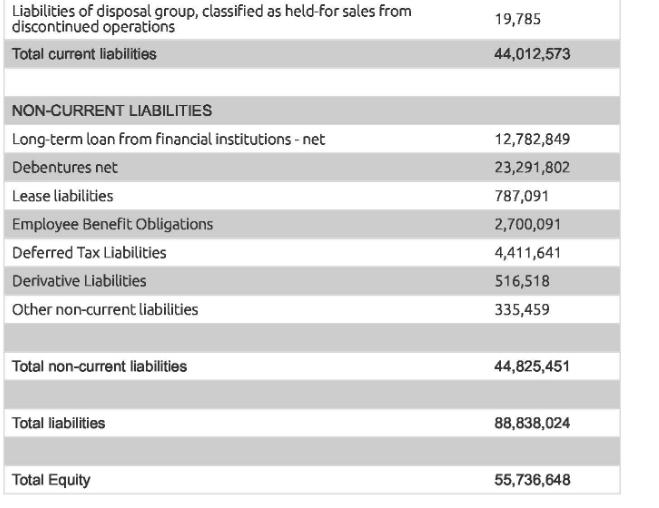

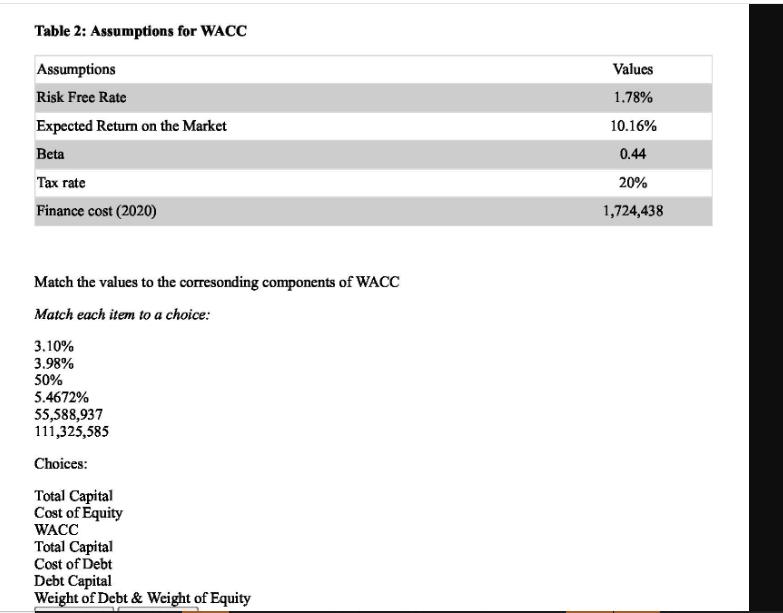

Given the selected information of Thai Union PCL. Estimate the company's WACC. Table 1: Liabilities and Shareholder's Equity of Thai Union PCL. CURRENT LIABILITIES Bank overdrafts and short-term loan from financial institutions Trade and other payables Short-term loans Current portion of long-term loan from financial institutions - Net Current portion of debentures Current portion of lease liabilities Income tax payables Derivatives liabilities Dec. 2021 13,406,089 19,067,570 59,147 1,624,950 6,049,050 414,227 392,925 482,044 2,496,786 Other current liabilities Liabilities of disposal group, classified as held-for sales from discontinued operations Total current liabilities 19,785 44,012,573 Liabilities of disposal group, classified as held-for sales from discontinued operations Total current liabilities NON-CURRENT LIABILITIES 19,785 44,012,573 Long-term loan from financial institutions - net 12,782,849 Debentures net 23,291,802 Lease liabilities 787,091 Employee Benefit Obligations 2,700,091 Deferred Tax Liabilities 4,411,641 Derivative Liabilities Other non-current liabilities 516,518 335,459 Total non-current liabilities Total liabilities Total Equity 44,825,451 88,838,024 55,736,648 Table 2: Assumptions for WACC Assumptions Risk Free Rate Expected Return on the Market Beta Tax rate Finance cost (2020) Match the values to the corresonding components of WACC Match each item to a choice: 3.10% 3.98% 50% 5.4672% 55,588,937 111,325,585 Choices: Total Capital Cost of Equity WACC Total Capital Cost of Debt Debt Capital Weight of Debt & Weight of Equity Values 1.78% 10.16% 0.44 20% 1,724,438

Step by Step Solution

★★★★★

3.53 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To estimate Thai Union PCLs weighted average cost of capital WACC we need to determine the cost of e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started