Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the state of the negotiations with the long standing customer, the current estimate of the probability of a successful closure of the major

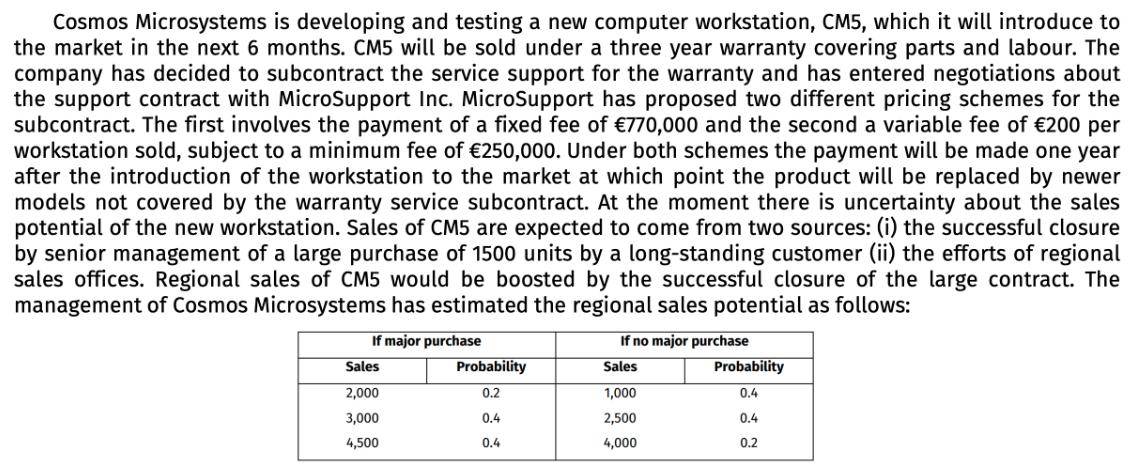

Given the state of the negotiations with the long standing customer, the current estimate of the probability of a successful closure of the major purchase is 60%. Draw a decision tree for the choice of pricing schemes for the warranty service subcontract. Which of the two pricing schemes minimises the expected value of costs for Cosmos? Cosmos Microsystems is developing and testing a new computer workstation, CM5, which it will introduce to the market in the next 6 months. CM5 will be sold under a three year warranty covering parts and labour. The company has decided to subcontract the service support for the warranty and has entered negotiations about the support contract with MicroSupport Inc. MicroSupport has proposed two different pricing schemes for the subcontract. The first involves the payment of a fixed fee of 770,000 and the second a variable fee of 200 per workstation sold, subject to a minimum fee of 250,000. Under both schemes the payment will be made one year after the introduction of the workstation to the market at which point the product will be replaced by newer models not covered by the warranty service subcontract. At the moment there is uncertainty about the sales potential of the new workstation. Sales of CM5 are expected to come from two sources: (i) the successful closure by senior management of a large purchase of 1500 units by a long-standing customer (ii) the efforts of regional sales offices. Regional sales of CM5 would be boosted by the successful closure of the large contract. The management of Cosmos Microsystems has estimated the regional sales potential as follows: major purchase Sales 2,000 3,000 4,500 Probability 0.2 0.4 0.4 If no major purchase Sales 1,000 2,500 4,000 Probability 0.4 0.4 0.2

Step by Step Solution

★★★★★

3.44 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started