Question

Given the simulation with 2 years into the future and 8 simulation paths below, compute the value of an American put option expiring in

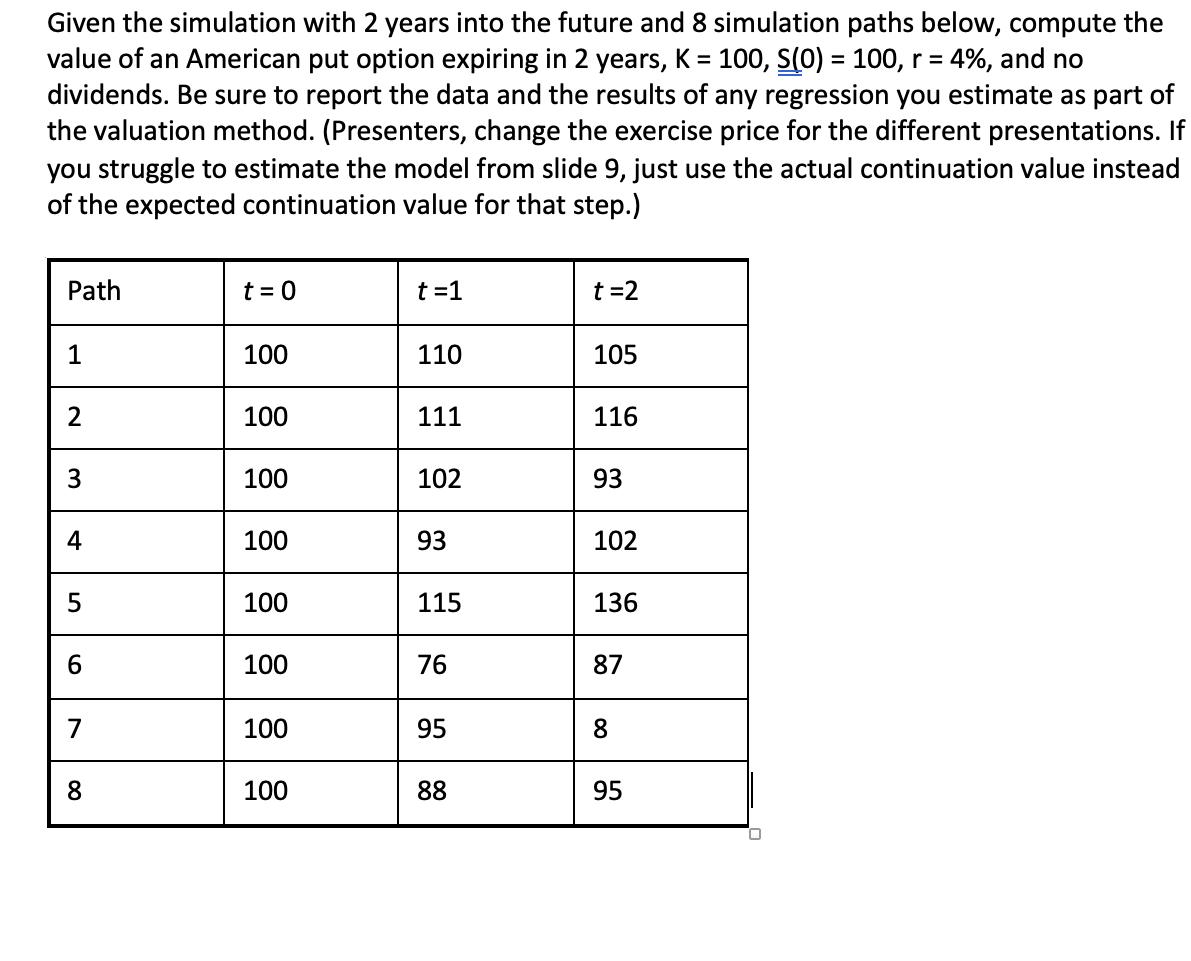

Given the simulation with 2 years into the future and 8 simulation paths below, compute the value of an American put option expiring in 2 years, K = 100, S(0) = 100, r = 4%, and no dividends. Be sure to report the data and the results of any regression you estimate as part of the valuation method. (Presenters, change the exercise price for the different presentations. If you struggle to estimate the model from slide 9, just use the actual continuation value instead of the expected continuation value for that step.) Path t = 0 t=1 t=2 1 100 110 105 2 100 111 116 3 100 102 93 4 100 93 102 5 100 115 136 6 100 76 87 7 100 95 8 8 100 88 95

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Futures and Options Markets

Authors: John C. Hull

8th edition

978-1292155036, 1292155035, 132993341, 978-0132993340

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App