Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GL 0 2 0 2 ( Algo ) - Based on Exercise 2 - 1 3 Prepare journal entries for each transaction and identify the

GLAlgo Based on Exercise

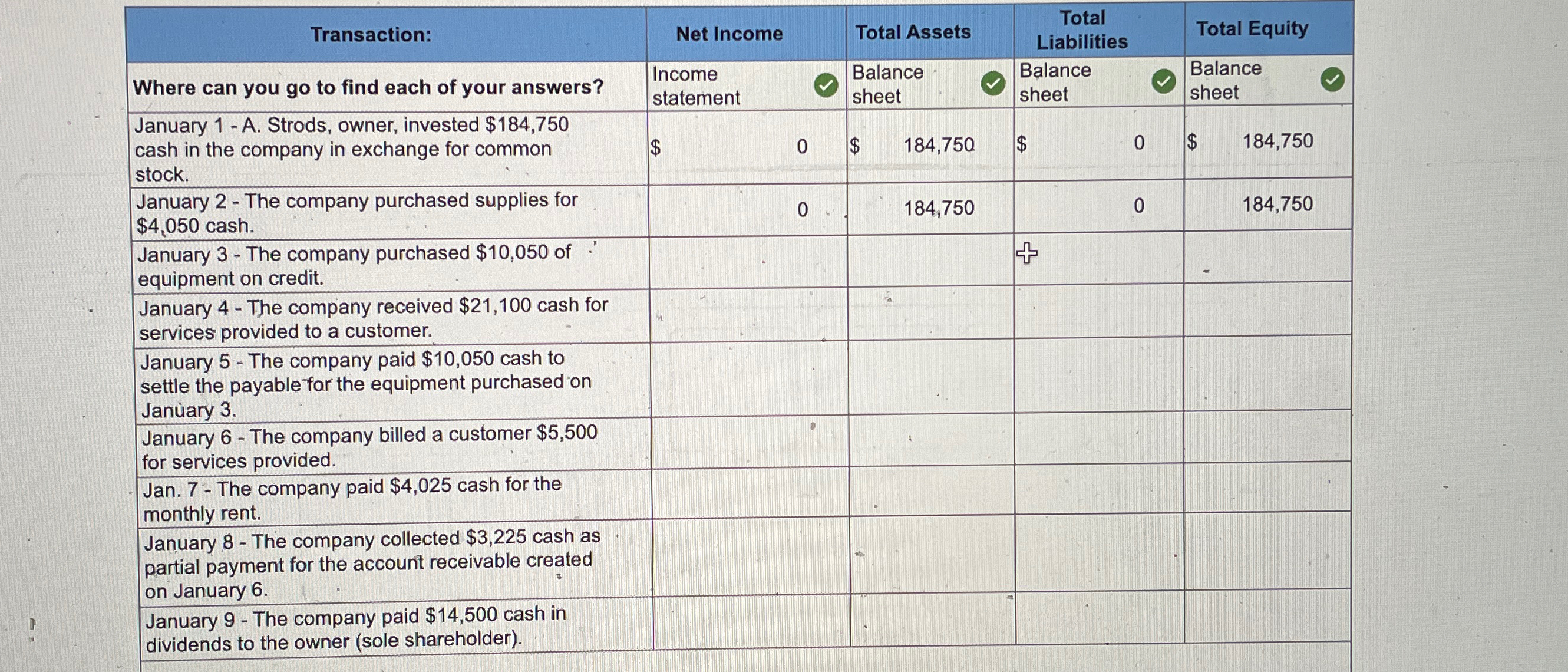

Prepare journal entries for each transaction and identify the financial statement impact of each entry.

The financial statements are automatically generated based on the journal entries recorded.

January A Strods, owner, invested $ cash in the company in exchange for common stock.

January The company purchased supplies for $ cash.

January The company purchased $ of equipment on credit.

January The company received $ cash for services provided to a customer.

January The company paid $ cas'h to settle the payable for the equipment purchased on January

January The company billed a customer $ for services provided.

January The company paid $ cash for the monthly rent.

January, The company collected $ cash as partial payment for the account receivable created on January

January The company paid $ cash in dividends to the owner sole shareholder

Answer is not complete.

General

Journal

General

Trial Balance

Income

St Retained

Balance Sheet:

FS Impact

The financial statements report the cumulative impact of all transactions recorded as of the financial statement date. Input the cumulative amount of a Net Income'Loss b Total Assets, c Total Liabilities, and d Total Equity that would be reported on the financial statements immediately after each transaction is recorded. Hint: You can check your work by selecting the date on the trial balance tab. The first transactions are completed for you!

General Journal Tab For each transaction, prepare the required journal entry on the General Journal tab. List debits before credits.

General Ledger Tab One of the advantages of general ledger software is that posting is done automatically. To see the detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the General Ledger tab.

Trial Balance Tab General ledger softwife also automates the preparation of trial balances. A trial balance lists each account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total credits.

Income Statement Tab The revenue and expense balances from the trial balance appear on the income statement, along with their balance as of the date selected. Review the income statement and indicate how the income statement is linked to the other financial'statements.

Statement of Retained Earnings Tab Beginning retained earnings plus minus net income loss for the period less dividends. Review the statement of Retained earnings and indicate how the statement is linked to the other financial statements.

Balance Sheet Tab Each asset and liability account balance, as reported on the trial balance, appears on the balance sheet, along with the equity balance. Review the balance sheet and then indicate how the balance sheet is linked to the other financial statements.

Financial Statement Impact Tab It is important to be able to identify the impact each transaction has on the financial statements. For each of the transactions, indicate the cumulative amount of net income, total assets, total liabilities and total equity that would appear on the financial statements immediately after each transaction is recorded.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started