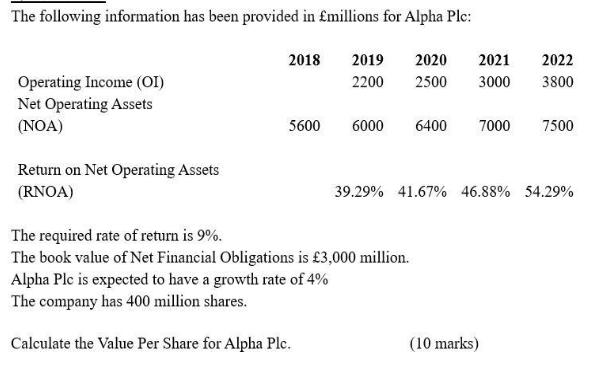

Question: The following information has been provided in millions for Alpha Plc: 2018 2019 2020 2021 2200 2500 3000 Operating Income (OI) Net Operating Assets

The following information has been provided in millions for Alpha Plc: 2018 2019 2020 2021 2200 2500 3000 Operating Income (OI) Net Operating Assets (NOA) Return on Net Operating Assets (RNOA) 5600 6000 6400 7000 7500 2022 3800 39.29% 41.67% 46.88% 54.29% The required rate of return is 9%. The book value of Net Financial Obligations is 3,000 million. Alpha Plc is expected to have a growth rate of 4% The company has 400 million shares. Calculate the Value Per Share for Alpha Plc. (10 marks)

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Answer 2 The value per share of Alpha Plc can be calculated using the Discounted Cash Flow DCF Model This model takes into account the net operating i... View full answer

Get step-by-step solutions from verified subject matter experts