Answered step by step

Verified Expert Solution

Question

1 Approved Answer

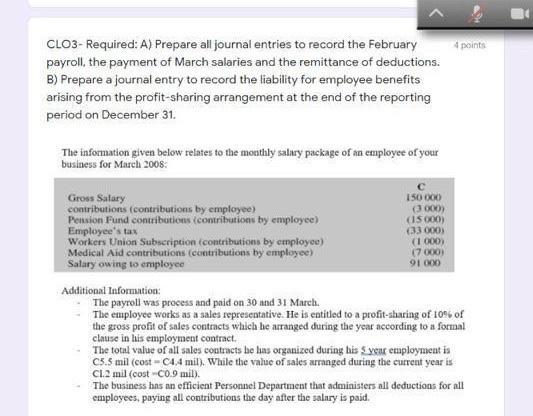

CLO3- Required: A) Prepare all journal entries to record the February payroll, the payment of March salaries and the remittance of deductions. B) Prepare

CLO3- Required: A) Prepare all journal entries to record the February payroll, the payment of March salaries and the remittance of deductions. B) Prepare a journal entry to record the liability for employee benefits arising from the profit-sharing arrangement at the end of the reporting period on December 31. The information given below relates to the monthly salary package of an employee of your business for March 2008: Gross Salary contributions (contributions by employee) Pension Fund contributions (contributions by employee) Employee's tax Workers Union Subscription (contributions by employee) Medical Aid contributions (contributions by employee) Salary owing to employee Additional Information: 150 000 (3000) (15000) (33 000) (1.000) (7.000) 91.000 4 points The payroll was process and paid on 30 and 31 March. The employee works as a sales representative. He is entitled to a profit-sharing of 10% of the gross profit of sales contracts which he arranged during the year according to a formal clause in his employment contract. The total value of all sales contracts he has organized during his 5 year employment is C5.5 mil (cost=C4,4 mil). While the value of sales arranged during the current year is CL.2 mil (cost-C0.9 mil). The business has an efficient Personnel Department that administers all deductions for all employees, paying all contributions the day after the salary is paid.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

wn 1 wn2 A 1 2 3 B 1 2 March March March note Salary Journal Entries working note 2 To contribution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started