1 15 points eBook Ask Print GL0201 (Algo)- Based on Problem 2-2A LO P1, P2, P3, P4 Williams Company shows the following costs for

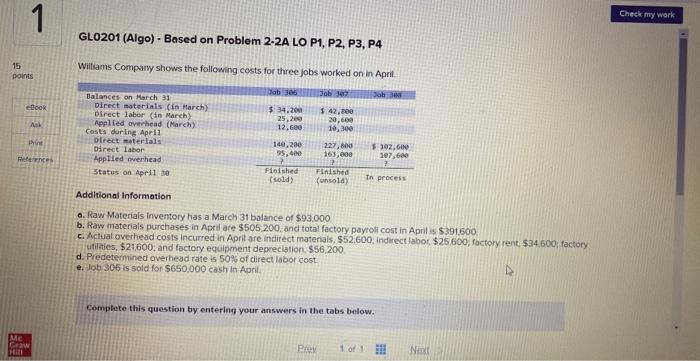

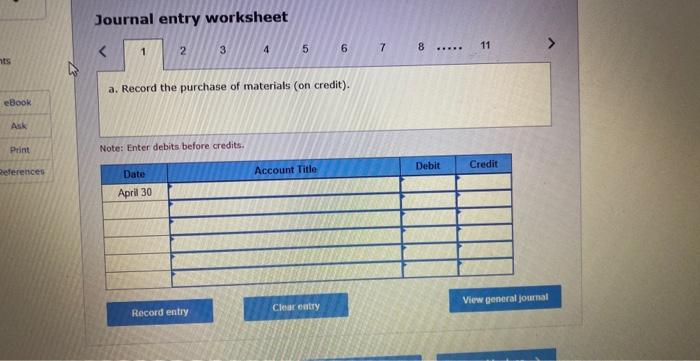

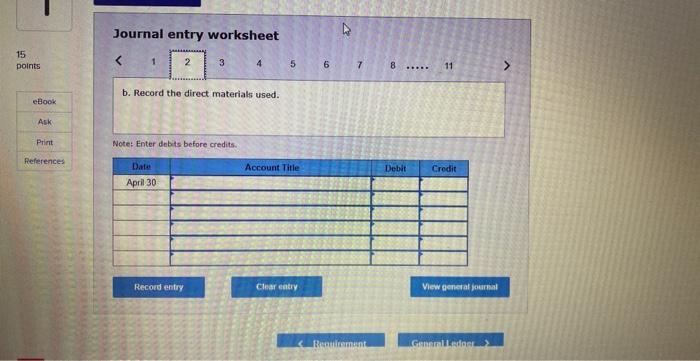

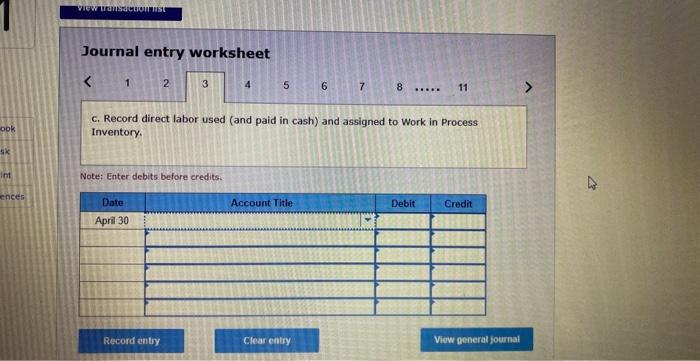

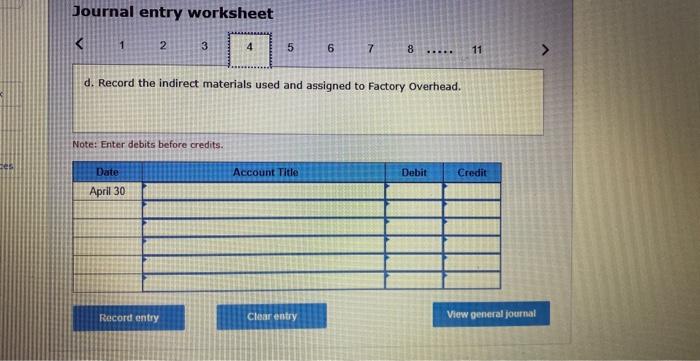

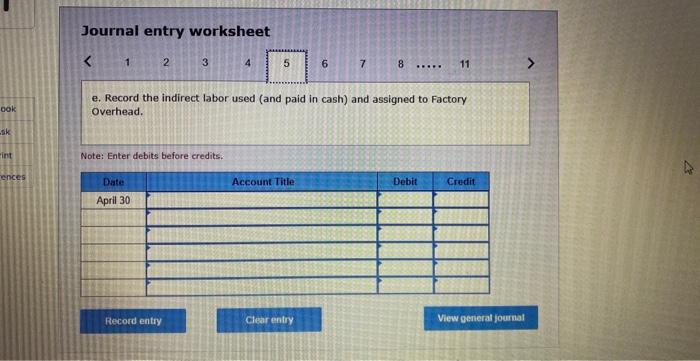

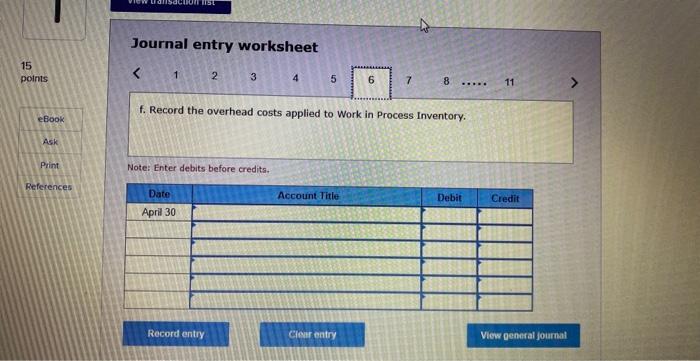

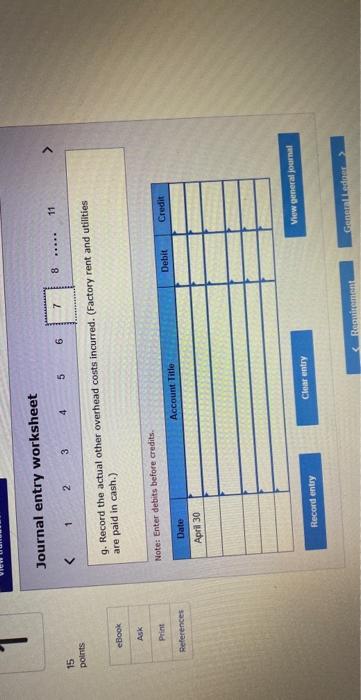

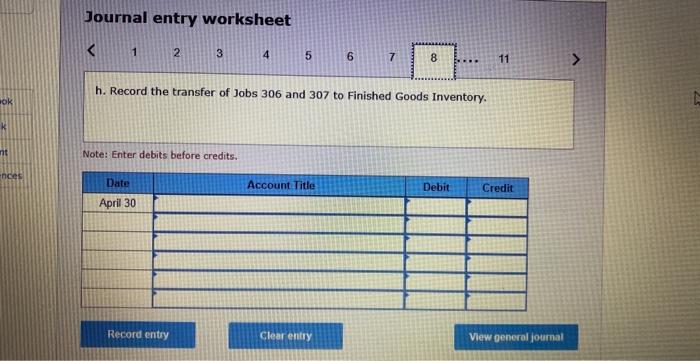

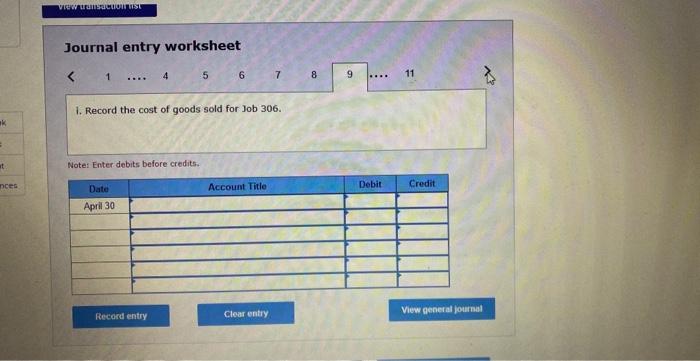

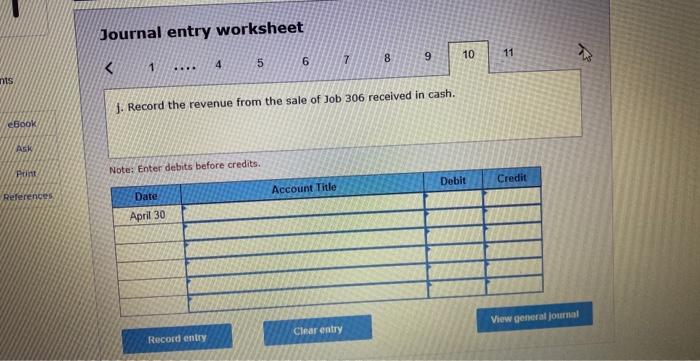

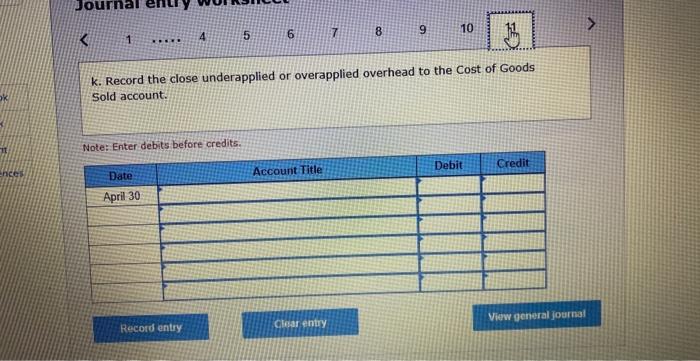

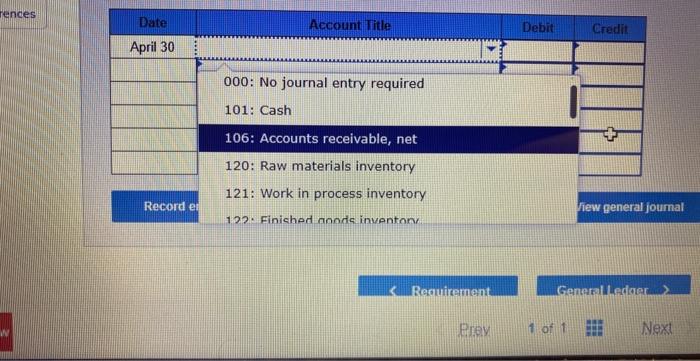

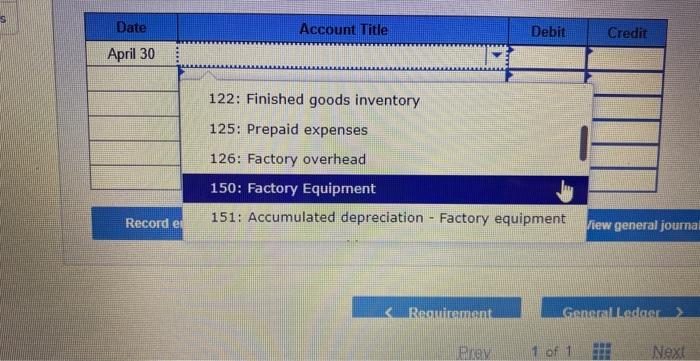

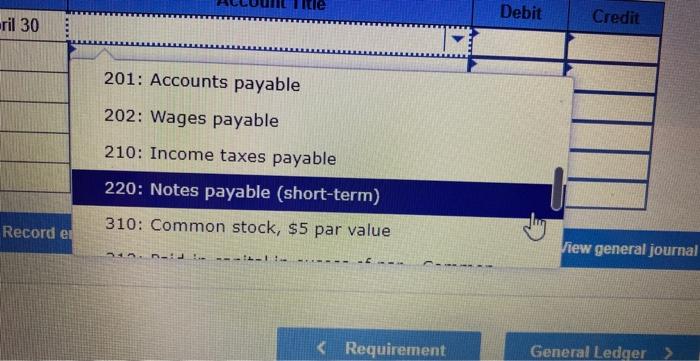

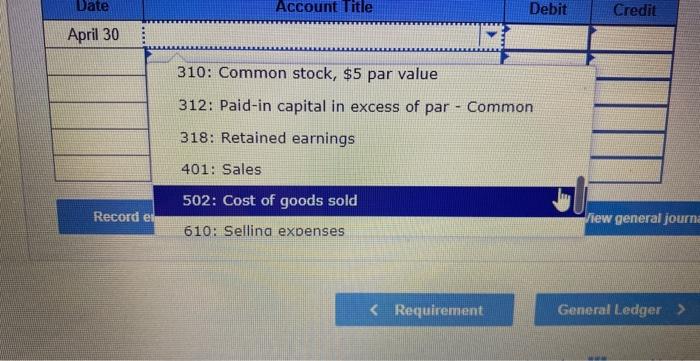

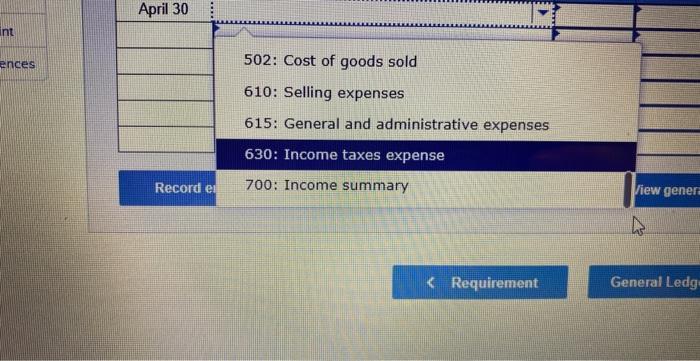

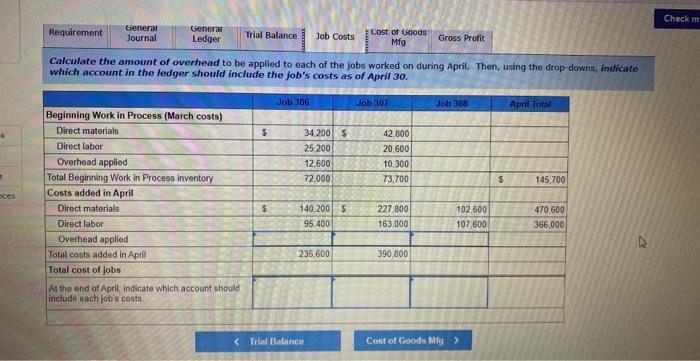

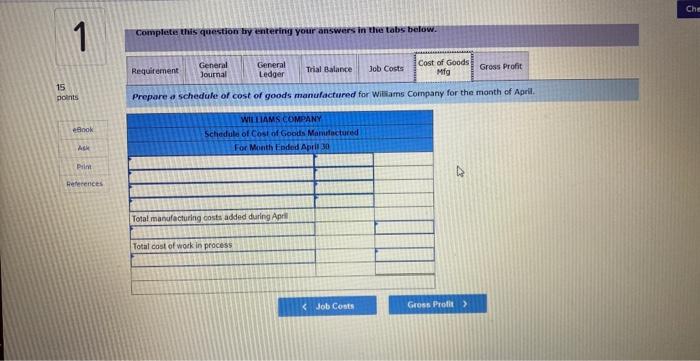

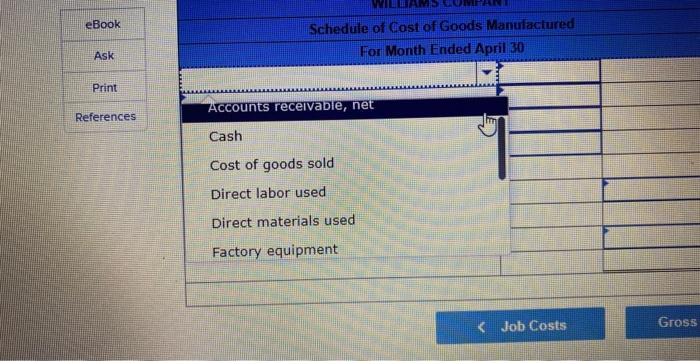

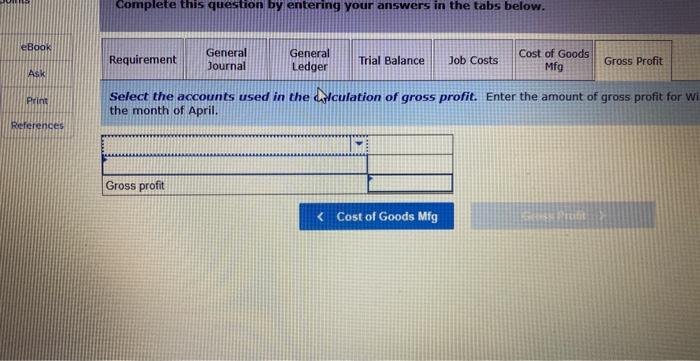

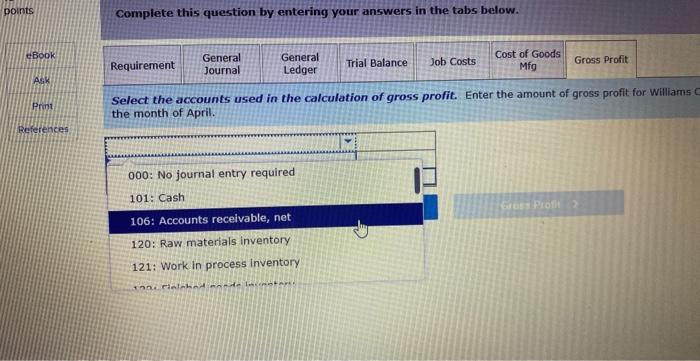

1 15 points eBook Ask Print GL0201 (Algo)- Based on Problem 2-2A LO P1, P2, P3, P4 Williams Company shows the following costs for three jobs worked on in April. Balances on March 31 Direct materials (in March) Direct labor (in March) Applied overhead (March)) Costs during April Direct materials Direct labor Applied overhead References Status on April 30 Additional Information $42,800 20,600 10,300 Job 306 Job 307 Job 3 $34,200 25,200 12,600 140,200 95,400 227,800 163,000 $102,600 107,600 Finished (sold) Finished (unsold) In process Mc Graw a. Raw Materials Inventory has a March 31 balance of $93,000 b. Raw materials purchases in April are $505,200, and total factory payroll cost in April is $391,600 c. Actual overhead costs incurred in April are indirect materials, $52,600, indirect labor, $25.600, factory rent, $34,600; factory utilities, $21,600: and factory equipment depreciation. $56,200 d. Predetermined overhead rate is 50% of direct labor cost e. Job 306 is sold for $650,000 cash in April. Complete this question by entering your answers in the tabs below. Prev 1 of 1 Next Check my work nts Journal entry worksheet 1 2 3 4 5 6 7 8 11 eBook Ask a. Record the purchase of materials (on credit). Print References Note: Enter debits before credits. Date April 30 Account Title Debit Credit Record entry Clear entry View general journal 15 points eBook Ask Journal entry worksheet 1 2 3 4 5 6 7 8 11 > b. Record the direct materials used. Print Note: Enter debits before credits. References Date April 30 Account Title Debit Credit Record entry Clear entry View general journal Requirement General Ledger ook sk int ences view transaction list Journal entry worksheet 1 2 3 4 5 6 7 8..... 11 c. Record direct labor used (and paid in cash) and assigned to Work in Process Inventory. Note: Enter debits before credits. Date April 30 Account Title Debit Credit Record entry Clear entry View general journal des Journal entry worksheet < 1 2 3 4 5 6 7 8 11 d. Record the indirect materials used and assigned to Factory Overhead. Note: Enter debits before credits. Date April 30 Account Title Debit Credit Record entry Clear entry View general journal ook sk rint cences Journal entry worksheet < 1 2 3 4 5 LO 6 7 8 11 e. Record the indirect labor used (and paid in cash) and assigned to Factory Overhead. Note: Enter debits before credits. Date April 30 Account Title Debit Credit Record entry Clear entry View general journal 15 ansaction st Journal entry worksheet < 1 2 points 3 4 5 6 7 8 11 eBook Ask Print References f. Record the overhead costs applied to Work in Process Inventory. Note: Enter debits before credits. Date April 30 Account Title Debit Credit Record entry Clear entry View general journal view Journal entry worksheet 15 points < 1 2 3 4 5 6 7 8 11 eBook Ask Print References g. Record the actual other overhead costs incurred. (Factory rent and utilities are paid in cash.) Note: Enter debits before credits. Date April 30 Account Title Debit Credit Clear entry Record entry View general journal Requirement General Ledger ok K nit nces Journal entry worksheet < 1 2 3 4 5 6 7 8 11 > h. Record the transfer of Jobs 306 and 307 to Finished Goods Inventory. Note: Enter debits before credits. Date April 30 Account Title Debit Credit Record entry Clear entry View general journal 1 k t nces view transaction st Journal entry worksheet 1 4 5 6 7 8 9 11 i. Record the cost of goods sold for Job 306. Note: Enter debits before credits. Date April 30 Account Title Debit Credit Record entry Clear entry View general journal Journal entry worksheet < 1 4 5 6 7 8 9 10 11 ots eBook Ask Punt References j. Record the revenue from the sale of Job 306 received in cash. Note: Enter debits before credits.. Date: April 30 Account Title Debit Credit A Record entry Clear entry View general journal ok ences Journa 1 A 5 6 7 8 9 10 k. Record the close underapplied or overapplied overhead to the Cost of Goods Sold account. Note: Enter debits before credits. Date: April 30 Account Title Debit Credit Record entry Clear entry View general journal rences W Date April 30 Record e Account Title Debit Credit 000: No journal entry required 101: Cash 106: Accounts receivable, net 120: Raw materials inventory 121: Work in process inventory + View general journal 122 Finished goods inventory Requirement General Ledger Prev 1 of 1 Next Date April 30 Account Title Debit Credit 122: Finished goods inventory 125: Prepaid expenses 126: Factory overhead 150: Factory Equipment 151: Accumulated depreciation Factory equipment Record et View general journal Requirement General Ledger Prev 1 of 1 Next ril 30 Title Debit Credit 201: Accounts payable 202: Wages payable 210: Income taxes payable 220: Notes payable (short-term) 310: Common stock, $5 par value Record e View general journal Date Account Title April 30 310: Common stock, $5 par value 312: Paid-in capital in excess of par Common 318: Retained earnings 401: Sales 502: Cost of goods sold Record e 610: Selling expenses Debit Credit View general journa int ences April 30 502: Cost of goods sold 610: Selling expenses 615: General and administrative expenses 630: Income taxes expense Record e 700: Income summary View genera Requirement General Journal General Ledger Trial Balance Job Costs Cost of Goods Mfg Gross Profit Calculate the amount of overhead to be applied to each of the jobs worked on during April. Then, using the drop-downs, indicate which account in the ledger should include the job's costs as of April 30. Job 306 Job 307 Job 308 April Total Beginning Work in Process (March costs) Direct materials $ 34,200 $ x 42,800 Direct labor 25,200 20,600 Overhead applied 12,600 10,300 T Total Beginning Work in Process inventory 72,000 73,700 S 145,700 ces Costs added in April Direct materials Direct labor $ 140,200 $ 227,800 102,600 470,600 95.400 163,000 107,600 366,000 Overhead applied Total costs added in April Total cost of jobs At the end of April, indicate which account should include each job's costs 235,600 390,800 Check m 15 points 1 Complete this question by entering your answers in the tabs below. General Requirement Journal General Ledger Trial Balance Job Costs Cost of Goods Mfg Gross Profit eBook Ask Print References Prepare a schedule of cost of goods manufactured for Williams Company for the month of April. WILLIAMS COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs added during April Total cost of work in process Job Costs Gross Profit > Che eBook Ask Print References ANT Schedule of Cost of Goods Manufactured For Month Ended April 30 Accounts receivable, net Cash Cost of goods sold Direct labor used Direct materials used Factory equipment Complete this question by entering your answers in the tabs below. eBook General Requirement Journal General Ledger Trial Balance Job Costs Cost of Goods Mfg Gross Profit Ask Print References Select the accounts used in the calculation of gross profit. Enter the amount of gross profit for Wil the month of April. Gross profit points Complete this question by entering your answers in the tabs below. eBook General Requirement Journal General Ledger Trial Balance Job Costs Cost of Goods Mfg Gross Profit: Ask Print References Select the accounts used in the calculation of gross profit. Enter the amount of gross profit for Williams C the month of April. 000: No journal entry required 101: Cash 106: Accounts receivable, net 120: Raw materials inventory 121: Work in process Inventory Gross Profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries for Transactions April 30 a Record the purchase of materials on credit Date Account Title Debit Credit April 30 Raw Materials Inventory 505200 Accounts Payable 505200 b Record the dire...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started