Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the table Answer the questions. Income Tax Rate 10% Individual Taxpayers $0 to $9,875 $9,876 to $40,125 Joint Taxpayers $0 to $19,750 $19,751 to

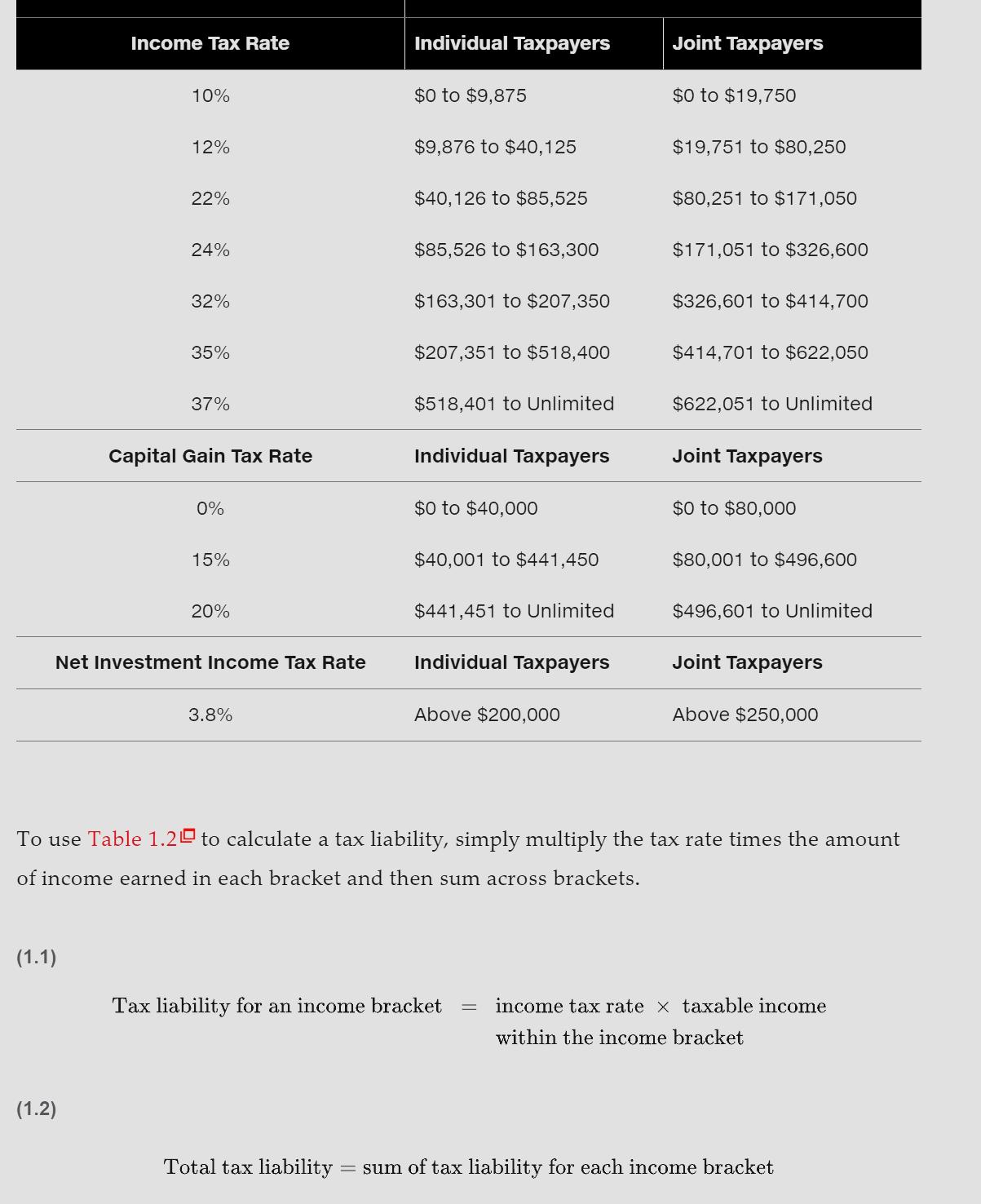

Given the table Answer the questions.

Income Tax Rate 10% Individual Taxpayers $0 to $9,875 $9,876 to $40,125 Joint Taxpayers $0 to $19,750 $19,751 to $80,250 12% 22% $40,126 to $85,525 $80,251 to $171,050 24% $85,526 to $163,300 $171,051 to $326,600 32% $163,301 to $207,350 $326,601 to $414,700 35% $207,351 to $518,400 $414,701 to $622,050 37% $518,401 to Unlimited $622,051 to Unlimited Capital Gain Tax Rate Individual Taxpayers Joint Taxpayers 0% $0 to $40,000 15% $40,001 to $441,450 $0 to $80,000 $80,001 to $496,600 20% $441,451 to Unlimited $496,601 to Unlimited Net Investment Income Tax Rate Individual Taxpayers Joint Taxpayers 3.8% Above $200,000 Above $250,000 To use Table 1.2 to calculate a tax liability, simply multiply the tax rate times the amount of income earned in each bracket and then sum across brackets. (1.1) Tax liability for an income bracket = income tax rate taxable income within the income bracket (1.2) Total tax liability sum of tax liability for each income bracket

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started