Question

5. Imperial Tasty Treats is a British food firm that has just signed a contract to sell haggis to a US firm. The firm

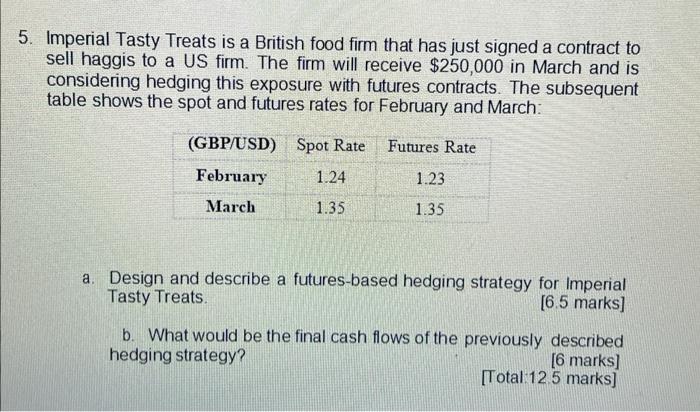

5. Imperial Tasty Treats is a British food firm that has just signed a contract to sell haggis to a US firm. The firm will receive $250,000 in March and is considering hedging this exposure with futures contracts. The subsequent table shows the spot and futures rates for February and March: (GBP/USD) February March Spot Rate 1.24 1.35 Futures Rate 1.23 1.35 a. Design and describe a futures-based hedging strategy for Imperial Tasty Treats. [6.5 marks] b. What would be the final cash flows of the previously described hedging strategy? [6 marks] [Total: 12.5 marks]

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The firm will received euros and needs to sell the euros ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding the Law

Authors: Donald L. Carper, John A. McKinsey

6th edition

538473592, 978-0538473590

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App