Giving the information below how would you answer part A?

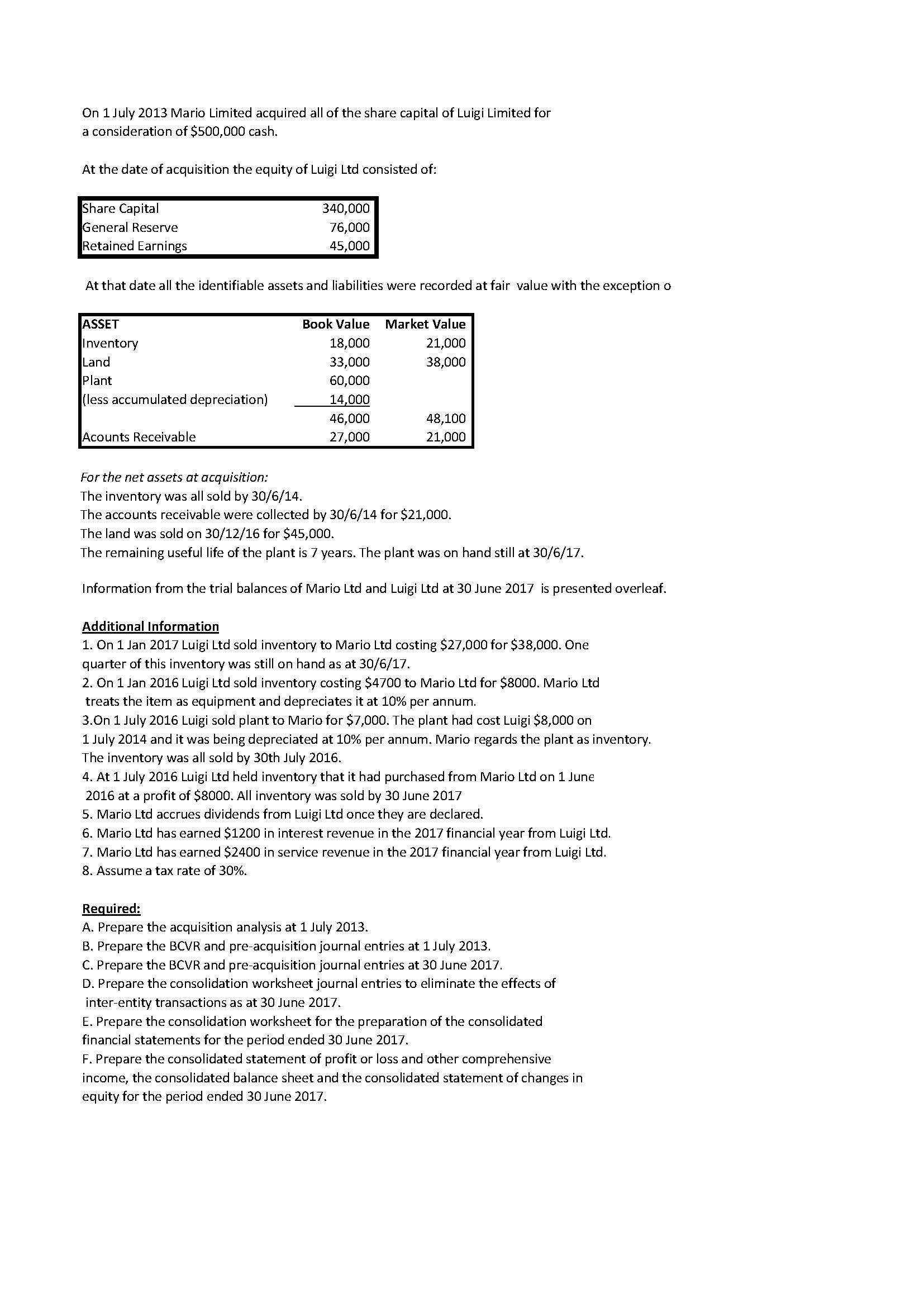

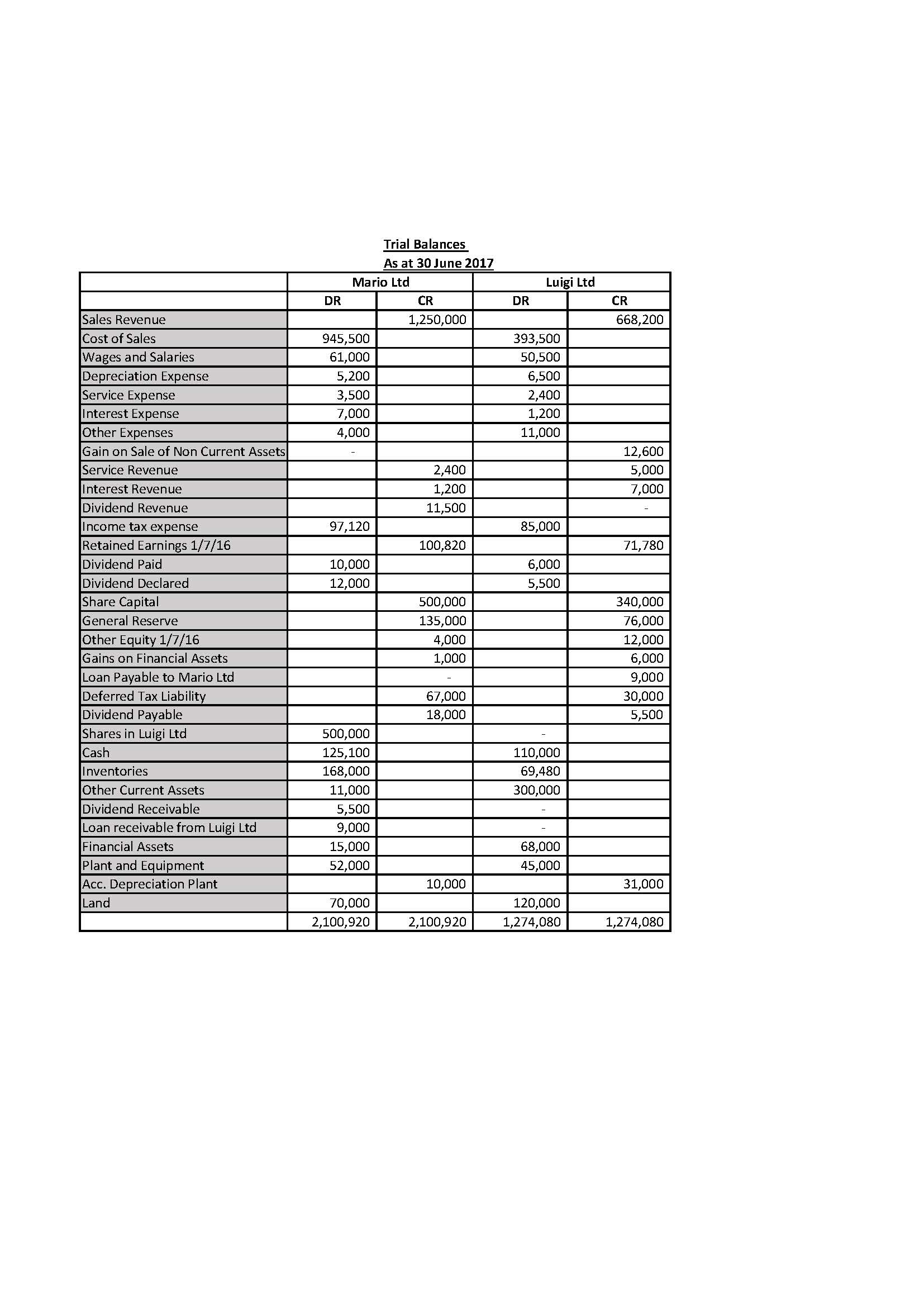

On 1July 2013 Mario Limited acquired all of the share capital of Luigi Limited for a consideration of $500,000 cash. At the date of acquisition the equity of Luigi Ltd consisted of: 340,000 76,000 Retained Earnings 45,000 At that date all the identifiable assets and liabilities were recorded at fair value with the exception 0 ASSET Book Value Market Value Inventory 18,000 21,000 Land 33,000 38,000 Plant 60,000 (less accumulated depreciation) 14,000 46,000 48,100 Acounts Receivable 27,000 21,000 For the net assets at acquisition: The inventory was all sold by 30/6/14. The accounts receivable were collected by 30/6/14 for $21,000. The land was sold on 30/12/16 for $45,000. The remaining useful life of the plant is 7 years. The plant was on hand still at 30/6/17. Information from the trial balances of Mario Ltd and Luigi Ltd at 30 June 2017 is presented overleaf. Additional Information 1. On 1 Jan 2017 Luigi Ltd sold inventory to Mario Ltd costing $27,000 for $38,000. One quarter of this inventory was still on hand as at 30/6/17. 2. On 1 Jan 2016 Luigi Ltd sold inventory costing $4700 to Mario Ltd for $8000. Mario Ltd treats the item as equipment and depreciates it at 10% per annum. 3.0n 1 July 2016 Luigi sold plant to IVIariofor $7,000. The plant had cost Luigi $8,000 on 1 July 2014 and it was being depreciated at 10% per annum. Mario regards the plant as inventory. The inventory was all sold by 30th July 2016. 4. At 1 July 2016 Luigi Ltd held inventory that it had purchased from Mario Ltd on 1 June 2016 at a profit of $8000. All inventory was sold by 30 June 2017 5. Mario Ltd accrues dividends from Luigi Ltd once they are declared. 6. Mario Ltd has earned $1200 in interest revenue in the 2017 financial year from Luigi Ltd. 7. Mario Ltd has earned $2400 in service revenue in the 2017 financial yearfrom Luigi Ltd. 8. Assume a tax rate of 30%. Required: A. Prepare the acquisition analysis at 1 July 2013. B. Prepare the BCVR and prefacquisitionjournal entries at 1July 2013. C. Prepare the BCVR and prefacquisition journal entries at 30 June 2017. D. Prepare the consolidation worksheet journal entries to eliminate the effects of intereentity transactions as at 30 June 2017. E. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for the period ended 30 June 2017. F. Prepare the consolidated statement of profit or loss and other comprehensive income, the consolidated balance sheet and the consolidated statement of changes in equity for the period ended 30June 2017.