Answered step by step

Verified Expert Solution

Question

1 Approved Answer

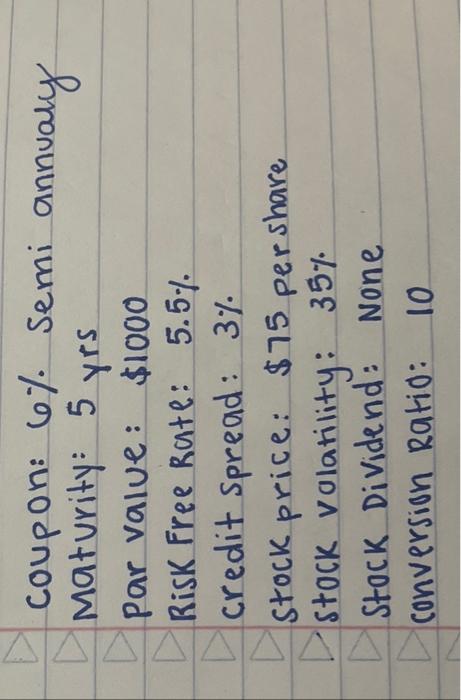

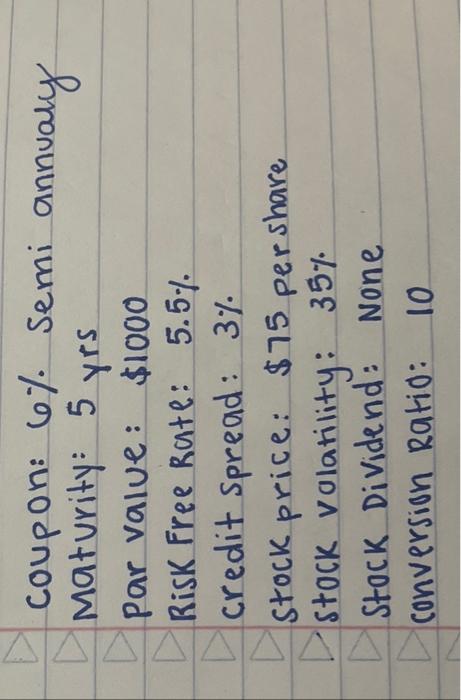

given this information, calculate the straight bond value. please show all of the steps. after finding the straight bond price, please find the valuation of

given this information, calculate the straight bond value. please show all of the steps.

after finding the straight bond price, please find the valuation of the convertible bond and show each step to getting the answer.

thank you i will leave a like if you answer this!

please show work for the valuation of convertible bond part using the black scholes model. please show every single step

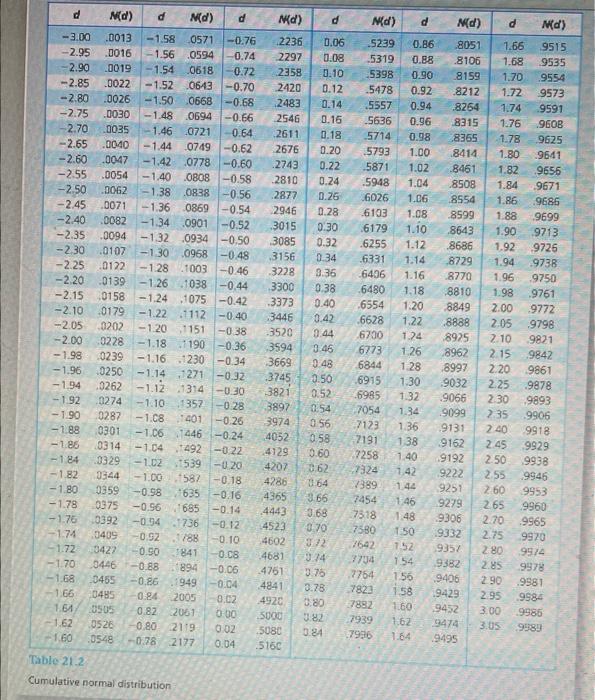

coupon: 6% Semi annualy maturity: 5 yrs par value: $1000 Risk Free Rate: 5.5% credit spread: 3% stock price: $75 pershare stock volatility: 35% Stock Dividend: None conversion Ratio: 10 Cumulative normal distribution coupon: 6% Semi annualy maturity: 5 yrs par value: $1000 Risk Free Rate: 5.5% credit spread: 3% stock price: $75 pershare stock volatility: 35% Stock Dividend: None conversion Ratio: 10 Cumulative normal distribution Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started