Question

GJH Company is a newly established retailer in the local market. The Company has no credit facilities and is considering financing its operating cycle. The

GJH Company is a newly established retailer in the local market. The Company has no credit facilities and is considering financing its operating cycle.

The company plans to finance an expansion project with the freed-up cash flow:

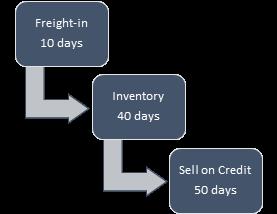

Currently, the Company purchases supplies on credit from a major wholesaler. The Company repays the credit after 20 days from the order placement date (days payable outstanding). It takes around ten days for the goods to reach the Company; on average, the inventory storage is 40 days before its sale (days inventory outstanding). All of the Company's sales are on credit. Account receivables collection is 50 days (days receivables outstanding). The Company is willing to finance its operations in-house.

Your task is:

1) Calculate the approximate Cash Conversion Cycle (CCC)

2) What staff does the Company need to be able to manage the operating and financing decisions in-house

3) Prepare the job description for the required staff.

4) Decide which computer-based information systems will efficiently deliver HR programs and services to train newly hired employees

Question1 : Calculating the Cash Conversion Cycle?

Question 2:Correctly identifying the required staff and preparing their job description?

Question 3:Identify the computer-based information systems to efficiently deliver HR programs and services to train the newly hired employees?

Note: assume any missing information. Clearly state your assumptions in your submissions?

Freight-in 10 days Inventory 40 days L Sell on Credit 50 days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculation of the Cash Conversion Cycle CCC The Cash Conversion Cycle CCC can be calculated using the following formula CCC DIO DSO DPO Where DIO Days Inventory Outstanding represents the average n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started